NFT Marketplace Comparison Tool

- Speed: Near-instant transactions

- Fees: 0.1-0.2% + listing fees

- User Experience: Intuitive interface, fiat on-ramp

- Security: Single point of failure

- Privacy: Requires KYC, central data storage

- Control: Platform owner controls listings

- Speed: Block finality (10-30 seconds)

- Fees: ~0.05% + gas fees

- User Experience: Wallet-first, technical barrier

- Security: Distributed nodes, smart contract risks

- Privacy: Pseudonymous, no KYC

- Control: Smart contracts govern operations

Choose Based On Your Needs:

Your Recommendation:

Important Notes:

- An NFT exists on the blockchain regardless of where it's listed

- Decentralized marketplaces may use centralized storage for metadata

- Gas fees apply to all blockchain transactions

- Centralized platforms can shut down, but your NFTs remain on-chain

With the NFT boom still roaring in 2025, the choice between NFT marketplaces can feel like a fork in the road: do you trust a big, user‑friendly platform, or do you chase the promise of full control on a blockchain‑only service? This guide breaks down the two architectures, weighs the real‑world trade‑offs, and gives you a practical checklist so you can decide which kind of marketplace fits your needs.

What is an NFT Marketplace?

When you hear the term, think of a digital storefront that lets creators list, buyers discover, and owners trade non‑fungible tokens. NFT Marketplace is a platform, either web‑based or protocol‑driven, where NFTs are minted, listed, bought, and sold. The marketplace handles the crucial steps of matching a seller’s token ID with a buyer’s address, confirming ownership via the blockchain, and recording the transaction in an immutable ledger.

Centralized NFT Marketplaces

Centralized platforms are run by a single company that owns the servers, the UI, and the customer‑support team. They act as a trusted intermediary, simplifying the experience for users who may not be comfortable dealing directly with wallets or gas fees.

OpenSea is the world’s largest centralized NFT marketplace, handling billions of dollars in sales and hosting over 1.3million buyers. Its sleek UI, easy‑to‑use search, and fiat checkout options make it feel more like a traditional e‑commerce site.

Coinbase NFT is a centralized exchange‑styled marketplace that ties directly into the Coinbase fiat‑on‑ramp and KYC infrastructure. Users can buy NFTs with a linked bank account, and the platform handles all custody behind the scenes.

