Blockchain Analytics: Tools, Trends, and Real‑World Applications

When working with blockchain analytics, the systematic examination of on‑chain data, transaction flows, and market metrics. Also known as chain data analysis, it helps investors, developers and regulators spot patterns, assess risk, and forecast price moves. In practice, tokenomics, the study of a token’s supply, distribution and incentive structures is a core subtopic, because understanding how coins reward participants directly feeds the analytics models. Likewise, decentralized exchange analysis, the evaluation of DEX liquidity, fee structures and trading volume provides the market‑side data that completes the on‑chain picture. Together, these pieces let you answer questions like: Which airdrop will actually deliver value? Which DEX offers the best depth for a new token? And how does a token’s economics shape its price trajectory?

One practical angle of blockchain analytics is crypto airdrop verification, the process of confirming that a free token distribution is legitimate and not a scam. By cross‑checking wallet eligibility, smart‑contract source code and official communications, analysts can filter out phantom drops that merely aim to harvest personal data. This verification step often uses the same data pipelines that power tokenomics dashboards—tracking token supply changes and distribution events in real time. When you combine airdrop checks with DEX analysis, you can see if a newly dropped token quickly gains liquidity or stalls on a single platform, which signals its real market potential.

Why Market Adoption Indexes Matter

The global crypto adoption index is another related entity that shapes blockchain analytics. It aggregates on‑chain activity, exchange registrations, and regulatory climates across countries to rank where crypto is actually being used. Analysts feed this index into their models to adjust risk weights: a token that shows strong adoption in high‑growth regions may warrant a higher valuation than one confined to a few niche markets. This index also influences DEX analysis, because regional user bases affect where liquidity pools form and which trading pairs thrive. By linking adoption data to tokenomics and airdrop outcomes, you get a full‑cycle view—from the macro trend down to a single wallet’s experience.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas. Whether you’re checking the legitimacy of the SHIBSC airdrop, comparing MCDEX’s perpetual contracts to other DEXs, or learning how Germany’s tax rules affect long‑term holdings, the posts are organized around the core concepts of blockchain analytics. Browse the list to see real examples, step‑by‑step guides, and data‑driven reviews that bring the theory we just outlined to life.

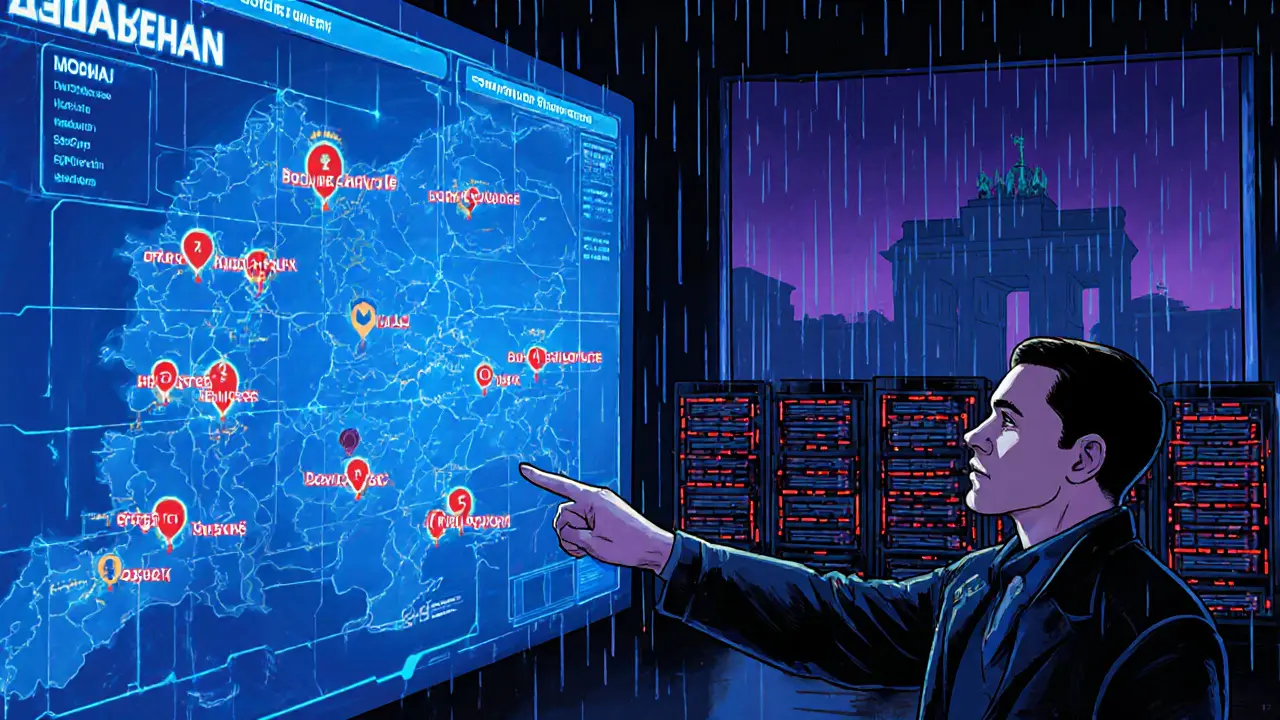

Operation Final Exchange: How Germany’s Biggest Crypto Crackdown Targets No‑KYC Exchanges

Operation Final Exchange was Germany's massive 2024 crackdown on 47 Russian no‑KYC crypto exchanges, seizing servers, data and disrupting sanctions evasion, ransomware, and darknet finance.

read more