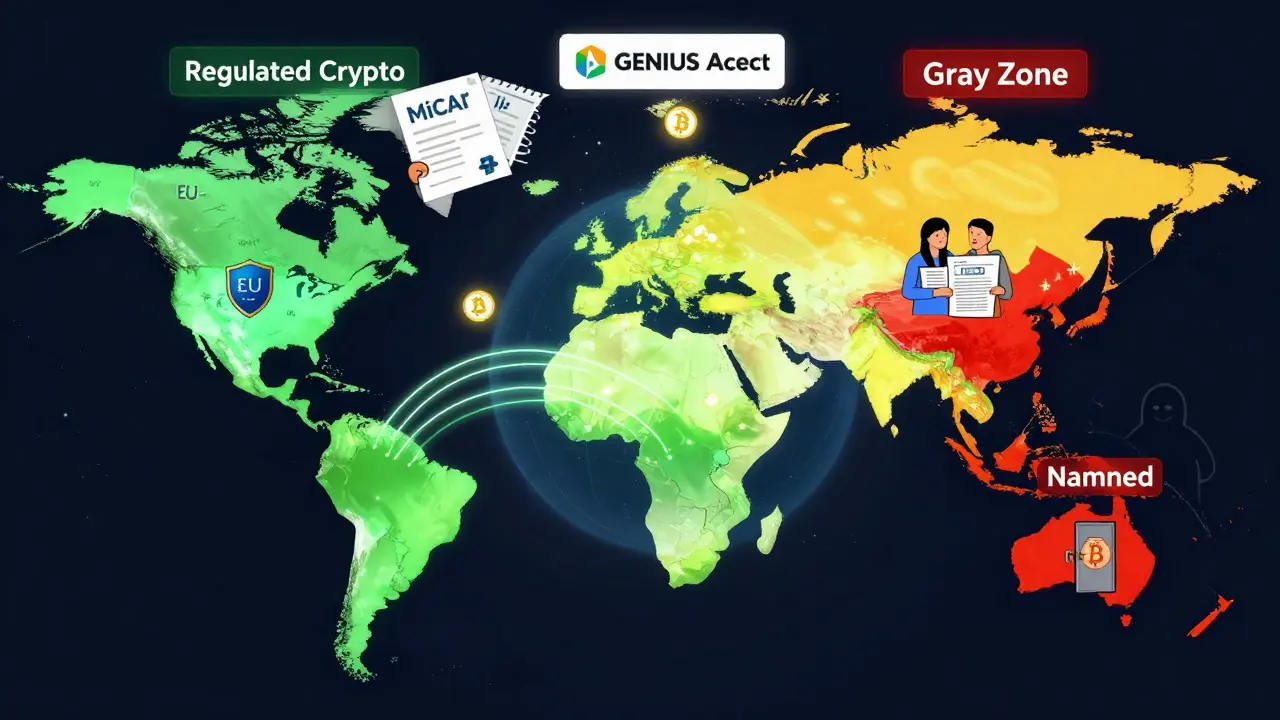

Is cryptocurrency legal? It’s not a yes-or-no question. Where you live determines whether you can buy Bitcoin, trade Ethereum, or use stablecoins without risking fines, bank freezes, or worse. In 2025, the world is split into three clear camps: countries that have embraced crypto with full rules, those that let it exist in a gray zone, and others that still treat it like contraband.

Where Crypto Is Fully Legal - And Regulated

The European Union took the lead in 2024 when MiCAR - the Markets in Crypto-Assets Regulation - became fully active. It’s the first unified crypto rulebook in the world. Under MiCAR, every crypto exchange, stablecoin issuer, and wallet provider must get licensed, disclose risks, and keep 1:1 reserves for stablecoins. If you’re running a crypto business in Germany, France, or Spain, you now follow the same playbook. This hasn’t killed innovation - it’s made it safer. Companies like Kraken and Bitpanda have moved their EU headquarters to Luxembourg and Malta, not because they’re avoiding taxes, but because they want clear rules.

