Cryptocurrency Fees: What You Need to Know

When dealing with cryptocurrency fees, the costs you pay to move, trade, or store digital assets. Also known as crypto transaction costs, they shift with network congestion, exchange policies, and the type of transaction you’re performing. In plain terms, a fee is the price of using a service—whether it’s the blockchain’s miners, a centralized platform’s infrastructure, or a DeFi protocol’s liquidity pool. Understanding these costs helps you avoid surprise deductions and plan smarter trades.

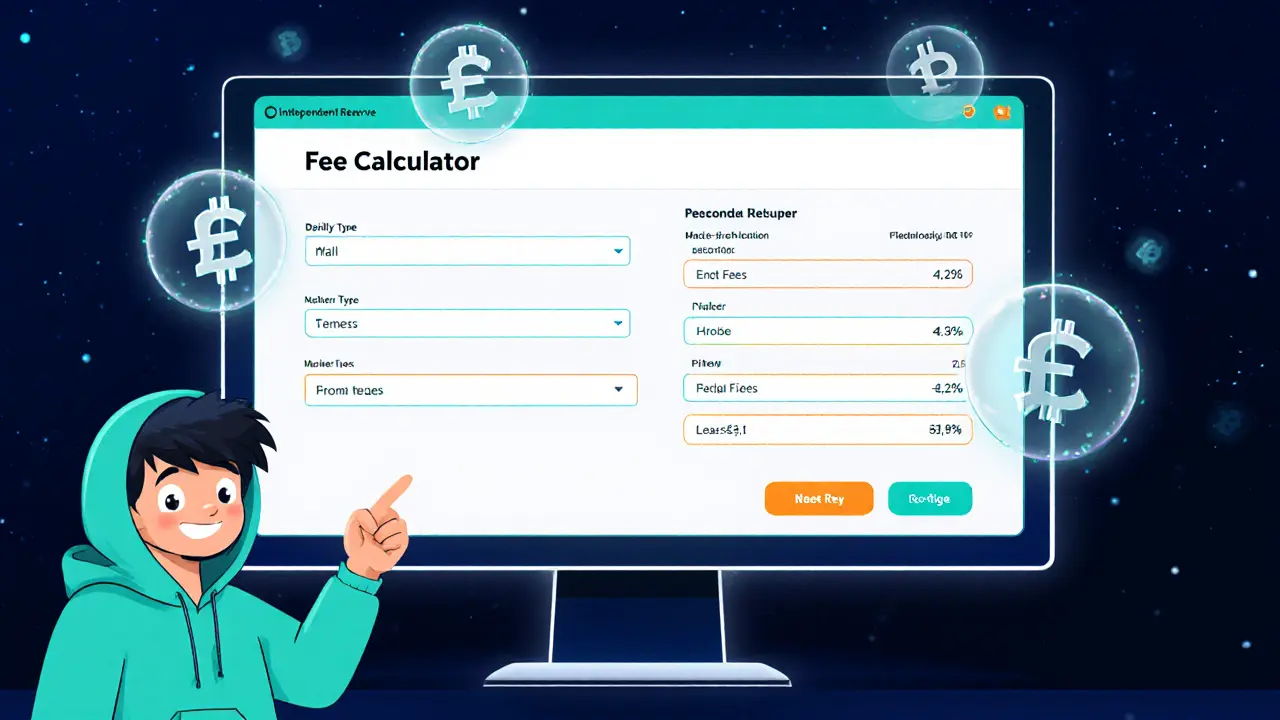

One of the biggest fee buckets comes from exchange fees, the charges levied by crypto exchanges for buying, selling, or swapping assets. Exchanges usually break these into “maker” and “taker” components: makers add liquidity to the order book and often earn a rebate, while takers remove liquidity and pay a higher rate. This maker‑taker model shapes how much you’ll spend on each trade and can affect your overall strategy, especially if you’re a high‑frequency trader. Some platforms also layer tiered discounts based on trading volume or native token holdings, turning fee structures into a dynamic part of your cost‑base.

Aside from trading, moving your crypto off‑exchange triggers withdrawal fees, the fixed or percentage‑based costs applied when you transfer funds from an exchange to an external wallet. These fees often cover the blockchain’s own transaction cost plus a service margin for the platform. Some exchanges bundle the network fee into the withdrawal amount, while others let you choose a speed tier—pay more for faster confirmation or less for slower processing. Knowing the withdrawal fee schedule prevents you from accidentally erasing a large chunk of your holdings when you simply want to secure them in a hardware wallet.

On the network side, gas fees, the charges paid to miners or validators to include a transaction on a blockchain, are the most volatile component. When a chain like Ethereum experiences high demand, gas prices can skyrocket, making even small transfers expensive. Conversely, layer‑2 solutions or alternative chains (e.g., Solana, Avalanche) often boast dramatically lower gas fees, attracting users who prioritize cost efficiency. Gas fees directly influence transaction speed: higher fees usually mean faster inclusion in the next block, while low fees can leave your transaction stuck in the mempool for minutes or hours.

The relationship between these fee types forms a web of trade‑offs. For example, a platform offering zero‑fee trades might compensate by charging higher withdrawal or gas fees, or by using a spread on the price. Conversely, an exchange with low maker fees may offset costs by offering fewer fiat on‑ramps, pushing users toward higher network fees on certain chains. Understanding how “cryptocurrency fees encompass exchange fees, withdrawal fees, and network gas fees” lets you pick the most cost‑effective path for each action you take.

DeFi protocols add another layer of complexity. Many rely on “fee rebates” that reward liquidity providers with a share of the trading fees, effectively reducing the net cost for active participants. Some yield farms even return a portion of the gas fee in native tokens, turning an expense into a partial income stream. However, these incentives can be temporary and may vanish once a project’s tokenomics shift, so it’s wise to treat them as bonuses rather than core savings.

Regulatory environments also shape fee structures. Certain jurisdictions impose caps on withdrawal fees or require exchanges to disclose fee breakdowns transparently. In places where crypto taxation is based on transaction size, higher fees can lower your taxable base, but they also affect your net return. Keeping an eye on local policy changes helps you adapt before a fee hike catches you off guard.

Below you’ll find a curated set of articles that dive deeper into each fee category, compare platforms, and offer step‑by‑step guides to minimize costs. Whether you’re a casual holder, a day trader, or a DeFi explorer, the insights ahead will help you keep more of your crypto where it belongs—in your portfolio.

Independent Reserve Crypto Exchange Review: Fees, Security & OTC Services

A deep review of Independent Reserve, Australia’s oldest crypto exchange. Covers regulation, security, fees, OTC desk, mobile app, user feedback and who should trade on it.

read more