Nigeria P2P Crypto Trader Simulator

Simulate Your P2P Trade

Trade Outcome

Key Risks

- Scam Risk: 42%

- Bank Freeze Risk: 67%

Why this matters: During the ban, 89% of Nigerians continued using crypto. Your trade could have affected real people like the 22-year-old student who saved ₦2.3 million for university.

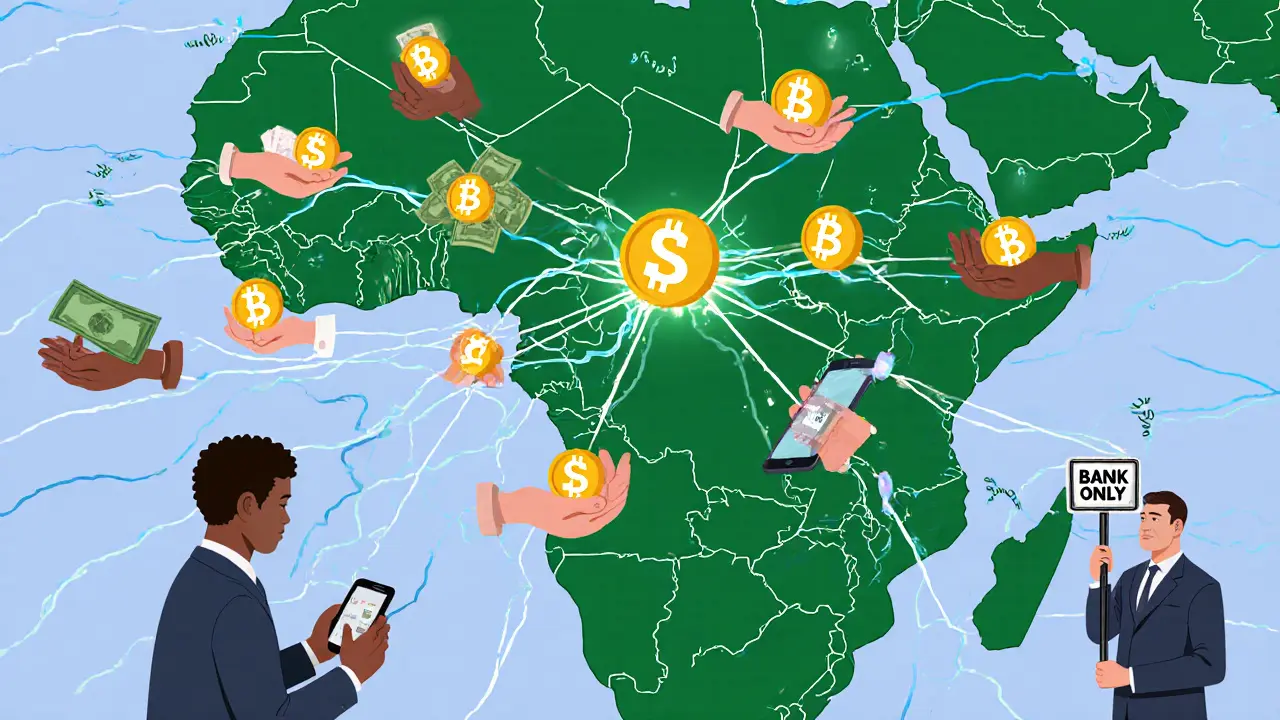

When Nigeria’s Central Bank banned banks from handling cryptocurrency transactions in February 2021, most expected crypto use to collapse. Instead, it exploded. What followed wasn’t a quiet retreat-it was a full-scale rebuild of the country’s financial infrastructure, one peer-to-peer trade at a time. Nigerians didn’t stop using crypto. They just stopped using banks to do it.

The Ban That Backfired

The Central Bank of Nigeria didn’t outlaw crypto. It outlawed banks from touching it. That small distinction made all the difference. Individuals could still buy, sell, and hold Bitcoin, Ethereum, and other tokens. But if you tried to link your bank account to a crypto exchange, your account got frozen. Some were shut down entirely. That’s when Nigerians got creative. Instead of waiting for permission, they built their own system. P2P trading platforms like Binance P2P became the new banks. By late 2022, over 1.2 million Nigerians were using Binance P2P alone, moving around $150 million every month in naira. People weren’t just trading-they were paying rent, buying groceries, funding education, and even starting businesses-all with crypto.How It Actually Worked

