Security Token Comparison Tool

Security Tokens

Represent ownership or financial rights in real-world assets. Subject to securities law and regulated marketplaces.

Utility Tokens

Provide access to products or services on a blockchain platform. Generally unregulated unless used as investment.

| Feature | Security Token | Utility Token |

|---|---|---|

| Primary Purpose | Represent ownership or financial rights | Provide access to a platform or service |

| Regulatory Treatment | Subject to securities law (Howey Test) | Generally unregulated, but can become regulated |

| Typical Holders | Accredited or qualified investors | Anyone interested in the service |

| Dividends/Revenue Share | Often included via smart contract | Rarely applicable |

| Liquidity Venues | Regulated marketplaces, security-focused exchanges | Decentralized exchanges, peer-to-peer platforms |

Security Token Example

Real Estate Investment: A commercial property is tokenized into 10,000 tokens, each representing 0.01% ownership. Investors can buy fractional stakes and receive rental income through smart contracts.

Utility Token Example

DApp Access: A decentralized app issues utility tokens that users must pay to access premium features or services within the platform.

Test your understanding of security vs utility tokens:

Ever wondered why investors keep hearing about security tokens while reading blockchain news? In simple terms, they are digital certificates that turn real‑world assets-like stocks, bonds, or real estate-into blockchain entries you can buy, sell, or hold, all while staying under the same rules that govern traditional securities. This guide walks you through what security tokens are, how they work, why they matter, and what you need to watch out for before diving in.

Key Takeaways

- Security tokens are blockchain‑based representations of ownership in real assets.

- They rely on tokenization, smart contracts, and regulated marketplaces to stay compliant.

- Benefits include fractional ownership, faster settlement, and transparent audit trails.

- Regulatory compliance is mandatory; the Howey Test is the standard in the U.S.

- Risks involve regulatory changes, platform security, and the performance of the underlying asset.

What Is a Security Token?

Security Token is a digital representation of ownership or rights to a real‑world asset stored on a blockchain. Unlike Bitcoin or Ether, which are primarily used as currencies or utility fuels, security tokens give you a claim-such as equity, debt, or revenue share-over an actual investment. In practice, owning a security token is similar to holding a share certificate, but the record lives on a decentralized ledger instead of a paper register.

How Tokenization Turns Assets Into Digital Tokens

Tokenization is the process of converting an asset’s legal ownership into a cryptographic token. First, the issuer defines the asset’s rights-say, a 10% equity stake in a startup. Next, a Smart Contract is deployed on a blockchain platform to enforce issuance, transfer, and dividend rules automatically. The contract mints a unique alphanumeric token for each share, assigns it a token ID, and records the mapping on the blockchain’s immutable ledger.

Because the ledger is public and tamper‑proof, every transfer is instantly visible to regulators and investors, eliminating the need for many middlemen that slow down traditional settlement.

Regulatory Framework: Staying Legal on the Blockchain

Security tokens are not exempt from securities law. In the United States, the Howey Test determines whether an instrument is a security by checking if it involves an investment of money in a common enterprise with an expectation of profit from the efforts of others. Similar tests exist in the EU, Singapore, and other jurisdictions.

Compliance is baked into the token’s smart contract: transfer restrictions can block non‑accredited investors, KYC/AML checks can be enforced on‑chain, and dividend distributions can be programmed to follow legal timelines. Platforms that list security tokens-known as Regulated Marketplace-must hold a license from a financial authority, such as the Monetary Authority of Singapore for the InvestaX market.

Benefits Over Traditional Securities

Here’s why many firms see security tokens as a game‑changer:

- Transparency: Every transaction is recorded on a public ledger, making audits straightforward.

- Speed: Settlement can happen in minutes instead of days, thanks to automated smart contracts.

- Fractional Ownership: Investors can buy tiny slices of a $10million property, opening markets to a broader audience.

- Global Access: With proper KYC, a qualified investor in Tokyo can purchase a token issued in New York without dealing with cross‑border clearinghouses.

- Reduced Costs: Fewer custodians and intermediaries mean lower issuance and trading fees.