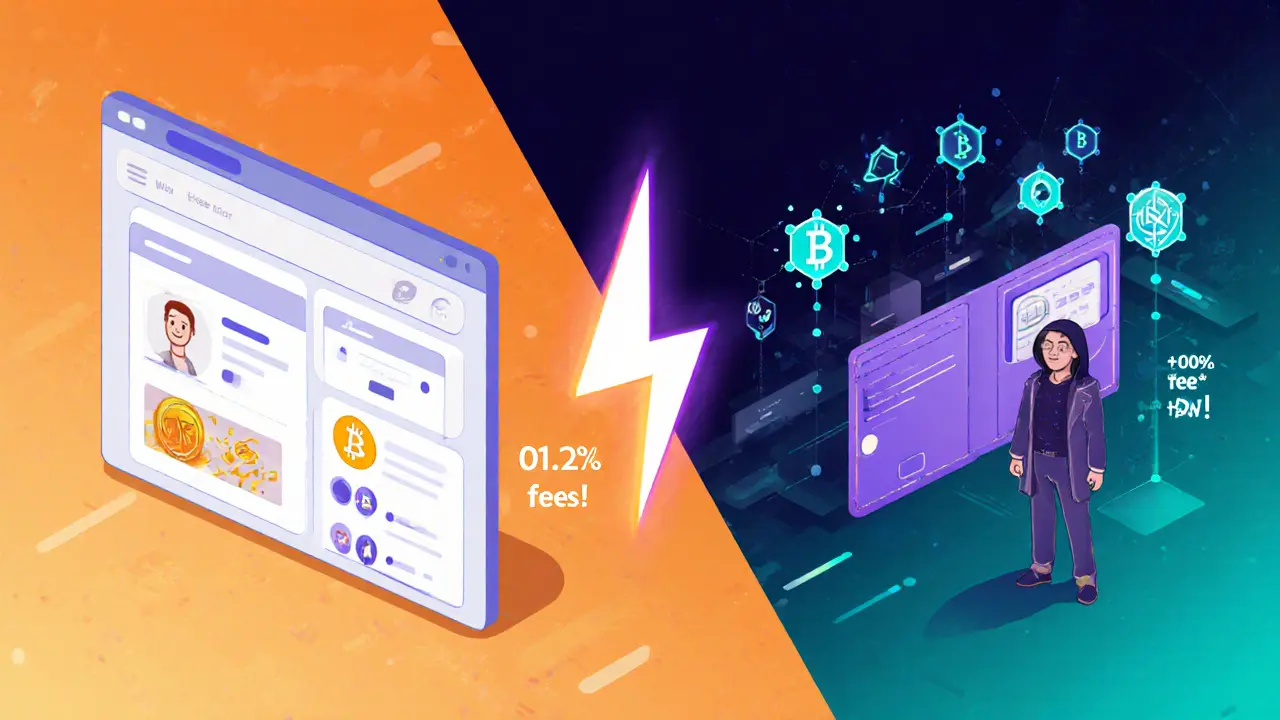

The advantages are clear: near‑instant transaction confirmations (because the platform validates internally), familiar onboarding flows, and 24/7 customer support. The downside? The platform decides which NFTs stay listed, can freeze accounts, and typically charges higher fees-often 0.1‑0.2% of the sale price, plus possible listing fees.

Decentralized NFT Marketplaces

Decentralized marketplaces run on smart contracts that live on a blockchain, meaning no single company owns the order book or the trade engine. Users interact directly with their wallets, retaining custody of private keys throughout the process.

IPFS is a peer‑to‑peer storage network that lets NFT metadata and assets be hosted without a central server. When a marketplace stores a token’s image on IPFS, the file is distributed across many nodes, reducing the risk of censorship.

Smart Contract is self‑executing code on a blockchain that enforces the rules of a trade without a middleman. In a decentralized NFT marketplace, the contract handles listings, bids, and final transfers automatically.

Because fees are baked into the contract, they tend to be lower-often around 0.05%-and are redistributed to liquidity providers or burned, depending on the protocol’s tokenomics.

However, the user experience can be rougher. You need a compatible wallet, you must pay gas fees (which can spike on Ethereum), and there’s limited direct support if something goes wrong.

Key Trade‑offs

- Speed: Centralized platforms confirm trades in seconds; decentralized trades wait for block finality, which on Ethereum can be 10‑30seconds plus network congestion.

- Fees: Centralized services charge 0.1‑0.2% plus possible listing fees; decentralized protocols often sit at 0.05% or lower, though gas fees add an unpredictable cost.

- User experience: Centralized sites offer intuitive UI, fiat on‑ramps, and help desks. Decentralized sites demand wallet management and a deeper grasp of blockchain concepts.

- Security: Centralized sites have a single point of failure-hack a server, you compromise everyone. Decentralized networks spread risk across nodes but can suffer from smart‑contract bugs.

- Privacy: Decentralized marketplaces let you trade pseudonymously, often without KYC. Centralized platforms usually require identity verification to comply with regulations.

- Control & Censorship: Centralized operators can delist tokens or block accounts. True decentralization means the token lives on the chain forever, though its metadata may still be on a centralized server.

