Crypto DCA Allocation Calculator

Recommended Allocation

Key Recommendations

Trying to grow a crypto portfolio with a dollar‑cost‑averaging plan sounds simple, but most investors trip over the same avoidable errors. Below you’ll find a step‑by‑step rundown of the most common pitfalls, why they hurt your returns, and practical fixes you can apply today.

What Dollar Cost Averaging Really Is

Dollar Cost Averaging (DCA) is an investment strategy that buys a fixed dollar amount of an asset at regular intervals, regardless of price fluctuations. In the world of cryptocurrency investing, DCA aims to smooth out the extreme swings that define the market.

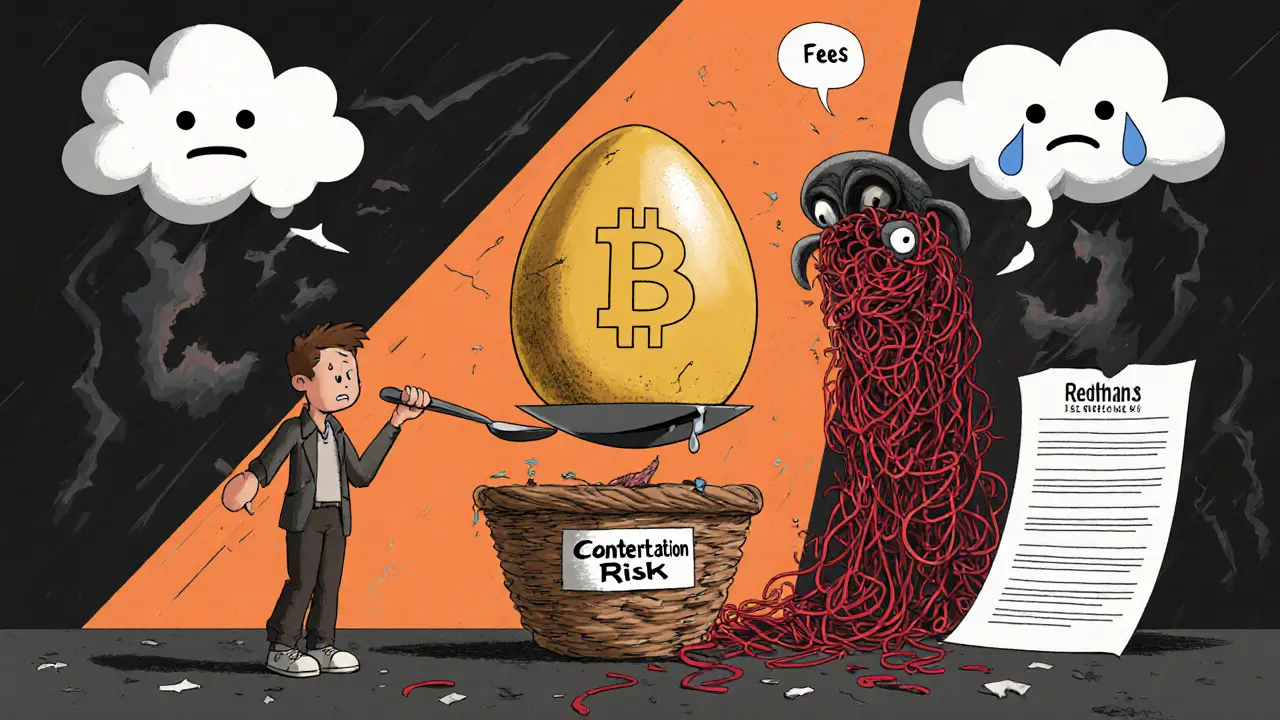

1. Concentration Risk - Putting All Eggs in One Basket

One of the biggest mistakes is buying only one or two coins and assuming they’ll always dominate. This concentration risk contradicts DCA’s core idea of risk mitigation. If your chosen asset drops 70% during a bear market, your entire DCA budget is exposed.

How to fix it: allocate each DCA purchase across at least three to five assets with different use‑cases - for example, a store‑of‑value (Bitcoin), a smart‑contract platform (Ethereum), a layer‑2 solution (Polygon), a DeFi token (Aave), and a promising newer project with solid fundamentals.