Forget exchanges. The real action happened in WhatsApp groups, Telegram channels, and local Facebook communities. Traders posted offers: “Buy BTC with bank transfer-₦1,000,000 available.” Buyers would message them directly. No middleman. No official platform. Just trust, verification, and a lot of patience. To avoid scams, traders developed their own rules. One common tactic: the small test trade. Before sending $500 worth of Bitcoin, you’d send $50 first. If the seller delivered on the smaller amount, you trusted them with the rest. Community-run blacklists spread through WhatsApp groups with 50,000+ members. If someone pulled a scam, their name, phone number, and bank details were posted instantly. You didn’t need a government system to enforce fairness-you needed your neighbors. Payment methods became just as diverse. Bank transfers were risky because they could trigger account freezes. So people turned to mobile money (Paga, Opay), airtime top-ups, and even cash handoffs in parking lots. Some traders used multi-signature escrow wallets-smart contracts that held funds until both sides confirmed delivery. Paxful reported Nigerians made up 32% of its global escrow volume during the ban.Why Nigeria Was Different

Other countries banned crypto completely. China cracked down on ownership. Egypt and Algeria restricted access. Nigeria’s ban was narrow: only financial institutions were targeted. That left a huge gray zone. Individuals could trade. They just couldn’t use banks to do it. That loophole turned Nigeria into the largest crypto market in Africa. Chainalysis data showed Nigeria accounted for $56.7 billion in crypto transactions between July 2021 and June 2022. That’s 1.2% of all global crypto volume-even though Nigeria only had 0.1% of the world’s GDP. In the 2022 Chainalysis Adoption Index, Nigeria ranked second globally, behind Vietnam. The country jumped from 28th place the year before. Why? Because Nigerians had no choice. Inflation was eating salaries. The naira was losing value fast. Remittances from abroad were slow and expensive. Crypto offered a way out. For students, it meant funding tuition without waiting for wire transfers. For small business owners, it meant selling to customers across borders without paying 8% bank fees.The Hidden Costs

It wasn’t all smooth sailing. Four out of ten traders reported being scammed at least once. One Reddit user lost ₦380,000 ($450) when a seller vanished after he released the crypto. Another lost ₦1.2 million after a fake bank transfer screenshot tricked him into releasing funds. Banking complications were even worse. Two-thirds of users who received crypto payments saw their personal bank accounts frozen. Some were locked out for months. Banks didn’t always explain why. People showed transaction records, proof of income, even legal opinions-but still, no access. The system didn’t know what to do with crypto. So it punished everyone who touched it. The biggest hurdle? Speed. Bank transfers took 12 to 72 hours to clear. That meant waiting days to get paid after sending crypto. In a country where cash flow is life, that kind of delay could mean missing rent, losing a deal, or going hungry.Who Was Really Using It?

The underground economy wasn’t just for tech bros. Sixty-eight percent of users were between 18 and 35. Students made up 41% of traders. Small business owners were 29%. Many weren’t even crypto fans-they were survivalists. A 22-year-old student in Ibadan told a local reporter she started trading with ₦5,000 in March 2021. By December 2022, she had ₦2.3 million saved-enough to pay for her final year of university. She didn’t get a loan. She didn’t ask her parents. She bought Bitcoin on Binance P2P, held it through volatility, and sold when the naira dropped. That’s how she funded her education. YouTube channels like “Crypto With Tolu” grew to 247,000 subscribers by 2023, teaching people how to avoid scams, verify trades, and handle bank restrictions. Telegram groups like “Naija Crypto Arbitration” resolved over 1,200 disputes every month. These weren’t official services. They were community-led lifelines.

What Happened After the Ban Lifted?

On December 23, 2023, the Central Bank reversed the ban. Officially, crypto was “allowed.” But the rules didn’t change much. Banks still couldn’t hold crypto. Cash withdrawals from licensed exchanges were blocked. And on February 2024, Binance P2P was banned in Nigeria. The SEC said it wanted to “protect the naira.” The underground economy didn’t disappear. It just went quieter. Many traders kept using P2P platforms, now operating through offshore accounts or alternative apps. Some switched to decentralized exchanges. Others moved to stablecoins like USDT, which kept their value even as the naira slipped. A 2024 Techpoint Africa survey found that 89% of Nigerians now see crypto as a legitimate financial tool-even if the government doesn’t. The ban didn’t kill crypto. It made it part of the culture.The Real Lesson

Nigeria’s underground crypto economy wasn’t a glitch in the system. It was the system working the way people needed it to. When formal institutions failed, ordinary Nigerians built something better-faster, cheaper, more accessible. The lesson isn’t that crypto can survive a ban. It’s that people will always find a way to transact when they’re forced to. Regulation can’t stop demand. It can only push it underground-and make it harder to control. Today, Nigeria’s crypto infrastructure is stronger than ever. New local platforms like Quidax and Bundle were born during the ban. Developers built tools to connect crypto with mobile money. The government may still be playing catch-up, but the people? They’re already ahead.Was cryptocurrency illegal in Nigeria during the ban?

