The European Union is moving to ban Monero and Zcash by July 1, 2027. This isn’t a rumor. It’s law. Regulation 2024/1624, passed in May 2024, makes it illegal for any EU-regulated crypto exchange, wallet provider, or financial institution to handle privacy coins. If you hold Monero or Zcash, you won’t be able to trade them on Binance EU, Kraken EU, or any other platform operating under EU law. You won’t be able to deposit them. You won’t be able to withdraw them. The clock is ticking - and there’s no turning back.

Why Monero and Zcash Are Being Banned

Monero and Zcash weren’t banned because they’re dangerous. They were banned because they work too well. Monero uses ring signatures and stealth addresses to hide who sent what, to whom, and how much. Zcash uses zero-knowledge proofs to make shielded transactions completely invisible on the blockchain. To regulators, that’s not privacy - it’s a blind spot. And blind spots are risky when you’re trying to stop money laundering and terrorist financing. The EU’s new Anti-Money Laundering Regulation (AMLR) doesn’t just want transparency - it demands it. Every crypto transaction over €1,000 must be tied to a verified identity. That’s fine for Bitcoin or Ethereum. You can trace every coin. But with Monero? You can’t. With Zcash’s shielded pools? You can’t. That’s why the regulation specifically targets "crypto-asset accounts allowing anonymization of transactions." There’s no loophole. No compromise. No gray area.What the Ban Actually Means

This isn’t just about stopping trading. It’s about cutting off the entire infrastructure. Crypto-asset service providers (CASPs) under the MiCA framework - that’s every exchange, custodian, and payment processor in the EU - must now build systems that actively block privacy coins. They’ll need to scan blockchain addresses, flag known Monero or Zcash inputs, and refuse any transaction that even hints at anonymity features. You might think, "But I can just use a decentralized exchange." Not so fast. If you’re in Germany, France, or Spain, and you use a DEX that’s registered with EU regulators - even if it’s hosted on a server in Estonia - you’re still bound by the rules. The ban applies to any entity licensed under MiCA. It doesn’t matter if the platform is called "Uniswap" or "MoneroSwap" - if it’s regulated in the EU, it’s banned.What You Can Still Do

You won’t be arrested for holding Monero or Zcash. The law doesn’t criminalize possession. It only bans regulated entities from touching them. That means you can still keep your coins in a non-EU wallet - like a Ledger or Trezor stored offline. You can still buy them on non-EU exchanges like KuCoin or Bybit. You can still send them peer-to-peer to someone outside the EU. But here’s the catch: if you want to cash out your Monero into euros, you’ll need to move it to a non-EU exchange first. Then convert it to Bitcoin or Ethereum. Then send it to an EU-based exchange. Then sell. That’s three steps, extra fees, and more risk. It’s not impossible - but it’s not easy either.

Who’s Enforcing This?

The EU isn’t leaving enforcement to chance. A new body called AMLA - the Anti-Money Laundering Authority - will start monitoring the biggest crypto firms in 2026. If you’re a service provider handling more than €50 million in crypto transactions or serving over 10,000 customers, you’re on AMLA’s radar. These firms will face audits, fines, and license revocations if they fail to block privacy coins. Smaller platforms won’t escape either. The European Banking Authority is finalizing the technical rules right now. By early 2027, every CASP will have to prove they’ve built compliance into their core systems. No exceptions. No delays. No "we didn’t know" defenses.What This Means for the Market