2. Skipping the Homework - Insufficient Research

Many newcomers follow hype on Twitter or Reddit without digging into the underlying technology, tokenomics, or team. This insufficient research leads to systematic buying of assets with weak long‑term prospects.

Solution: spend a few minutes each week reviewing the project’s whitepaper, recent developer activity (GitHub commits), and market‑share trends before adding it to your DCA list.

3. Letting Emotions Drive the Numbers

When the market climbs, the urge to increase the weekly amount - often called chasing quick gains - appears rational. Likewise, FOMO pushes investors to binge‑buy during a hype‑driven rally. Both actions break the disciplined cadence that makes DCA effective.

Practical tip: set a fixed amount (e.g., $150) and a strict schedule (every Monday). If you feel tempted to add extra cash, write it down and revisit it after the next scheduled purchase; most urges fade.

4. Over‑Rigidity - Ignoring Market Context

Sticking to the exact same dollar amount during a prolonged bear market can over‑expose you to a sinking ship. While DCA stresses consistency, a flexible strategy that trims exposure or shifts a small portion to more stable assets (stablecoins) can preserve capital for later re‑entry.

Adjustments to consider:

- Reduce the weekly dollar amount by 20‑30% if the total crypto allocation exceeds 7.5% of your net worth.

- Temporarily allocate a portion of each purchase to a high‑yield stablecoin to earn interest while you wait for a market bottom.

5. Ignoring Fees - The Hidden Drag

Frequent small purchases mean transaction fees pile up. On some exchanges, a $5 fee on a $50 DCA buy erodes 10% of that week’s investment before any market move.

Best practice: choose platforms with sub‑$0.10 maker fees or that offer free recurring purchases. Some custodial wallets bundle multiple purchases into a single on‑chain transaction, dramatically reducing cost.

6. Timing Mistakes - Buying High on Up‑Swings

Because DCA runs on a calendar, you may end up buying after a sharp rally, effectively raising your average cost‑basis. This is especially painful if the rally is followed by a correction.

Mitigation: set your recurring purchase day to a low‑traffic time (e.g., early Sunday morning) when price volatility historically dips, or use a “price‑threshold” trigger that only executes when the asset is below its 30‑day moving average.

7. Portfolio Allocation Errors - Over‑Investing in Crypto

CoinShares research suggests crypto should occupy 4%-7.5% of a diversified portfolio. Yet many DCA enthusiasts pour 15% or more of their savings into crypto, ignoring the rule that loss of the entire crypto stake should never jeopardize essential expenses.

Action step: calculate your total investable assets, apply the 5%‑rule, and cap your DCA budget accordingly. If you earn $4,000/month and have $20,000 of investable cash, aim for a $1,000‑$1,500 total crypto allocation - roughly $40‑$60 per week.

8. Poor Risk Management - No Exit Plan

DCA focuses on systematic entry, but many forget to set a systematic exit. Without a stop‑loss or target‑profit rule, you may keep buying while the market stalls, leading to diminishing returns.

Set clear triggers such as:

- Sell 30% of holdings if the portfolio value drops 25% from its peak.

- Take profits on half the position once the asset appreciates 100% from the average cost‑basis.

Quick Reference Table

| Mistake | Typical Impact | Fix |

|---|---|---|

| Concentration risk | Potential loss of >70% if a single asset crashes | Diversify across 3‑5 assets with distinct use‑cases |

| Insufficient research | Buying projects with weak fundamentals | Review whitepapers, dev activity, and tokenomics before adding |

| Emotional scaling | Higher exposure during bull runs, bigger drawdowns | Lock in a fixed weekly amount; avoid extra purchases |

| Fee blindness | Erosion of 5‑10% of portfolio over 1‑2 years | Choose low‑fee exchanges; batch purchases when possible |

| Over‑allocation | Portfolio volatility spikes; risk of cash‑flow problems | Stick to 4%‑7.5% of total investable assets |

Putting It All Together - A Sample 12‑Month DCA Blueprint

- Determine total investable assets and set a 5% crypto allocation.

- Select five diversified coins (BTC, ETH, SOL, AAVE, MATIC).

- Choose a platform with low transaction fees and enable recurring weekly purchases on Sunday 02:00 GMT.

- Allocate $50 per week, split evenly ($10 each) across the five coins.

- Every quarter, review each coin’s fundamentals; swap out any that no longer meet criteria.

