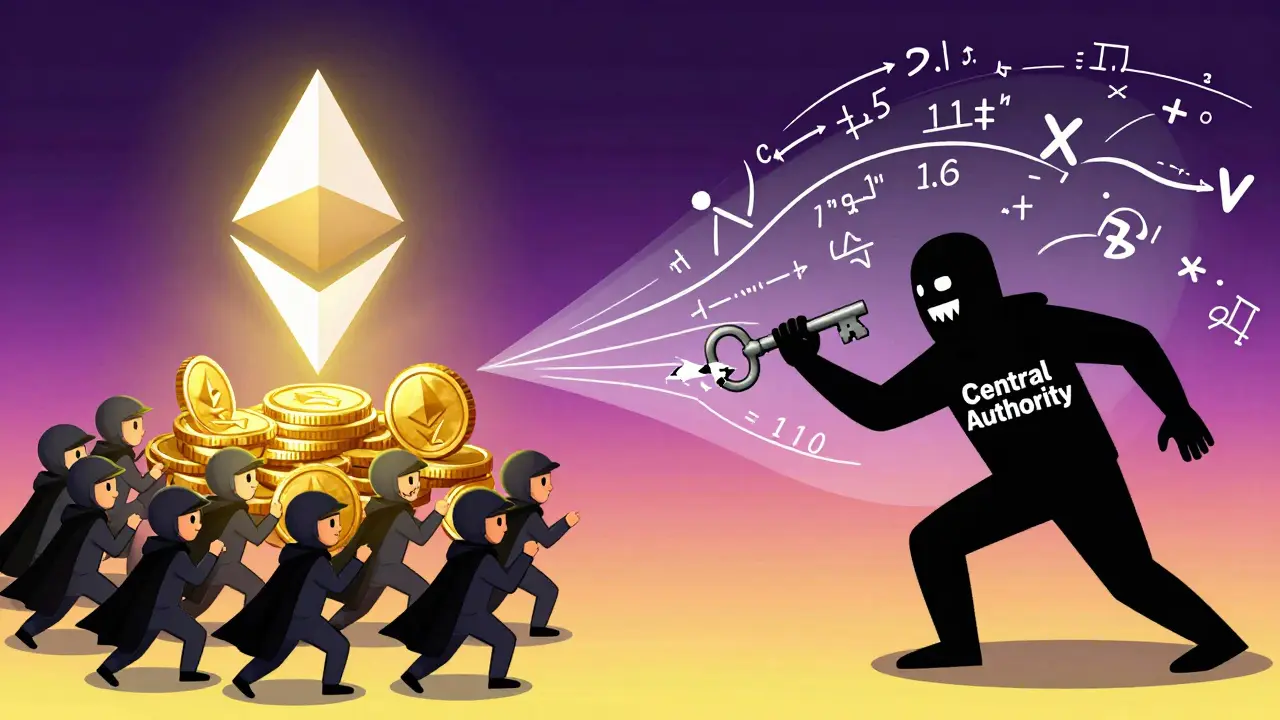

A public blockchain network is a digital ledger that anyone in the world can see, use, and help maintain-no permission needed. Think of it like a shared Google Doc that everyone can read, but only certain people can edit, and every change is permanently recorded and visible to all. Unlike banks or payment apps, there’s no company in charge. No CEO, no headquarters, no one can shut it down. That’s the core idea.

How It Works: No Middlemen, Just Code

Public blockchains run on a network of computers-called nodes-spread across the globe. Each one holds a copy of the entire transaction history. When you send Bitcoin or interact with a smart contract on Ethereum, that transaction gets broadcast to all these nodes. They then work together to verify it’s real using math, not trust.

This verification happens through consensus mechanisms. Bitcoin uses Proof of Work (PoW), where miners compete to solve complex puzzles using powerful hardware. The first one to solve it gets to add the next block of transactions and earns new Bitcoin as a reward. Ethereum switched to Proof of Stake (PoS) in 2022. Now, validators lock up (or "stake") 32 ETH to participate. The network picks validators randomly to propose and confirm blocks. If they act dishonestly, they lose their stake.

Each block contains a list of transactions, a timestamp, and a cryptographic link to the previous block. That’s where the name "blockchain" comes from. Altering one block would mean changing every single block after it-which is practically impossible without controlling more than half the network’s computing power.

Transparency and Immutability: The Built-In Audit Trail

Everything on a public blockchain is open. You can look up any Bitcoin address on Etherscan or Blockchain.com and see every transaction it’s ever made-how much it received, where it sent money, and when. No hiding. No secret ledgers.

This transparency makes fraud incredibly hard. Once a transaction is confirmed and buried under several blocks, it’s nearly impossible to reverse. That’s why public blockchains are used for things like tracking art ownership (NFTs), recording land titles, or verifying supply chains. If someone tries to double-spend coins or fake a record, the network rejects it automatically.