The United States didn’t wait for Congress to act as a whole. In July 2025, the GENIUS Act passed, setting the first federal standards for payment stablecoins. Now, any company issuing a stablecoin like USDC or USDT must back every dollar with cash or short-term U.S. Treasuries. They need monthly audits and public reports. It’s not perfect - the SEC and CFTC still fight over who controls what - but it’s a step toward clarity. The Stablecoin Trust Act and FIT Act are now moving through Congress, and if they pass, they’ll bring even more structure to crypto markets by 2026.

Switzerland, Singapore, and Japan have long been crypto-friendly. Switzerland’s "Crypto Valley" in Zug is home to over 1,000 blockchain firms. Singapore’s Payment Services Act requires all exchanges to be licensed, with strict anti-money laundering checks. Japan requires crypto firms to register with its Financial Services Agency and keep customer funds separate from company assets. These aren’t just permissive countries - they’re structured ones. Businesses know exactly what’s expected.

Where Crypto Is Legal But Unclear

Many countries don’t ban crypto, but they don’t officially embrace it either. South Africa is one of them. The Reserve Bank says virtual currency has no legal status - but the tax office treats it as an intangible asset. That means you pay capital gains tax if you sell Bitcoin for profit, even though the bank won’t help you open a business account for a crypto startup. It’s confusing, but not illegal.

India and Kenya are similar. India banned banks from serving crypto firms in 2018, then reversed it in 2020. Now, crypto trading is legal, but there’s no dedicated regulator. The government taxes crypto at 30% with no deductions - a rate higher than most stocks. Despite that, over 100 million Indians trade crypto. Kenya’s central bank warned against crypto in 2022, then issued its first regulatory guidance in March 2024. Adoption still exploded - 54% of Kenyans now use crypto, mostly for remittances and savings. Why? Because traditional banking is slow and expensive.

Even in the U.S., individual users face a patchwork. One state might tax crypto trades, another might not. The IRS treats it as property, not currency. You have to track every purchase, sale, and swap. If you bought $100 of Bitcoin in 2020 and sold it for $1,500 in 2025, you owe taxes on $1,400 - even if you never cashed out to your bank. No one gives you a 1099 form. You’re on your own.

Where Crypto Is Banned or Restricted

Some countries still treat crypto like a threat. Namibia banned banks from processing crypto transactions in 2017. If you try to send Bitcoin to pay for goods, your bank will freeze your account. People there still use it - mostly through peer-to-peer apps like Paxful - but it’s harder, slower, and more expensive. One user on X said switching from crypto to Western Union cost him 20% more in fees.

Zimbabwe’s situation is messy. The central bank banned crypto in 2020. Then, in 2024, the High Court overturned the ban. The central bank appealed. As of early 2026, it’s still in legal limbo. You can technically own crypto, but no bank will touch it. No exchange is licensed. No one knows if you’ll get fined tomorrow.

China is the most extreme example. It banned crypto trading and mining in 2021. Any exchange operating inside China is illegal. Even using foreign platforms can trigger bank account freezes. The government says it’s to protect financial stability - but the real goal is to push adoption of its own digital currency, the digital yuan. Crypto is still traded underground, but it’s risky. People get arrested for running mining rigs.

Angola is an odd exception. The government warns people not to use crypto, but no law bans it. You can buy Bitcoin, sell it, send it - legally. But if something goes wrong, you have no recourse. No regulator will help you. No court will enforce a crypto contract. It’s legal, but unprotected.

Why Regulation Matters - Even If You’re Just a User

You might think, "I don’t run a business. I just buy Bitcoin. Why should I care about laws?" But regulation affects you directly.

First, it affects your access. In regulated countries, exchanges are licensed, so withdrawals take 1-2 days. In unregulated places, it can take 5-7 days - or longer. Customer support is better. Fraud is rarer. In 2025, users in regulated markets reported 63% higher satisfaction with crypto services.