No. The Central Bank of Nigeria only banned financial institutions from facilitating crypto transactions. Individuals could still buy, sell, and hold crypto. The ban targeted banks, not people. This legal gray area is what allowed the underground economy to grow so large.

How did Nigerians trade crypto without banks?

They used peer-to-peer (P2P) platforms like Binance P2P, WhatsApp groups, Telegram channels, and direct cash exchanges. Traders posted offers, negotiated prices, and used test trades to verify trust. Payment methods included mobile money, airtime top-ups, and bank transfers that bypassed traditional banking limits.

Did the crypto ban reduce crypto use in Nigeria?

No. It had the opposite effect. Nigeria’s crypto adoption jumped from 28th to 2nd globally in Chainalysis’ 2022 Adoption Index. Transaction volume reached $56.7 billion in just one year. The ban forced people to innovate, creating one of the world’s most active crypto markets.

What were the biggest risks of trading crypto underground in Nigeria?

The biggest risks were scams and frozen bank accounts. About 42% of traders reported being scammed at least once. Over 67% had their personal bank accounts frozen after receiving crypto payments. There was no official recourse-no police, no bank support, no legal protection for informal trades.

Is crypto still popular in Nigeria after the ban was lifted?

Yes. Even after the ban was lifted, over 89% of Nigerians still view crypto as a legitimate financial tool. The infrastructure built during the ban-P2P networks, trust systems, local platforms-remains active. The government’s continued restrictions on P2P trading suggest the underground economy is still very much alive.

Comments

Debby Ananda

Honestly? This is peak human ingenuity. 🤯 The fact that people built a decentralized financial ecosystem from scratch using WhatsApp and trust-based test trades? That’s not just crypto-that’s post-capitalist evolution. Banks are dinosaurs. Nigeria didn’t break the system. They upgraded it. 😌💎

Vicki Fletcher

wait… so they just… used whatsapp?? like… no escrow?? no verification?? and people just… trusted each other?? i mean… that’s insane. but also… kinda beautiful? like… community over bureaucracy? 🤔

Nadiya Edwards

Let me get this straight-Nigerians got scammed, had their bank accounts frozen, and still kept going? That’s not resilience. That’s desperation. And now you want to glorify it? This isn’t innovation-it’s collapse with a hashtag. The West doesn’t need this chaos. We have systems. Real ones.

Ron Cassel

This is exactly what the globalists want. The CBN didn’t ban crypto to protect the naira-it was a cover for the IMF to destabilize African sovereignty. You think those P2P platforms aren’t monitored by Soros-funded NGOs? They’re building a parallel financial system to bypass national borders. This isn’t freedom. It’s financial colonization.

Malinda Black

I just want to say how inspiring this is. People without access to formal banking built trust networks, peer verification, and community arbitration-all without a single government handout. That’s the kind of grassroots innovation we should be teaching in schools. You don’t need permission to solve problems. You just need grit and neighbors who show up.

Chris Strife

Nigeria banned banks from crypto and somehow that made it stronger? That’s not a win. That’s proof the system was already broken. People don’t build underground economies because they’re smart. They do it because they’re trapped. This isn’t progress. It’s survival with extra steps

Mehak Sharma

This is not just about crypto this is about human spirit when institutions fail people dont wait for permission they create their own rules the test trade system the whatsapp blacklists the airtime payments these are not hacks they are cultural adaptations in real time imagine if we treated finance like this everywhere not as a privilege but as a right

Kymberley Sant

so they used telegram and p2p… cool. but like… how many people actually got their money back after a scam? like… i feel like this is just a fancy way of saying ‘we trusted strangers and lost everything’

Edgerton Trowbridge

The emergence of this peer-to-peer infrastructure represents a profound shift in the sociotechnical architecture of value exchange. By circumventing institutional intermediaries, Nigerian citizens activated latent social capital-trust networks, reputation systems, and localized arbitration mechanisms-to construct a resilient, albeit informal, monetary ecosystem. This is not merely an adaptation; it is a redefinition of financial sovereignty at the micro level.