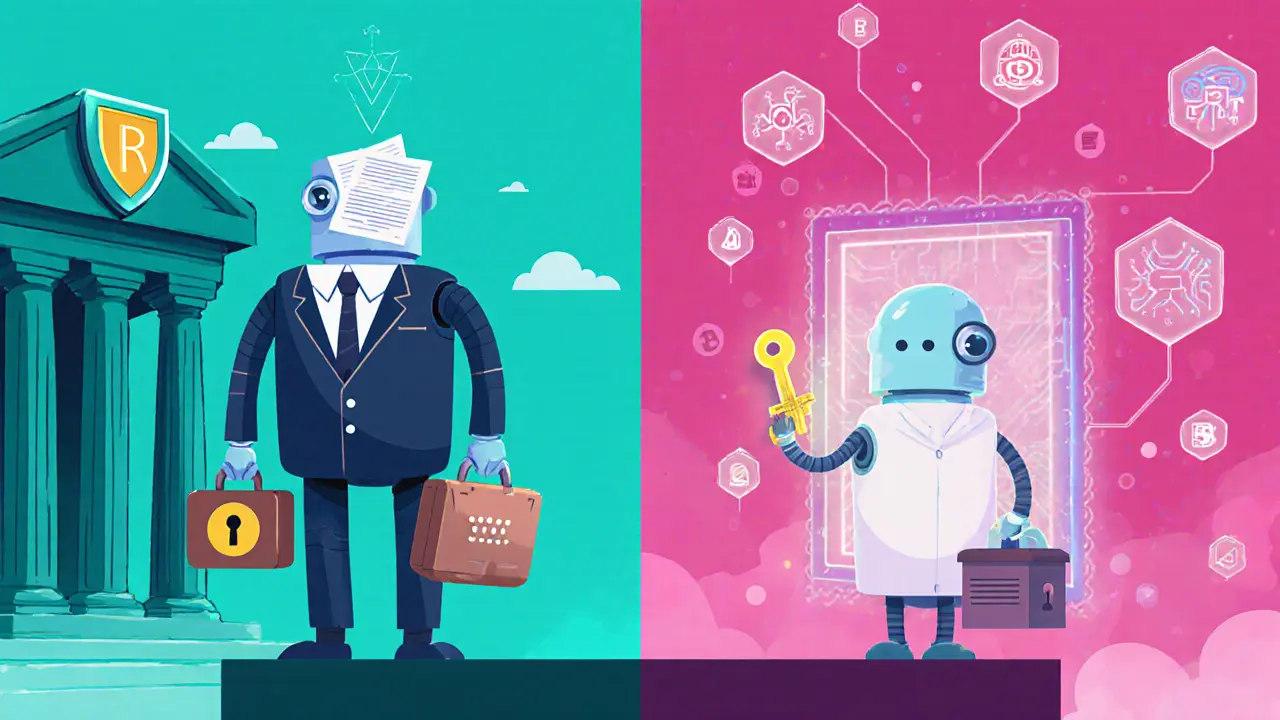

Security Tokens vs. Utility Tokens

Both live on blockchains, but they serve different purposes. Utility tokens grant access to a product or service-think of a token you need to use a decentralized app. Security tokens, on the other hand, convey ownership and profit rights, and thus attract regulatory scrutiny.

| Feature | Security Token | Utility Token |

|---|---|---|

| Primary purpose | Represent ownership or financial rights | Provide access to a platform or service |

| Regulatory treatment | Subject to securities law (e.g., Howey Test) | Generally unregulated, but can become regulated if used as investment |

| Typical holders | Accredited or qualified investors | Anyone interested in the service |

| Dividends/Revenue share | Often included via smart contract | Rarely applicable |

| Liquidity venues | Regulated marketplaces, security‑focused exchanges | Decentralized exchanges, peer‑to‑peer platforms |

Real‑World Use Cases

Security tokens have already been deployed across several asset classes:

- Equity: A biotech startup issued 1million security tokens representing shares, allowing investors worldwide to participate without a traditional IPO.

- Debt: A European real‑estate fund tokenized a $50million senior loan, offering fixed‑interest payments directly to token holders.

- Real Estate: A commercial property in London was split into 10,000 tokens, each representing a 0.01% ownership stake, enabling fractional investment.

- Revenue‑Sharing: A music royalty platform tokenized future streaming revenue, letting fans earn a slice of an artist’s earnings.

How to Acquire and Trade Security Tokens

Getting started is similar to buying any crypto, but you’ll need tools that support compliance:

- Choose a compliant Digital Wallet that can hold ERC‑20 or similar token standards (e.g., Metamask, Coinbase Web3 Wallet).

- Complete KYC/AML verification on a Regulated Marketplace like InvestaX, tZERO, or Securitize.

- Transfer funds (usually fiat or stablecoin) to the platform’s escrow account.

- Buy the desired security token in a primary offering (STO) or secondary market.

- Hold the token in your wallet; any dividends or interest are automatically distributed by the smart contract.

Remember, because the token is a security, you must retain documentation of your investor status and transaction records for tax and regulatory reporting.

Risks and Pitfalls to Watch

While the technology sounds flawless, several practical challenges persist:

- Regulatory shifts: A change in securities law can render a token non‑compliant overnight.