Second, it affects your taxes. Portugal eliminated capital gains tax on crypto after one year - adoption jumped 47%. Germany taxes short-term trades up to 42%. That’s why most Germans hold crypto for over a year - not because they believe in it, but because they want to avoid the tax.

Third, it affects your safety. In the EU, if a licensed exchange goes bankrupt, your crypto is kept in segregated wallets. In the U.S., under MiCAR and GENIUS, stablecoin issuers must prove their reserves every month. In Nigeria or Vietnam, where rules are weak, exchange hacks are common. In 2024, over $1.2 billion was stolen from unregulated platforms - more than in all regulated markets combined.

What’s Changing in 2026

The global trend is clear: more regulation, not less. The G20’s Crypto Regulatory Roadmap, released in July 2025, pushes all member countries to implement the "Travel Rule" by 2027. That means every crypto transfer over $1,000 must include sender and receiver info - just like bank wire transfers.

The EU is expanding MiCAR in June 2026 to cover DeFi protocols with over 1 million users. That’s huge. It means decentralized apps like Uniswap or Aave might need licenses. The U.S. is likely to pass the Stablecoin Trust Act in early 2026, which will require federal licensing for all stablecoin issuers - not just payment ones.

Meanwhile, countries like Brazil, Canada, and Australia are tightening rules. Brazil now requires crypto exchanges to report all transactions over $10,000 to tax authorities. Canada added crypto to its anti-money laundering rules in 2024. Australia now requires all exchanges to register with AUSTRAC.

Even in places with no laws, like parts of Africa and Southeast Asia, regulators are watching. The World Bank and IMF are pushing for basic frameworks. The pressure is mounting - not because governments hate crypto, but because they can’t ignore it anymore.

What This Means for You

If you’re holding crypto, check your country’s rules. Don’t assume it’s legal just because you can buy it on Binance or Coinbase. Some platforms block users from banned countries. Others report activity to local authorities.

If you’re trading, keep records. Even in places without clear laws, tax agencies are catching up. Use tools like Koinly or CoinTracker to track your buys, sells, and swaps. You’ll thank yourself when tax season comes.

If you’re thinking of moving or starting a business, pick a country with clear rules. Switzerland, Singapore, and the EU offer real stability. Avoid places where the law changes overnight. In 2025, crypto businesses in regulated markets were 87% more likely to survive five years than those in unregulated ones.

Crypto isn’t going away. But the wild west is over. The new frontier isn’t about anonymity or rebellion - it’s about compliance, transparency, and trust. The most successful users aren’t the ones who mined Bitcoin in 2010. They’re the ones who learned the rules - and played by them.

Is cryptocurrency legal in the United States?

Yes, cryptocurrency is legal in the U.S., but it’s heavily regulated. The GENIUS Act of 2025 requires stablecoin issuers to back every coin with cash or U.S. Treasuries and submit monthly audits. The SEC and CFTC split oversight - the SEC handles tokens seen as securities, the CFTC handles Bitcoin and Ethereum as commodities. You must report crypto trades on your taxes. No federal ban exists, but some states have additional rules.

Which countries have banned cryptocurrency?

As of 2025, countries with outright bans include China (mining and trading), Namibia (banking restrictions), and Egypt (financial institutions barred from crypto). Nigeria and Bangladesh have restricted banking access but don’t ban personal ownership. Zimbabwe and Algeria have conflicting court rulings and official warnings, creating legal uncertainty. These bans target financial institutions, not individuals - but using crypto can still carry risks.

Is Bitcoin taxable?

Yes, in nearly every country that regulates crypto, Bitcoin is treated as property, not money. Selling, trading, or spending Bitcoin triggers a taxable event. In the U.S., you pay capital gains tax based on how long you held it. In Germany, short-term sales (under one year) are taxed up to 42%. Portugal eliminates capital gains after one year. India taxes all crypto sales at 30%. Always track your purchase price and sale date - the tax agency will ask.

