Cryptocurrency Scam: Spotting Fraud in the Crypto World

When dealing with cryptocurrency scam, a deceptive scheme that uses digital assets to trick investors or steal funds. Also known as crypto fraud, it thrives on the fast‑moving, often unregulated nature of the market and exploits users' lack of experience.

One of the most common entry points is a crypto exchange, a platform where users buy, sell, or trade cryptocurrencies. Scammers either create fake exchange sites that mimic legitimate ones or infiltrate real exchanges with weak KYC processes to run rug pulls and market manipulations. Another vector is the phishing attack, an attempt to steal login credentials or private keys by masquerading as a trusted service. A simple email or spoofed message can give a fraudster full control over a wallet in seconds.

Typical Scam Patterns You’ll Encounter

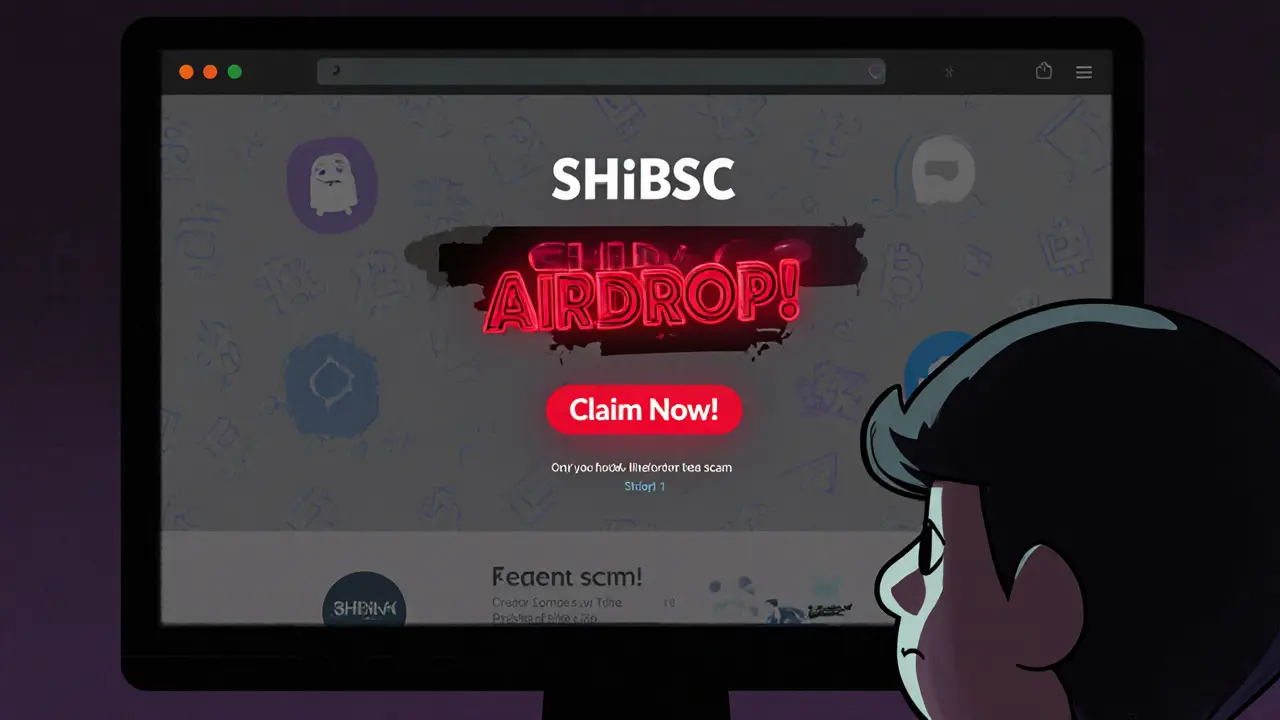

Beyond exchanges and phishing, Ponzi scheme, an investment model that pays earlier participants with money from newer investors has evolved into the crypto space. Promises of guaranteed returns, high‑yield DeFi farms, or token‑staking rewards often mask a classic pyramid structure. When the inflow dries up, the whole project collapses and investors lose everything. Another frequent pattern involves “airdrop” scams that lure users with free token promises, then harvest their private keys or require a fee to claim the reward.

Regulatory bodies worldwide are stepping up. Germany’s Operation Final Exchange, for example, took down dozens of no‑KYC platforms, while Thailand banned foreign P2P services to curb illicit flows. These crackdowns show that enforcement can be a powerful deterrent, but they also push scammers to more sophisticated tactics like smart‑contract exploits or flash‑loan attacks on DeFi protocols. Understanding the legal landscape helps you evaluate whether a project is operating under proper jurisdiction or hiding behind anonymity.

So, how can you protect yourself? Start with basic hygiene: always verify the URL, enable two‑factor authentication, and never share your seed phrase. Use block‑explorers to check token contracts—look for verified source code and audit reports. When a project promises unrealistic returns, ask for a whitepaper, road‑map, and transparent tokenomics. If anything feels rushed or secretive, it probably is. Diversify your holdings, keep most of your assets in hardware wallets, and stay informed through reputable research sites.

Should you fall victim, act fast. Transfer any remaining funds to a secure wallet, document the incident, and file a report with local law enforcement or the relevant crypto watchdog. Many exchanges cooperate with investigations and may freeze malicious accounts. Joining community watchdog groups can also increase the chances of recovery, as collective intelligence often uncovers patterns that individuals miss.

Below you’ll find a curated list of articles that dive deeper into each of these angles—exchange reviews, airdrop warnings, regulatory updates, and technical guides on DeFi security. Whether you’re a beginner looking for a safety checklist or a seasoned trader wanting to spot the next rug pull, the collection offers practical insights you can apply right away.

SHIBSC (Shiba BSC) Airdrop Details, Risks & How to Verify

Learn why the SHIBSC (Shiba BSC) airdrop lacks official backing, spot red flags, and follow a step‑by‑step guide to verify any crypto airdrop safely.

read more