Matthew Affrunti

Man, this is wild. I used to think crypto was just for rich tech bros. But hearing about students paying for tuition with Bitcoin? That’s next level. People are literally using this to survive. No hype. No fluff. Just real life solutions. Respect.

mark Hayes

so basically nigeria turned crypto into a community sport 🤝 no banks? no problem. scams? blacklist em. slow transfers? use airtime. they didn’t need a license. they just needed each other. this is the internet doing what governments failed to do. peace out 🙌

David Roberts

The structural inefficiencies of the Nigerian banking sector created an arbitrage opportunity for crypto adoption. The P2P model, while emergent, exhibits characteristics of a non-cooperative game with incomplete information-where reputation mechanisms serve as equilibrium selection devices. The 42% scam rate suggests a suboptimal Nash equilibrium, yet the persistence of participation indicates path dependency driven by liquidity constraints.

Monty Tran

This isn’t a story of triumph. It’s a tragedy wrapped in blockchain. People had to risk their bank accounts just to buy groceries. That’s not innovation. That’s a failed state with Wi-Fi. And now you’re calling it cool? Wake up.

Beth Devine

I’ve seen so many stories about people losing money in these P2P trades… but then I hear about the student who saved ₦2.3 million just by holding Bitcoin. That’s the kind of hope that keeps people going. It’s not perfect. But it’s real. And sometimes real is enough.

Brian McElfresh

You think this is about crypto? Think again. This is a controlled demolition. The Central Bank didn’t ban crypto to protect the naira-they did it to force people into stablecoins. And now? The Fed’s got eyes on USDT. This isn’t grassroots. It’s a Fed-backed experiment to phase out cash. They want everyone on digital currency. This is the first phase.

Hanna Kruizinga

So let me get this straight-Nigeria has a 42% scam rate, people get their bank accounts frozen for no reason, and you’re calling this a success? That’s not resilience. That’s a dumpster fire with a blockchain logo. And now you want to export this model? Please.

David James

I think this is really cool. People figured out how to use crypto to pay rent and buy food even when banks said no. That’s smart. That’s resourceful. I don’t know much about crypto but I know when people are trying to get by, you gotta cheer them on.

Shaunn Graves

If this is the future of finance, I’m terrified. No oversight. No accountability. Just random people on WhatsApp handing over thousands based on a screenshot. This isn’t innovation. It’s anarchy dressed up as tech.

Jessica Hulst

They didn’t build a better financial system. They built a mirror of one. A broken system forced them to reflect their own ingenuity back at themselves. The banks didn’t fail them-their own trust in institutions did. And in that vacuum, they didn’t just survive. They redefined what ‘money’ could mean. Funny how oppression teaches you more than policy ever could.

Kaela Coren

The data is compelling. The Chainalysis figures, the adoption index jump, the volume of P2P trades-all indicate a systemic shift. However, one must consider the psychological burden of operating in a high-risk, low-legal-protection environment. The absence of institutional support does not equate to the presence of stability. This is a fascinating anomaly, not a replicable model.

Nabil ben Salah Nasri

This is beautiful. 🌍 People from different tribes, religions, cities-none of that mattered. They just needed to get paid. Used crypto to connect. Built trust without borders. No government. No bank. Just humans helping humans. That’s the internet’s greatest gift. And it’s happening right now. 🙏

alvin Bachtiar

Let’s be real-this isn’t a triumph of decentralization. It’s a monument to institutional failure. The CBN didn’t lose control of crypto. They lost control of the naira. The P2P explosion is the sound of a currency dying. And now we’re romanticizing the autopsy. USDT dominance? That’s not freedom. That’s dollarization by stealth.

Josh Serum

You’re telling me people are risking their entire bank accounts just to buy Bitcoin? And you think that’s smart? That’s not financial literacy-that’s gambling with your livelihood. If your country’s economy is this broken, maybe you should fix the system instead of playing crypto roulette.

DeeDee Kallam

i lost my whole savings on a fake screenshot 😭 i trusted them and they just vanished… now i dont even use whatsapp for crypto anymore… this whole thing feels like a nightmare

Helen Hardman

I just want to say-this isn’t just about money. It’s about dignity. A student in Ibadan didn’t ask for a loan. She didn’t beg. She traded. She held. She won. That’s the kind of power no bank can give you. This isn’t crypto. This is agency. And it’s alive. And it’s beautiful. 🌱

Debby Ananda

The fact that you’re crying over a scam while ignoring the 89% adoption rate is the exact problem. Not everyone lost. Many won. And they didn’t win because they were lucky. They won because they were smarter than the system that tried to silence them. 🌟