Can I use crypto to pay for things overseas?

It depends on the country. In the EU, Japan, and Singapore, businesses can legally accept crypto as payment. In the U.S., many small businesses do. But in Namibia, banks block crypto transfers, so even if a vendor accepts it, you can’t pay through your bank. In Nigeria, peer-to-peer apps like Paxful are common for cross-border payments. Always check local banking rules - your crypto might be legal, but your bank might not let you send it.

Why do some countries allow crypto while others ban it?

Countries that allow crypto usually want to attract tech investment, reduce remittance costs, or modernize finance. Singapore and Switzerland use crypto rules to draw startups. Countries that ban it often fear losing control over money supply, worry about fraud, or want to push their own digital currency - like China’s digital yuan. Some, like Nigeria, ban crypto to protect their national currency from volatility. It’s less about technology and more about power, control, and economic stability.

Comments

Mike Reynolds

I’ve been holding BTC since 2021 and honestly, the regulation stuff finally makes sense now. I used to panic every time a new law dropped, but now I just check my state’s rules and move on. It’s not perfect, but it’s way better than the wild west days.

Also, Koinly saved my tax season last year. If you’re not using something like that, you’re doing it wrong.

And yes, I know Germany taxes short-term trades at 42% - I’ve considered moving there just to avoid it. Not seriously. But I’ve thought about it.

Ian Koerich Maciel

It is, indeed, a fascinating and profoundly consequential development - the global institutionalization of cryptocurrency under regulatory frameworks. One cannot help but observe that the transition from speculative asset to regulated financial instrument reflects a maturation of market infrastructure, and perhaps, a necessary evolution of monetary sovereignty in the digital age.

That said, the notion that compliance equates to trust is, in my estimation, a fallacy - for compliance may be enforced, but belief remains voluntary.

And yet, the data - 87% higher survival rates for businesses in regulated jurisdictions - is compelling. It is not merely about legality; it is about sustainability.

dina amanda

THEY’RE USING THIS TO TRACK US!!!

MiCAR? GENIUS Act? The Travel Rule??

They’re building a digital ID system and crypto is the backdoor! The Fed’s gonna freeze your wallet if you buy too much Bitcoin. Mark my words - next thing you know, your crypto balance will affect your credit score and your kids’ school enrollment.

They don’t want you to be rich. They want you to be controlled. And China? They’re the ones pulling the strings. The digital yuan is the real enemy.

Jordan Fowles

There’s a quiet irony here: we built crypto to escape centralized control, and now we’re asking governments to give us rules so we can feel safe.

It’s like building a fortress to protect yourself from the very people you built it to keep out.

But I get it. Human beings need structure. Even anarchists need traffic lights.

The real question isn’t whether regulation is good - it’s whether we can keep the spirit of decentralization alive while playing by someone else’s rules.

And honestly? I think we can. If we’re smart.

Steve Williams

As someone from Nigeria, I can say with certainty that crypto is not a luxury - it is survival. Banks here charge 15% to send $100 to family abroad. Crypto? 2%.

Yes, the Central Bank warns us. Yes, some exchanges are blocked. But we adapt. We use P2P. We use Telegram groups. We use whatever works.

Regulation may come. But the people have already decided: money should move freely. No law can change that.

Thank you for acknowledging our reality. Many Western articles ignore it.

Jack and Christine Smith

OMG I JUST REALIZED I’M PAYING 30% TAX ON MY BTC IN INDIA??

Wait wait wait - I thought that was just for stocks??

Also, why does everyone act like the EU is some crypto utopia? I tried to open a wallet there last year and they asked for my birth certificate, 3 pay stubs, and a notarized letter from my cat.

Also, I think the author is a Kraken shill. Just saying.