- Platform security: Hacks on wallet providers or marketplace smart contracts could lead to loss of tokens.

- Liquidity constraints: Not all tokens have active secondary markets, making it hard to sell quickly.

- Underlying asset risk: The token mirrors the performance of its real‑world asset; a drop in property value affects your token’s price.

- Compliance overhead: Ongoing reporting, KYC updates, and tax filings can be time‑consuming for investors.

Doing thorough due diligence-checking the issuer’s legal counsel, the smart contract audit, and the marketplace’s licensing-can mitigate many of these risks.

Frequently Asked Questions

How do security tokens differ from traditional stocks?

Both represent ownership, but security tokens live on a blockchain, enabling instant settlement, fractional ownership, and programmable rights, while traditional stocks rely on legacy clearinghouses and paper‑based processes.

Do I need a special wallet to hold security tokens?

Yes. You need a wallet that supports the token’s standard (usually ERC‑20 or ERC‑1400) and can integrate with compliance checks, such as Metamask, Coinbase Web3 Wallet, or a custodial solution offered by a regulated exchange.

What is an STO?

An STO, or Security Token Offering, is the blockchain equivalent of an IPO. The issuer sells digital security tokens to accredited investors, following securities regulations and often using a smart contract to manage issuance and distribution.

Are dividends automatically paid to token holders?

If the token’s smart contract includes dividend logic, payouts are automatically sent to each wallet address on the scheduled date, eliminating manual distribution.

Can I trade security tokens on public crypto exchanges?

Generally, no. Because they are regulated securities, they must trade on licensed platforms that enforce KYC/AML. Some specialized digital security exchanges allow limited secondary trading.

Comments

Sonu Singh

security tokens r kinda like digital shares but way faster n cheaper fr fr. i bought a slice of a london building last month n my phone just auto-pays me rent every month. no bank, no paperwork, just blockchain magic. still scared of hacks tho 😅

Peter Schwalm

Really glad someone broke this down clearly. The fractional ownership angle is the real game-changer - imagine a college student owning 0.01% of a skyscraper. That’s not just investing, that’s generational wealth democratized. Smart contracts doing the heavy lifting? Yes please.

Alex Horville

USA has the best regulatory framework for this. If you’re outside the US trying to trade these, you’re playing Russian roulette with your money. SEC knows what it’s doing - other countries are still trying to figure out if blockchain is real or just crypto hype.

Marianne Sivertsen

It’s funny how we’re building this whole new financial system on code, yet still clinging to old ideas like ‘accredited investor’ status. The tech doesn’t care about income - it just wants to transfer ownership. Maybe the real revolution isn’t the token… it’s us letting go of who we think deserves to own something.

Shruti rana Rana

OMG this is so exciting!! 🌟 Finally, the world is catching up to what India has been dreaming about for years - financial inclusion through tech! I just shared this with my entire family. My aunty wants to buy a piece of a Mumbai apartment now 😍 Thank you for making it so clear!!

Stephanie Alya

So let me get this straight… you’re telling me I can now own a tiny piece of a building and get paid in crypto without ever talking to a broker? And people still say crypto is ‘just gambling’? 🤡 I’ve seen better regulation from my local taco truck.

olufunmi ajibade

This is beautiful. In Nigeria, we’ve been waiting for something like this to bypass broken banking systems. Imagine a smallholder farmer tokenizing his cocoa farm and getting direct payments from investors in Berlin. No middlemen. No corruption. Just code and fairness. This isn’t finance - it’s justice.

Manish Gupta

wait so if i buy a token for a property in delhi, can i sell it to someone in canada? or do i need to wait for some gov approval? also can i use crypto to buy it or only usd? 🤔

Gabrielle Loeser

While the benefits are compelling, I urge caution. The compliance burden on retail investors is often underestimated. Tax reporting, ongoing KYC updates, and jurisdictional restrictions can create more administrative stress than traditional securities. Technology simplifies transactions - but not regulation.

Cyndy Mcquiston

Why are we even doing this. Real assets should stay real. Blockchain is a distraction. The system works fine. Stop trying to fix what isn’t broken.

Abby Gonzales Hoffman

YES. This is the future and it’s already here. I helped a friend tokenize a small solar farm in Arizona - now 500 people own bits of it. They get quarterly payouts, track production live on their phones, and feel connected to clean energy. That’s not finance - that’s community. Let’s build more of this.

Rampraveen Rani

bro i just bought 500 tokens of a mumbai mall and now i get 20 rupees every month like a snack fund 😎 blockchain is the new atm

ashish ramani

The underlying asset performance is the real risk. A token is only as good as the property, company, or revenue stream it represents. Don’t confuse blockchain transparency with investment safety.