- Set a stop‑loss at 25% drawdown and a profit‑target to take 50% of holdings after a 100% gain.

- Re‑assess allocation after major market events; if crypto share exceeds 7.5%, reduce weekly spend by 20%.

Following a disciplined plan like this keeps you from the typical traps while still leveraging DCA’s power to smooth out volatility.

Frequently Asked Questions

Can I use DCA on volatile altcoins?

Yes, but limit exposure. Choose altcoins with solid development teams and clear use‑cases, and keep their combined weight under 30% of your total crypto allocation.

How often should I adjust my DCA schedule?

Quarterly reviews are a good balance. They let you react to major protocol upgrades or macro‑economic shifts without over‑reacting to short‑term noise.

Do fees really matter for small weekly buys?

Absolutely. A 2% fee on a $25 purchase removes $0.50 each week - that adds up to $26 a year, cutting into your compounding gains.

What’s the best day of the week for recurring crypto purchases?

Data shows Sunday mornings often have lower trading volume and smaller price swings, making them a low‑risk window for automated buys.

Should I ever pause my DCA during a market crash?

Pausing can be wise if your overall crypto allocation exceeds the 7.5% ceiling or if you need cash for emergencies. Otherwise, keep buying - the crash is exactly when DCA shines.

Comments

Marina Campenni

Seeing the DCA pitfalls laid out like this feels like a safety net for anyone learning the ropes. It’s easy to get caught up in hype, but spreading the risk across a handful of solid projects can really smooth out those wild swings. I’d also add that keeping an eye on fee structures can save a surprising chunk of returns over time. Overall, a solid reminder to stay disciplined while staying curious.

Irish Mae Lariosa

While the article covers the obvious errors, it glosses over the deeper strategic flaws that many newcomers inadvertently adopt. For instance, the suggestion to allocate across “three to five assets” fails to consider portfolio correlation, which can render the diversification moot if the assets move in lockstep during a market downturn. Moreover, the emphasis on weekly fixed amounts ignores the fact that cash flow volatility for many retail investors can make such rigidity unsustainable, potentially leading to forced liquidation of other essential assets. The piece also neglects the importance of tax implications associated with frequent small purchases, which can erode net gains, especially in jurisdictions with high capital gains rates. In addition, the advice to “set a price‑threshold trigger” presupposes access to advanced trading tools that are not universally available, thereby alienating the very audience the guide intends to help. Finally, the recommendation to “pause DCA during a crash” appears contradictory to the core principle of dollar‑cost averaging, which thrives precisely on buying low during downturns. Therefore, a more nuanced approach, incorporating personal liquidity assessments, tax efficiency, and correlated exposure analysis, would render the guidance more actionable and less generic.

Nick O'Connor

Dollar‑cost‑averaging, when done properly, offers a simple, yet powerful, way to mitigate volatility, but only if you respect the underlying principles, such as diversification, fee awareness, and emotional discipline, all of which are highlighted in the guide.

Hailey M.

Oh wow, another post telling us not to panic‑buy during a rally 🙄-as if we all have the self‑control of a monk! But seriously, the advice to lock in a fixed $150 and ignore the urge to double‑down is solid, because nothing screams “financial maturity” like resisting the siren song of FOMO. And let’s not forget the dramatic flair of setting “Sunday mornings” as the holy hour for purchases-who knew crypto had a designated brunch time? 😆 Still, the tip about batching purchases to dodge fees is pure gold, because why pay $5 on a $50 buy when you could just wait and save a few bucks? In short, follow the plan, or keep shouting at the charts and hope for a miracle.

Jason Zila

One thing that stands out is the need for regular portfolio reviews; without a quarterly check‑in you’ll never know if a project’s fundamentals have shifted, and that can turn a promising DCA into a costly mistake.

Cecilia Cecilia

The fee point is critical; choose low‑cost platforms to preserve returns.

Kaitlyn Zimmerman

If you’re looking for a low‑fee solution, many custodial wallets now bundle weekly purchases into a single on‑chain transaction, which can slash costs dramatically while keeping the process automated.

Deepak Kumar

Remember, every small step counts-keep that weekly $50 rolling, stay disciplined, and watch compound interest do its magic; you’ve got this!