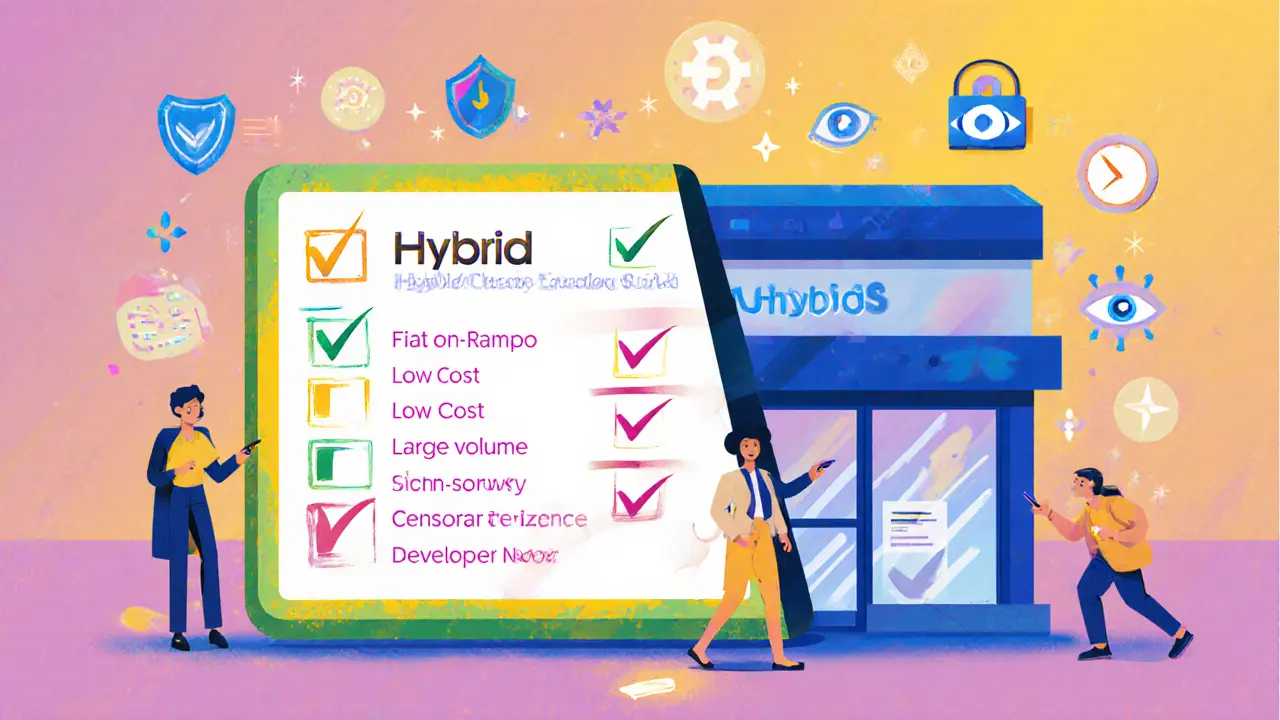

Hybrid & Emerging Models

Many projects now prefer a hybrid approach: a white‑labeled front‑end that feels like a centralized site, but the underlying trade engine is a decentralized smart contract. This gives creators brand control while preserving low fees and user‑owned custody.

Advances in metadata storage solutions such as IPFS gateways with pinning services and emerging protocols like Filecoin are reducing the reliance on centralized servers, closing a major loophole in the “decentralized” claim.

Regulators in the US and EU are also shaping the space. Platforms that want to stay compliant may adopt KYC on‑ramps while still using decentralized trade execution, resulting in a middle ground that satisfies both users and authorities.

Comparison Table

| Aspect | Centralized | Decentralized |

|---|---|---|

| Control | Single entity decides listings, fees, and access | Governed by smart contracts; no single admin |

| Typical Fees | 0.1‑0.2% + possible listing fees | ~0.05% + on‑chain gas costs |

| Transaction Speed | Seconds (off‑chain confirmation) | Block finality (10‑30seconds on Ethereum) |

| User Experience | Intuitive UI, fiat support, help desk | Wallet‑first, higher technical barrier |

| Privacy | KYC required, data stored centrally | Pseudonymous, no mandatory KYC |

| Security Model | Central server - single point of failure | Distributed nodes - smart‑contract risks |

| Metadata Storage | Often hosted on proprietary servers | Prefer IPFS/Filecoin for decentralized storage |

Quick Decision Checklist

- Do you need fiat on‑ramps and live support? → Centralized.

- Is low cost and full custody a priority? → Decentralized.

- Will you be handling large‑volume trades that need deep liquidity? → Centralized platforms usually have bigger order books.

- Are you comfortable managing private keys and gas fees? → Decentralized.

- Is censorship resistance critical for your project? → Decentralized (but verify metadata storage).

Frequently Asked Questions

Can I list the same NFT on both a centralized and a decentralized marketplace?

Yes. An NFT lives on the blockchain, so any platform that reads the token contract can list it. However, you must meet each marketplace’s metadata standards and, for centralized sites, may need to go through a verification process.

Why do many “decentralized” marketplaces still use centralized servers for images?

Storing large files on‑chain is expensive. Most projects place the image on IPFS or a cloud service and then point the token’s metadata URI to that location. If the server goes down, the token’s link breaks, which is why true decentralization requires pinning services or Filecoin backup.

Are gas fees higher on decentralized NFT marketplaces?

Gas fees are paid whenever you write to the blockchain-listing, buying, or transferring. Centralized platforms often batch transactions or use layer‑2 solutions to hide fees, while pure‑chain marketplaces expose the cost directly to the user.

What happens if a centralized marketplace shuts down?