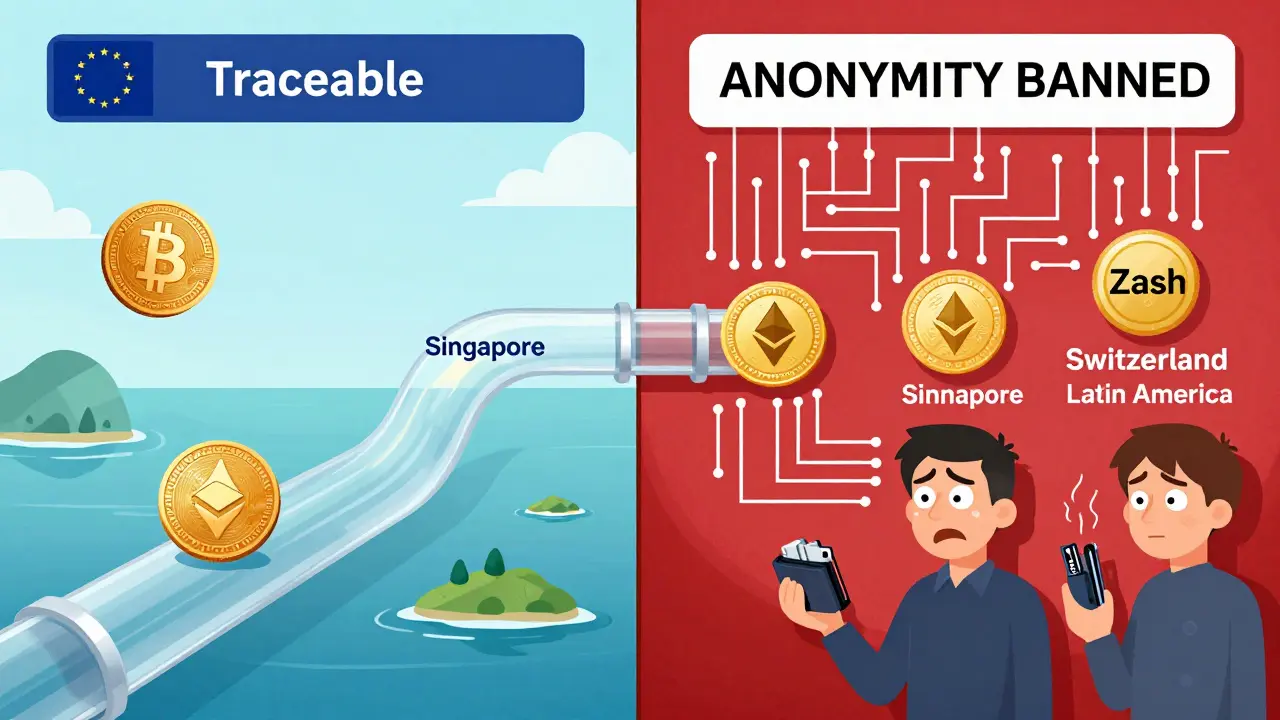

The EU is home to over 450 million people. It’s one of the biggest crypto markets in the world. When a market this size shuts the door on privacy coins, the impact ripples globally. Trading volume for Monero and Zcash has already dipped 18% since the regulation was announced in 2024. Some exchanges have quietly delisted them. Others are preparing to do so by March 2027. But here’s something you won’t hear in mainstream headlines: the ban might actually help privacy coins in the long run. As EU access dries up, demand could shift to underground networks, peer-to-peer marketplaces, and decentralized bridges. Some analysts believe the real value of Monero and Zcash will move offshore - to places like Singapore, Switzerland, or even parts of Latin America. The coins aren’t dying. They’re being forced underground.What Comes Next?

The EU’s move is setting a global precedent. The UK is watching closely. The US Treasury has already signaled interest in similar rules. If the EU’s system works - meaning it reduces illicit activity without causing mass market disruption - other countries will follow. That’s why privacy advocates are warning this isn’t just about crypto. It’s about financial privacy as a right. If governments can demand full transparency on every digital transaction, what’s next? Are your bank transfers, your online purchases, your charitable donations - all next? For now, the EU’s position is clear: anonymity is not a feature. It’s a flaw. And they’re fixing it - one coin at a time.

What Should You Do Now?

If you hold Monero or Zcash and live in the EU:- Don’t panic. You’re not breaking the law by holding them.

- Don’t sell in a panic. Prices may drop before July 2027, but they could rebound if demand shifts overseas.

- Move your coins to a non-EU wallet. Use a hardware wallet. Store your seed phrase offline.

- Don’t use EU-based exchanges after mid-2027. They’ll be legally required to block your transactions.

- Learn how to use non-custodial tools. DEXs like Thorchain or Osmosis might become your new lifeline.

- Watch for price spikes in late 2026 as users scramble to move coins out of EU platforms.

- Consider diversifying into non-EU jurisdictions. Some countries are already positioning themselves as privacy coin havens.

- Track AMLA’s official guidance. The final technical rules will drop in Q1 2027 - they’ll tell you exactly what’s allowed.

Will Other Privacy Coins Be Affected?

Yes. Dash, Pirate Chain, and any coin with built-in obfuscation features are also on the list. The regulation doesn’t name coins - it bans functionality. Any coin that hides sender, receiver, or amount will be blocked. That’s why the EU’s wording is so broad: "anonymity-enhancing coins." It’s not about the name. It’s about the code.Can This Ban Be Reversed?

No. The core prohibition is locked in. Public consultations in 2025 and 2026 were only about implementation details - how to detect privacy coins, how to classify them, how to train staff. The decision to ban them? Final. Even if Monero’s developers released a "compliant" version tomorrow, it wouldn’t matter. The EU doesn’t want privacy coins. Not even modified ones.Can I still own Monero or Zcash after the 2027 ban?

Yes. The EU ban targets service providers, not individuals. You can still hold Monero or Zcash in your personal wallet. But you won’t be able to trade them on any EU-regulated exchange, app, or platform after July 1, 2027.

