Blockchain NFT Trading

When working with blockchain NFT trading, the practice of buying, selling, and swapping non‑fungible tokens on a public ledger. Also known as NFT trading on blockchain, it connects creators, collectors, and markets in a decentralized way.

Key Components of Blockchain NFT Trading

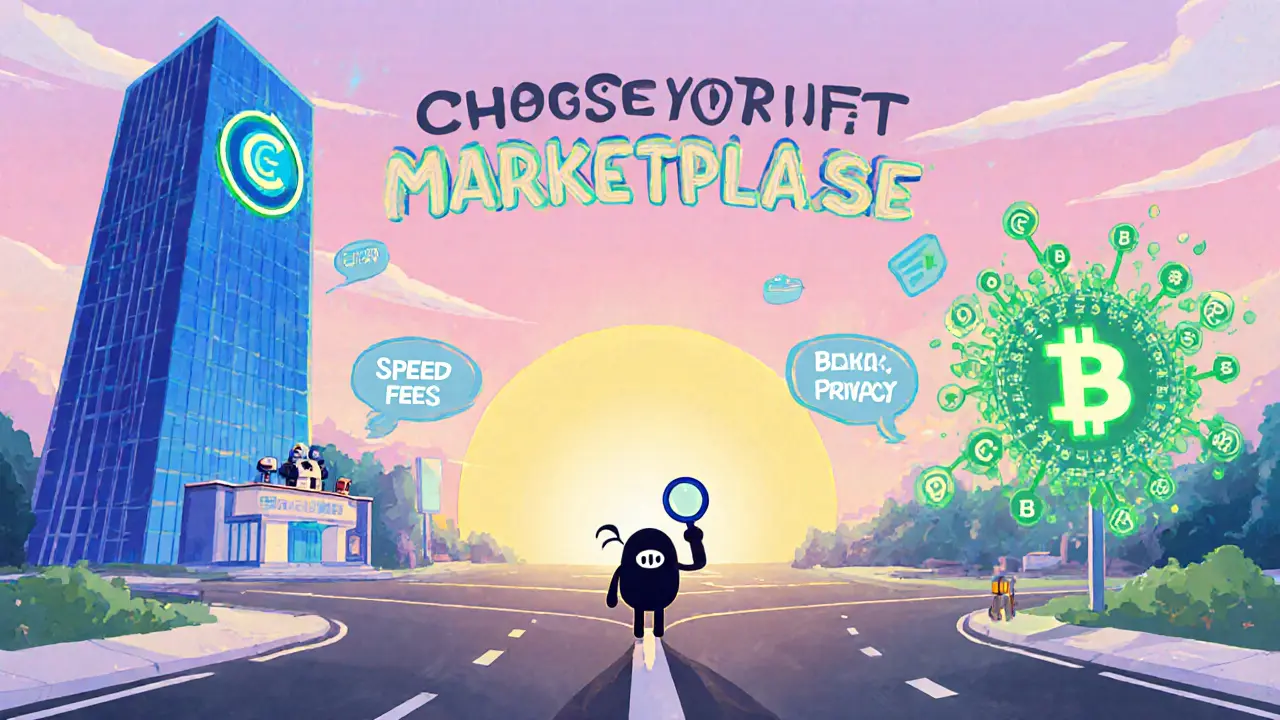

The backbone of any NFT transaction is the NFT marketplace, a platform where users list, discover, and trade digital collectibles. Marketplaces such as OpenSea or MagicEden provide the UI, the order book, and the escrow smart contracts that make trades safe. They also host the metadata that tells you what each token represents, from art pieces to in‑game skins. Without a solid marketplace, the whole ecosystem would stall.

blockchain NFT trading often overlaps with play‑to‑earn games, gaming experiences that reward players with tradeable NFTs or tokens. Games like Axie Infinity or KittySpin let you earn assets that you can later sell on a marketplace, turning gameplay into a revenue stream. This creates a feedback loop: the more engaging the game, the higher the demand for its NFTs, which in turn fuels marketplace volume.

To move those assets quickly, traders rely on a crypto exchange, a service that lets you convert crypto into fiat or other tokens. Exchanges provide the liquidity needed when you want to cash out earnings from a play‑to‑earn title or purchase new NFTs with stablecoins. They also offer price charts and order types that help you time your buys and sells. In short, a robust exchange is the cash register for NFT traders.

Another boost comes from NFT airdrop, a distribution event where free tokens or NFTs are sent to eligible wallets. Airdrops can spark sudden interest in a project, swell its community, and drive up secondary‑market activity. However, they also attract scammers, so verifying the source and following safety steps is essential. When done right, an airdrop acts as a marketing catalyst that feeds both marketplaces and exchanges.

Tokenomics ties all these pieces together. Understanding supply caps, burn mechanisms, and royalty structures helps you gauge a token’s long‑term value. For example, a marketplace that charges a 2.5 % royalty on secondary sales can create sustainable revenue for creators while keeping fees low enough for traders. Meanwhile, play‑to‑earn games often embed token sinks—features that require spending tokens—to balance inflation. Grasping these dynamics lets you spot genuine opportunities versus hype.

Security can’t be ignored. Smart‑contract bugs, phishing attacks, and rug pulls are real risks. Using audited contracts, hardware wallets, and two‑factor authentication reduces exposure. Many reputable marketplaces now display audit reports and offer bug bounty programs, while exchanges list their custodial safeguards. Treat each step—marketplace trade, game reward claim, exchange withdrawal—as a separate security layer.

Looking ahead, cross‑chain bridges are expanding the NFT playground. Assets can now move between Ethereum, Solana, and Polygon without losing provenance, opening arbitrage chances and broader audiences. Meanwhile, decentralized identifiers (DIDs) promise richer provenance tracking, helping collectors verify authenticity. Staying aware of these trends will keep your strategies fresh and competitive.

Below you’ll find a curated mix of guides, reviews, and alerts that dive deeper into each facet of blockchain NFT trading, from marketplace selection to airdrop safety and beyond.

Centralized vs Decentralized NFT Marketplaces: Pros, Cons & Comparison

Explore the differences between centralized and decentralized NFT marketplaces, covering fees, speed, security, privacy, and future hybrid models to help you choose the right platform.

read more