Cryptocurrency Sanctions Evasion

When talking about cryptocurrency sanctions evasion, the act of using digital assets to get around government‑imposed economic bans. Also known as crypto sanction circumvention, it creates legal headaches for traders, developers, and even everyday users who think they’re just moving money fast.

At its core, a sanction, a government tool that freezes assets or blocks transactions against a target country, entity, or individual is meant to pressure regimes or groups that threaten international stability. When a sanction meets a blockchain, the normally transparent ledger suddenly becomes a playground for those trying to hide the trail. That’s where OFAC, the U.S. Office of Foreign Assets Control that enforces most American sanctions and AML, anti‑money‑laundering regulations that require monitoring and reporting suspicious activity step in. Both demand that crypto services screen wallets, freeze illicit funds, and keep detailed records, but the decentralized nature of many platforms makes compliance a moving target.

Why Understanding Sanctions Evasion Matters

For anyone swapping tokens, launching a DeFi project, or simply holding a hardware wallet, knowing the risks is practical, not academic. Cryptocurrency sanctions evasion can trigger frozen accounts, hefty fines, or even criminal charges. Exchanges that ignore screening duties may lose banking relationships, face lawsuits, or be blacklisted from the global financial system. On the flip side, users who stay informed can pick services with robust compliance tools, avoid tokens that are flagged on watchlists, and structure transactions in ways that respect the law without sacrificing speed.

Consider a typical scenario: a user in a sanctioned country tries to buy US‑dollar stablecoins on a peer‑to‑peer platform. If the platform lacks proper KYC/AML checks, the transaction might slip through, but the user could later find their assets frozen once the blockchain analytics firm tags the address as high‑risk. The same thing happens in DeFi when liquidity providers unknowingly route funds through a “privacy‑focused” DEX that has been identified as a conduit for sanction‑busting activity. By the time regulators act, the money may have moved across multiple chains, making it hard to recover.

Understanding how sanctions, OFAC, AML, and crypto exchanges interact gives you a roadmap to navigate the gray zones. It also helps you spot red flags—like sudden spikes in token volume from obscure wallets, or new tokens that appear on sanction watchlists without clear purpose. In the posts that follow, we break down flash‑loan arbitrage tricks, DCA pitfalls, privacy‑first exchanges, and more, all with an eye on how each strategy could run afoul of sanction rules.

Ready to see how these concepts play out in real‑world guides, reviews, and risk assessments? Below you’ll find a curated set of articles that dive deep into specific tools, platforms, and tactics, giving you both the technical know‑how and the compliance context you need to stay on the right side of the law while exploring crypto opportunities.

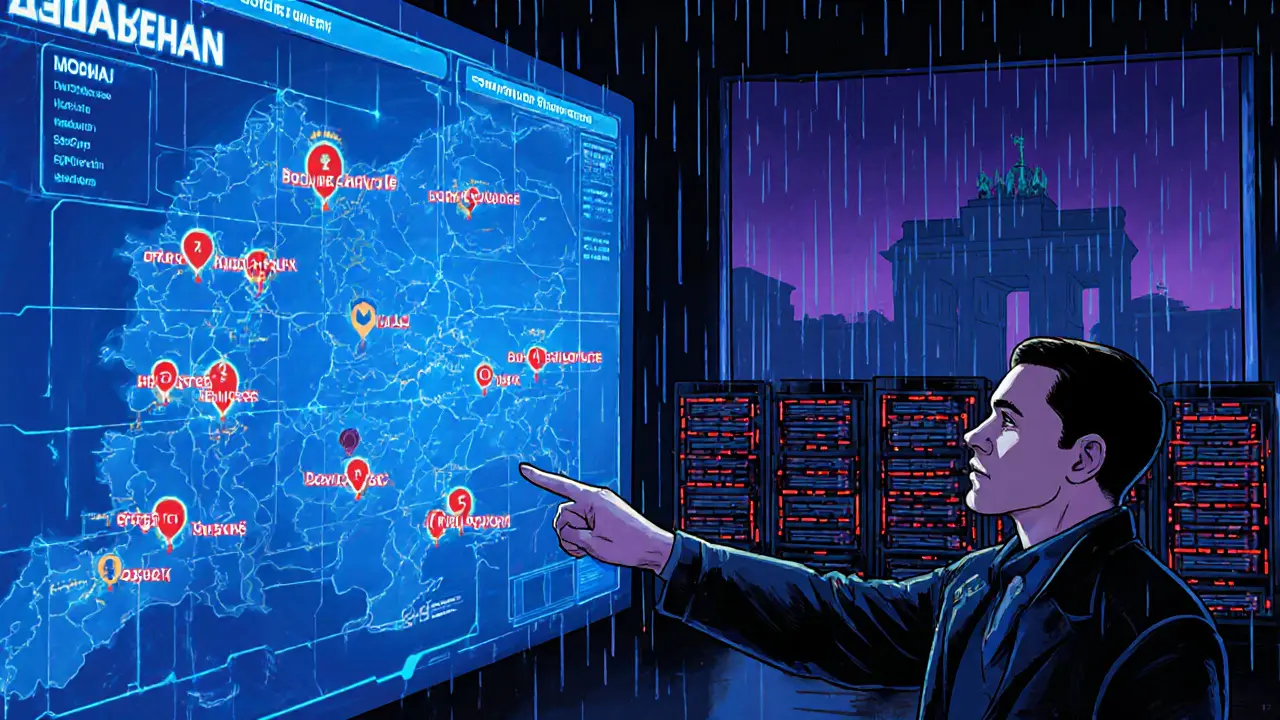

Operation Final Exchange: How Germany’s Biggest Crypto Crackdown Targets No‑KYC Exchanges

Operation Final Exchange was Germany's massive 2024 crackdown on 47 Russian no‑KYC crypto exchanges, seizing servers, data and disrupting sanctions evasion, ransomware, and darknet finance.

read more