And because there’s no central server to hack, the network stays up almost all the time. Bitcoin has operated continuously since January 2009 with just 0.02% downtime. That kind of reliability comes from thousands of independent computers working together.

Public vs. Private Blockchains: What’s the Difference?

Not all blockchains are public. Some are private or consortium-based, meaning only approved organizations can join. Companies like Walmart or IBM use private blockchains to track shipments internally. These are faster and more private-but they rely on trust in the controlling group.

Public blockchains are the opposite. They’re designed for distrust. You don’t need to know or trust the person you’re sending money to. The system enforces rules through code. This makes them perfect for:

- Buying and sending cryptocurrency (Bitcoin, Ethereum)

- Using decentralized finance apps (DeFi) like lending or trading without a bank

- Buying and selling NFTs-digital art, music, or collectibles with provable ownership

- Building apps (dApps) that run without a company pulling the strings

But they’re not perfect. Bitcoin can only handle about 7 transactions per second. Ethereum does around 30. Compare that to Visa, which handles 65,000 per second. During busy times, fees spike. In May 2021, Ethereum gas fees hit $50 per transaction. People lost hundreds of dollars just trying to mint an NFT.

Real-World Use Cases: Beyond Cryptocurrency

People use public blockchains for more than just trading crypto. In Nigeria, someone sent $5,000 from New York to Lagos in 2022 and saved $1,200 in wire transfer fees. The transaction took 47 minutes-slower than a bank transfer, but cheaper and irreversible.

Developers are building entire financial systems on Ethereum. As of late 2023, over 4,900 decentralized apps (dApps) were active on Ethereum, locking up $56 billion in value. These apps let you lend money, trade tokens, or even insure crops-all without a bank.

Even governments are watching. El Salvador made Bitcoin legal tender in 2021. The European Union passed MiCA in 2024 to regulate crypto markets. Meanwhile, China banned all crypto transactions. The rules vary wildly-but the technology keeps running, regardless.

Challenges: Fees, Speed, and Learning Curves

Public blockchains aren’t easy to use. If you lose your private key-your digital password-you lose access to your funds forever. Over $3.8 billion in crypto was lost in 2022 because people forgot passwords or sent money to the wrong address.

Running a full node (a computer that stores the entire blockchain) requires at least 2TB of storage, 16GB of RAM, and a solid internet connection. Syncing a Bitcoin node can take days.

Learning to code for these networks is tough. Writing a smart contract in Solidity (Ethereum’s language) takes 200-250 hours of study. Most developers spend months before they can build something safe.

And then there’s energy. Bitcoin uses as much electricity as Argentina annually. Critics call it wasteful. Supporters argue it’s the cost of security and decentralization.

The Future: Scaling Up Without Losing Decentralization

The biggest problem for public blockchains is scaling. How do you handle millions of users without slowing down or making fees unaffordable?

Ethereum’s solution? Layer-2 networks. These are secondary systems built on top of Ethereum that process thousands of transactions off-chain, then bundle them into one final record on the main blockchain. As of September 2023, Ethereum’s Layer-2s were handling over 5 million daily transactions-nearly half of all activity on the network.

Upgrades like Danksharding (coming around 2025) aim to boost Ethereum’s capacity to 100,000 transactions per second. Bitcoin is exploring sidechains like Drivechain to add more functionality without changing its core.

Quantum computing could one day break today’s cryptography. That’s why researchers are already working on quantum-resistant algorithms. NIST, the U.S. standards body, is finalizing new encryption methods expected to roll out by 2028.

The goal isn’t to replace banks or credit cards. It’s to create a new layer of financial infrastructure-open, global, and resistant to censorship. One where you don’t need permission to send money, build an app, or own digital property.

Why It Matters

Public blockchains give people control over their money and data. For the 1.4 billion adults without bank accounts, they offer a way to participate in the global economy. For developers, they’re a blank canvas to build applications that can’t be shut down by a corporation or government.

They’re not perfect. They’re slow. They’re expensive sometimes. They’re confusing to use. But they’re the first system in human history that lets strangers transact directly, securely, and permanently-without relying on a central authority.

That’s why Bitcoin and Ethereum together make up nearly 60% of the entire $1.2 trillion cryptocurrency market. They’re not just digital money. They’re a new kind of trust system-and it’s still being built.

Can anyone join a public blockchain network?

Yes. Anyone with an internet connection and a device can join. You don’t need approval. You can download a wallet, send or receive cryptocurrency, or even run a node to help secure the network. That’s what makes it "permissionless."

Is Bitcoin the only public blockchain?

No. Bitcoin was the first, launched in 2009, but Ethereum (launched in 2015) is now the most used public blockchain for apps and smart contracts. Others include Litecoin, Solana, and Dogecoin. Each has different rules, speeds, and purposes.