Will the EU ban affect my Bitcoin or Ethereum?

No. Bitcoin and Ethereum are transparent blockchains. Every transaction can be traced. They’re fully compliant with the EU’s new rules. You can keep using them normally on EU platforms.

What happens if I try to send Monero to a EU exchange after 2027?

The exchange will reject the deposit. Their systems will scan incoming transactions and automatically block any that match Monero or Zcash’s signature patterns. Your funds won’t disappear - they’ll just sit in limbo until you withdraw them back to a non-EU wallet.

Can I use a VPN to access non-EU exchanges from inside the EU?

Technically yes, but it’s risky. Using a VPN doesn’t change your legal jurisdiction. If you’re a resident of France or Italy, you’re still subject to EU law. Some exchanges may ban your account if they detect you’re trying to bypass compliance rules. Don’t assume anonymity tools protect you from legal consequences.

Is there a chance the EU will delay the ban?

No. The July 1, 2027 deadline is fixed. The only thing still being worked out are technical details - like how to detect shielded transactions. The decision to ban privacy coins was finalized in 2024 and cannot be undone.

Will this ban make Monero and Zcash worthless?

Not necessarily. The EU is a big market, but not the only one. If demand shifts to Asia, Latin America, or decentralized networks, these coins could still thrive - just outside the EU’s reach. Their value may drop short-term, but their core technology remains strong.

Comments

Allen Dometita

This is wild. They're banning privacy coins like it's 2003 and we're still using dial-up. 🤦♂️

Brittany Slick

I feel like this is the beginning of something way bigger... like, what’s next? Are they gonna ban encrypted messaging next? 😔

Sherry Giles

They think they’re stopping crime but they’re just making the rich richer. The Feds can track everything except their own offshore accounts. This is pure control. 🇺🇸🇨🇦

Surendra Chopde

Interesting. In India, we don’t have strict crypto laws yet. But I worry this will push global regulation in a dangerous direction. Privacy isn’t crime.

Tre Smith

Let’s be real - Monero’s anonymity features are a liability in a regulated financial ecosystem. The EU isn’t being draconian; they’re being pragmatic. If you can’t KYC it, it doesn’t belong in the system.

Ritu Singh

They call it anti-money laundering but it’s really anti-freedom... we’re being herded into a financial panopticon where every coin tells a story they wrote

kris serafin

If you’re holding Monero or Zcash, just move it to a hardware wallet and chill. No need to panic. Use a non-EU DEX like Thorchain. Easy peasy. 🛡️

Jordan Leon

There’s a philosophical tension here - between state security and individual sovereignty. One side says transparency prevents harm. The other says silence protects dignity. Neither side is wrong. But one side has the guns.

Rahul Sharma

As someone from India, I find this concerning. Financial privacy is a human right. If the EU can enforce this, it will pressure emerging markets to follow. We must resist.

LeeAnn Herker

Oh please. The EU banned privacy coins because they can’t tax them properly. Next they’ll ban cash. Then they’ll track your heartbeat. #BigBrotherIsWatching

Andy Schichter

So we’re supposed to be grateful they’re not locking us up for owning crypto? Wow. What a relief. 🙃

Caitlin Colwell

I just hope people don’t lose their coins trying to move them. Stay safe out there.

Charlotte Parker

They’re not banning privacy coins. They’re banning the idea that you can have secrets. Welcome to the new normal, folks. No more hiding. Ever.

Calen Adams

This is a game-changer. The EU just declared war on decentralized finance. I’m already looking at Solana-based privacy layers and sidechains. The cat’s out of the bag.

Valencia Adell

This is why I sold my Zcash in 2023. I knew they’d come for it. Now the retail fools are panicking. Classic. 😏

Jon Martín

Yo, if you’re holding privacy coins, don’t just sit there. Learn how to use Wasabi Wallet, Samourai, or even Lightning Network with privacy layers. The future’s not dead - it’s just moving offshore. We got this 💪

Tracey Grammer-Porter

You don’t have to be a crypto bro to care about this. What happens to your bank account when the government says you can’t have secrets? This isn’t about crypto - it’s about you.

sathish kumar

The European Union's regulatory framework is grounded in the principle of financial integrity. The prohibition of anonymity-enhancing cryptocurrencies is a logical extension of the Anti-Money Laundering Directive. One must acknowledge the necessity of oversight in a global financial system.

Don Grissett

Bro… you think they’ll let you keep your coins? Nah. Next thing you know, they’ll freeze your wallet. I seen this movie before. They always come for the weird ones first.

Katrina Recto

I’m not scared. I’m just done trusting systems that don’t trust me.