OTC Trading

When navigating OTC trading, over‑the‑counter trading is the off‑exchange process where large blocks of cryptocurrency are swapped directly between parties. Also known as off‑exchange trading, it helps avoid slippage and market impact you’d see on public order books.

One of the core players in this space is the crypto OTC desk, a service that matches buyers and sellers, handles settlement, and often provides custody solutions. These desks rely on deep liquidity, the ability to source enough counterparties to fill large orders without moving the market. Because the trades happen off public books, they usually require strict KYC compliance, identity verification to meet regulatory standards and prevent illicit activity. The interaction between liquidity and KYC shapes the price discovery process, where price discovery, the method by which the true market value of a large trade is negotiated takes place directly between counterparties.

Why OTC Trading Matters

OTC trading offers traders a way to move big sums without shaking the market. Institutional investors often prefer it because a single multi‑million‑dollar order on a regular exchange could cause the price to spike or tumble, eroding the intended position. By using an OTC desk, they get a negotiated price that reflects current supply and demand, while keeping the transaction discreet. This secrecy also reduces the risk of front‑running, where other market participants try to profit from knowing a large order is about to hit the market.

Another advantage is flexibility. OTC desks can handle a wide range of assets—from Bitcoin and Ethereum to obscure altcoins that lack deep order books. They also support settlement in fiat, stablecoins, or even other cryptocurrencies, catering to the diverse needs of hedge funds, family offices, and high‑net‑worth individuals. Because the trade is bilateral, both parties can agree on custom terms such as delayed settlement, escrow usage, or multi‑leg strategies that would be cumbersome on a traditional exchange.

However, OTC trading isn’t risk‑free. Counterparty risk is real; if the other side defaults, you could lose the asset or the payment. That’s why reputable desks perform thorough credit checks and often require collateral. Regulatory risk also looms—jurisdictions differ on how they treat OTC activity, and new rules can affect how desks operate. Staying aware of the latest KYC and AML guidelines is essential to avoid surprises.

In the collection below you’ll find deep dives into specific crypto tokens, reviews of exchanges, and guides that touch on OTC concepts like liquidity sourcing, price negotiation, and compliance. Whether you’re curious about how an OTC desk works, want to compare it with traditional exchanges, or are looking for practical tips on executing a large trade, the articles ahead give you actionable insight.

Ready to explore the practical side of OTC trading? Browse the posts below for detailed analyses, real‑world examples, and step‑by‑step advice that will help you decide if going off‑exchange is the right move for your next crypto move.

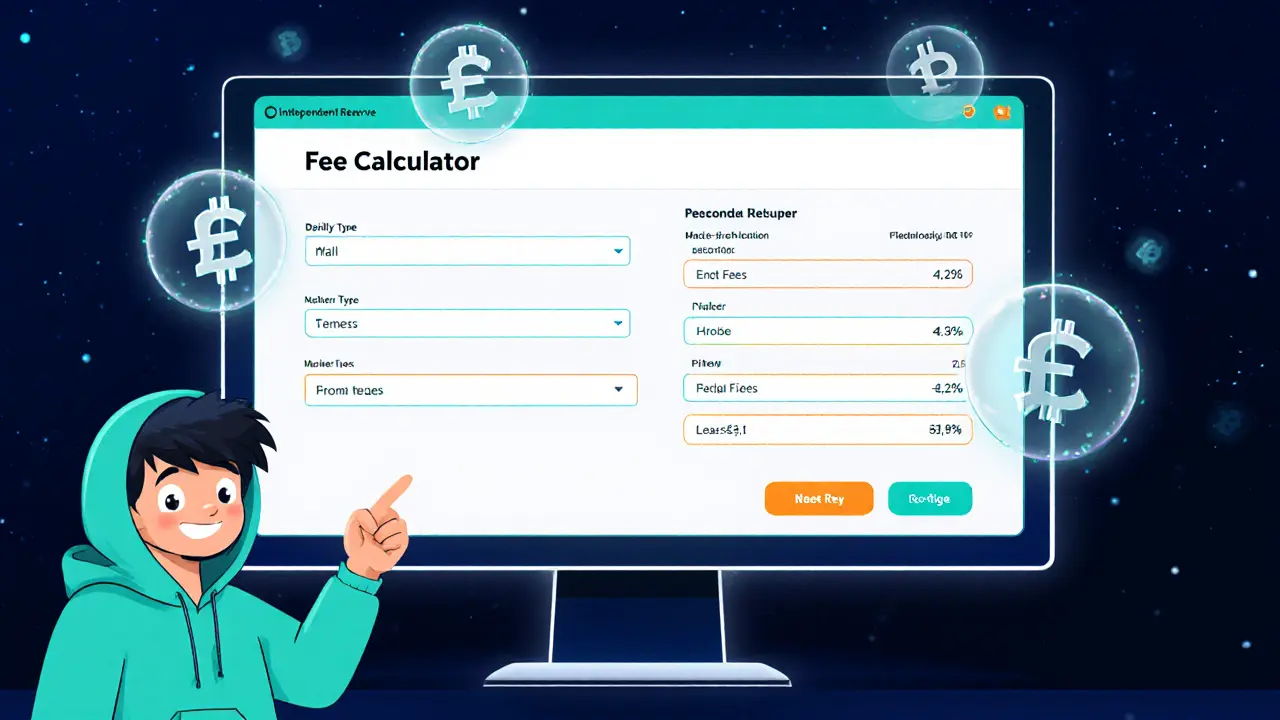

Independent Reserve Crypto Exchange Review: Fees, Security & OTC Services

A deep review of Independent Reserve, Australia’s oldest crypto exchange. Covers regulation, security, fees, OTC desk, mobile app, user feedback and who should trade on it.

read more