Jackson Storm

Hey if you’re new to crypto and just starting out - here’s the cheat sheet:

1. Track every trade. Even the $5 ones.

2. Use CoinTracker or Koinly - they’re free for basic use.

3. Hold for over a year if you’re in the US or Germany - tax savings are huge.

4. Don’t trust exchanges that don’t show reserve proofs.

5. If your country bans crypto banking but you still trade? Use P2P. Paxful, LocalBitcoins, even WhatsApp groups.

You got this. And yeah, I’ve been doing this since 2017. I’ve lost money. I’ve made money. I’m still here. You will be too.

Raja Oleholeh

India 30% tax? Good. 😎

Let the rich pay. We don’t need more crypto bros acting like they’re Elon.

Also, why is everyone pretending crypto is ‘financial freedom’? It’s just gambling with better graphics.

But hey, if you wanna lose money, go ahead. Just don’t blame the government when you do.

Prateek Chitransh

Oh, so now we’re supposed to be grateful that the U.S. finally decided to regulate crypto like it’s a bank account?

Let me guess - next they’ll require us to wear ID badges when we send ETH.

Meanwhile, in India, we’ve been using crypto to pay for groceries since 2022. No one asked for a license. No one audited our wallet.

Funny how ‘regulation’ only becomes important when your country wants to tax it.

Keep your rules. We’ll keep our freedom.

Michelle Slayden

The notion that regulation diminishes innovation is a myth perpetuated by those who misunderstand the nature of markets. Regulation, when thoughtfully implemented, does not stifle - it clarifies.

It allows capital to flow with confidence. It enables institutional participation. It protects consumers who are not technologically literate.

The EU’s MiCAR is not an imposition - it is a covenant between the state and the market. And in that covenant lies the potential for true, enduring innovation - not the speculative frenzy of 2021.

Let us not confuse control with oppression. Let us recognize structure as liberation.

christopher charles

Man, I just bought my first $50 of Dogecoin last week and now I’m reading this like it’s a PhD thesis.

So… if I sell it next week, I owe taxes? And if I buy a pizza with it, that’s a taxable event too??

Wait wait - so I’m supposed to track every single tiny trade? Even the ones where I lost $2?

Can someone just make a button that says ‘I’m done, IRS, take it all’?

Also, why is everyone so calm about this? I’m sweating bullets.

Amy Garrett

YOOOOO I JUST MADE $2000 ON SHIB LAST MONTH AND NOW I’M SCARED TO CASH OUT 😭

WHO DO I TALK TO?? HOW DO I REPORT THIS??

THANKS FOR THE ARTICLE - I FEEL LESS LOST NOW 😊

ALSO WHO WANTS TO MEET UP AND COIN-TRACK TOGETHER? I’LL BRING COFFEE ☕️

Haritha Kusal

My dad in rural India uses crypto to send money to my cousin in Dubai. No bank. No fees. No waiting.

He doesn’t know what blockchain is. He just knows it works.

So when people say crypto is risky or illegal - I just smile.

Because for millions of us, it’s not a gamble.

It’s hope.

dayna prest

Oh wow, so the ‘free market’ is now just the government’s new favorite toy?

Let me get this straight - we were told crypto was about decentralization, then suddenly everyone’s cheering for the SEC to ‘protect us’?

Next they’ll mandate that all Bitcoin wallets have a ‘trust badge’ and a customer service hotline.

Where’s the rebellion? Where’s the chaos? Where’s the fun?

They turned the revolution into a compliance seminar.

Andy Reynolds

I love how this post doesn’t just list laws - it shows why they matter to real people.

Like that guy in Namibia paying 20% more to use Western Union? That’s the human cost of bad policy.

And the fact that 54% of Kenyans use crypto for savings? That’s not tech hype - that’s economic necessity.

Regulation isn’t the enemy. Ignorance is.

Thanks for writing this. It’s the kind of stuff that actually helps.