Are public blockchains safe?

The networks themselves are extremely secure. Bitcoin and Ethereum have never been hacked. But users can lose funds through scams, lost passwords, or sending crypto to the wrong address. The blockchain doesn’t forget or reverse mistakes-it just records them.

Why do transaction fees vary so much?

Fees are set by supply and demand. When lots of people are sending transactions, the network gets crowded. Miners or validators prioritize transactions with higher fees. During peak times-like NFT launches or market crashes-fees can spike from under $1 to over $50.

Can governments shut down a public blockchain?

No. Because the network runs on thousands of computers worldwide, no single government can shut it down. They can ban its use within their borders, regulate exchanges, or restrict access-but the blockchain itself keeps running. That’s why El Salvador can make Bitcoin legal tender while China bans it-the network doesn’t care.

What’s the difference between a public and private blockchain?

Public blockchains are open to everyone and decentralized. Private blockchains are controlled by one organization or a group of trusted parties. Private ones are faster and more private but rely on trust in the operator. Public ones sacrifice speed for openness and censorship resistance.

Comments

Alex Strachan

So basically it's like a global Google Doc that can't be deleted, edited by just anyone, and runs on pure math and caffeine? 🤯 I love it. Also, why does my wallet keep asking for 37 confirmations? I just wanted to buy a meme coin, not join NASA.

Rick Hengehold

Public blockchains aren't perfect. They're slow, expensive, and confusing. But they're the first system that lets strangers transact without trusting each other. That's revolutionary. Stop complaining about gas fees and learn how to use it.

Brandon Woodard

I must say, the structural integrity of decentralized consensus mechanisms is nothing short of a marvel in modern computational governance. The mathematical underpinnings of Proof of Stake, particularly as implemented by Ethereum post-merge, represent a paradigm shift in trust architecture. One must appreciate the elegance.

Antonio Snoddy

You know... when I first heard about blockchain, I thought it was just crypto bros being weird. But then I started wondering: if no one owns it, who's really in charge? Are we all just nodes in some cosmic consciousness? Is the blockchain... alive? And if so, does it dream of electric sheep? Or just more ETH? I've been staring at my wallet for 3 hours now trying to figure it out. 🤔

Ryan Husain

The concept of permissionless innovation is profoundly significant. It democratizes access to financial infrastructure in ways previously unimaginable. While scalability remains a challenge, the collective ingenuity of the community continues to push boundaries. This is not merely technology-it is a new social contract.

Rajappa Manohar

i think blockchian is cool but fees too high sometimes

prashant choudhari

Public blockchains eliminate intermediaries. That's the core. No banks. No gatekeepers. Just code enforcing rules. Simple. Effective. Revolutionary.

Willis Shane

I appreciate the technical depth, but let's be honest: most users don't care about consensus mechanisms. They just want to send money without paying $50 in fees. This is brilliant engineering, but terrible UX.

Jake West

So let me get this straight. You're telling me I have to run a 2TB node just to be "part of the movement"? And if I lose my password, my life savings vanish forever? Cool. So this is like a crypto cult where the only rule is "you're on your own". Thanks for the anxiety.

Shawn Roberts

blockchain is the future 💪 no more banks taking your money with fees and delays. just send it and forget it. even my grandma got her first crypto transfer last week and she didn't even know what a hash was 😎

Bianca Martins

I used to think blockchain was just for tech bros until I saw a friend in Nigeria send money home for less than a dollar. That's the real power here-not speculation, but real human impact. Also, yes, the fees suck, but Layer 2s are fixing it. Give it time.

alvin mislang

You people are naive. This isn't freedom-it's a trap. Governments are watching. The NSA has backdoors. Your "decentralized" system is just a new way for the elite to control you without the paperwork. Wake up. The blockchain is a distraction. 🕵️♂️

Monty Burn

If no one owns it then who is the self? If the ledger records everything then is identity just a hash? If the network runs on energy then is consciousness just a byproduct of computation? I'm just asking questions nobody else dares to

Kenneth Mclaren

They say Bitcoin is secure. But what if the entire network is a psyop? What if the miners are all controlled by a single entity? What if the "proof of work" is just a way to hide the fact that the government owns all the ASICs? I've seen the patterns. The timestamps don't add up. The blockchain is a lie. They're using it to track us. I'm not paranoid. I'm prepared.

Alexandra Wright

Let’s be real-this tech is brilliant but the onboarding is a disaster. If your grandma can’t use it without crying, it’s not truly accessible. We need wallets that feel like TikTok, not a terminal. Also, stop calling it "decentralized finance" when 80% of the value is locked in centralized exchanges. Hypocrisy much?

Jack and Christine Smith

we just bought our first nft last week its a cat with sunglasses and we love it lol. also my cousin in india said he sent money to his sister in canada with crypto and saved like 300 bucks. crazy right? 🐱💸