Matthew Theuma

When I first started DCA-ing crypto, I felt like I was planting seeds in a storm‑tossed garden, hoping some would sprout despite the wind. Over time I realized that the garden’s soil-your portfolio mix-needs careful preparation, otherwise you end up with weeds choking the good plants. Diversification across blockchain layers, from Bitcoin’s store‑of‑value roots to Polygon’s scaling branches, creates a resilient ecosystem that can weather bear markets. Fees, on the other hand, act like invisible pests; even a tiny nibble each week can erode growth, so choosing a platform with sub‑dollar maker fees is non‑negotiable. Emotional impulses are another hidden hazard, they’re like sudden frosts that can damage tender shoots if you’re not sheltered with a fixed schedule. Setting a strict $150 weekly cap, as the guide suggests, is akin to installing a greenhouse-protecting your assets from the wild fluctuations outside. I also found that reviewing tokenomics quarterly is similar to pruning; it removes dead weight and encourages healthier growth. The notion of pausing DCA during a crash may sound counter‑intuitive, but think of it as letting the soil rest after a drought before planting again. Yet, the core beauty of DCA is buying low when the market is down, so a balanced approach works best. Remember to allocate a portion to high‑yield stablecoins; they act like fertilizer, providing extra nutrients while you wait for the next bloom. Consistency, patience, and low fees together form the triad of successful long‑term investing-ignore any one and the garden suffers. It’s also worth noting that over‑rigidity can backfire; adjusting your weekly amount when your crypto share exceeds 7.5% of net worth is like thinning out over‑crowded plots. Lastly, never underestimate the power of an exit strategy; setting a stop‑loss at a 25% drawdown is like installing a fence, protecting your harvest from total loss. Keep these principles in mind, and your DCA garden will thrive, season after season. Stay patient, stay humble, and let time do the heavy lifting. 🌱

Carolyn Pritchett

This advice is total garbage.

Pierce O'Donnell

Honestly, most people will ignore these tips and keep losing money.

Vinoth Raja

From a DeFi protocol perspective, layering your DCA through liquidity pools can optimize slippage, but you must monitor TVL shifts to avoid impermanent loss exposure.

DeAnna Brown

Look, no one knows crypto better than us, and if you follow this playbook you’ll be ahead of the global herd that’s still stuck in fiat‑only thinking.

Chris Morano

Sticking to a modest weekly amount and keeping fees low is a solid way to stay in the game without overextending yourself.

Ikenna Okonkwo

Balancing risk and reward is a journey; a well‑structured DCA plan can serve as a steady compass amid market turbulence.

Bobby Lind

Wow, great guide-very helpful-especially the part about fee avoidance!!!

Jessica Cadis

In many cultures, disciplined saving is a virtue, and applying that same mindset to crypto through DCA aligns well with traditional financial prudence.

Katharine Sipio

It is advisable to review each asset’s fundamentals on a quarterly basis to ensure that the portfolio remains aligned with long‑term objectives.

Shikhar Shukla

The article fails to address the critical issue of tax compliance, which can render an otherwise sound DCA strategy financially detrimental.

lida norman

Reading this felt like a roller‑coaster of emotions 🎢-the stakes are high, but with the right plan you can survive the wildest dips! 💪

Miguel Terán

Delving deeper into the mechanics of dollar‑cost averaging reveals that the timing of each purchase can be as pivotal as the amount itself, especially when considering market micro‑structures and order‑book depth. By aligning weekly buys with periods of reduced volatility-often observed on Sunday mornings-investors can subtly enhance their average entry price without the need for complex algorithms. Additionally, the integration of automated recurring orders on platforms that support batch‑settlement can dramatically curtail transaction overhead, thereby preserving more of the capital for actual investment. It is also prudent to periodically reassess the tokenomics of each holding, ensuring that development velocity and governance participation remain on an upward trajectory. Moreover, allocating a modest slice of the DCA budget to high‑yield stablecoins not only cushions against market downturns but also generates passive income that compounds over time. Ultimately, marrying disciplined regularity with strategic flexibility creates a robust framework capable of navigating both bull and bear cycles. Remember, consistency is the engine, but intelligent adaptation fuels the journey.

Shivani Chauhan

Thanks for the thorough breakdown; I’ll definitely incorporate the fee‑saving tips and the quarterly review habit into my own DCA routine.