Your NFTs remain on the blockchain, but if they were stored in a custodial wallet, you’ll need to withdraw them first. Some platforms offer migration tools; otherwise you can export the token ID and import it into a decentralized UI.

Is there a regulatory advantage to using a centralized marketplace?

Centralized platforms already implement KYC/AML procedures, which can make them safer for fiat on‑ramps and institutional buyers. Decentralized services may face future compliance hurdles, especially in jurisdictions tightening crypto rules.

Comments

Shanthan Jogavajjala

When you juxtapose a layer‑2 scaling solution with a monolithic UI, you essentially create a hybrid stack where the transaction settlement lives off‑chain while the user‑experience remains tethered to a centralized orchestrator. This architecture introduces an implicit trust boundary that most newcomers fail to notice, especially when the front‑end caches state without cryptographic verification. Moreover, the latency asymmetry between the rollup finality and the immediate UI feedback can foster a false sense of security, prompting users to overlook the underlying consensus delays. In practice, this means that a “near‑instant” purchase on a centralized portal may still be pending on the blockchain for several minutes, risking double‑spends or front‑running. Developers should therefore instrument transparent status indicators that reflect both layers, not just the web‑app’s optimistic updates.

Millsaps Delaine

One cannot merely skim the surface of the marketplace dichotomy without acknowledging the profound epistemological ramifications that undergird each paradigm; the very act of choosing a venue is tantamount to a declaration of one's ontological alignment with either custodial centralization or cryptographic anarchy. The centralized behemoths, draped in polished brand façades, masquerade as benign gatekeepers while extracting a non‑trivial portion of the transactional surplus through systemic fee structures that are, in essence, a form of rent‑seeking on the user base's enthusiasm. Simultaneously, they impose identity verification regimes that, while ostensibly compliant with regulatory edicts, erode the pseudonymous sanctity that was the original raison d'être of non‑fungible tokens. Conversely, the decentralized assemblages, though lauded for their egalitarian ethos, are not without their own insidious inefficiencies; they perpetuate a milieu where gas price volatility can render even modest trades economically prohibitive, thereby reintroducing a barrier to entry that rivals the fiat on‑ramps they purport to eschew. Moreover, the reliance on smart contract logic, immutable by design, embeds a latent risk vector wherein any latent vulnerability-be it re‑entrancy or integer overflow-can be weaponized at scale, producing cascades of loss that surpass the modest fees extracted by their centralized counterparts. It is imperative, therefore, to assess the opportunity cost of each model not solely through the lens of immediate utility but through a longitudinal perspective that contemplates regulatory drift, technological entropy, and the evolving expectations of a user base that is increasingly savvy yet perpetually vulnerable to both overt and covert forms of coercion. In sum, the decision matrix is not a binary toggle but a multidimensional vector that demands rigorous scrutiny, lest one inadvertently capitulate to a system that subtly subverts the very freedoms it claims to safeguard.

Jack Fans

Hey folks! Just wanted to add a quick note: if you're leaning towards the decentralized side, consider using a reputable IPFS pinning service to keep your NFT assets persistently available-otherwise you might end up with broken image links later on. Also, many dApps now support gas‑fee relayers that let you pay in stablecoins, which can smooth out the cost spikes. Lastly, don't forget to verify the contract's source code on Etherscan; it's a good habit to ensure transparency and avoid hidden malicious logic. Happy minting!!

Adetoyese Oluyomi-Deji Olugunna

While the above suggestions are adequate, they fail to appreciate the inherent superiority of platforms that enforce a rigorous curation process-only the most aesthetically refined collections deserve visibility, and this filter maintains market integrity. Moreover, without KYC, the ecosystem is vulnerable to spammers and illicit activity, which ultimately devalues genuine artistic expression.

Krithika Natarajan

I understand both sides have merits; if you need quick onboarding and support, a centralized site is helpful, but if you value ownership, a decentralized protocol works.

Ayaz Mudarris

Esteemed community, allow me to articulate the philosophical underpinnings of this deliberation. Centralized exchanges, while offering expediency, embody a concession of sovereignty to an administrative entity, thereby imposing an external locus of control upon the participant. Decentralized frameworks, conversely, champion self‑governance, situating authority within the cryptographic primitives that define the ledger. Yet, this emancipation is not devoid of cost; the necessity of managing private keys introduces a non‑trivial cognitive load, and the stochastic nature of gas fees can impede equitable access. Therefore, the prudent actor must balance the ontological desire for autonomy against the pragmatic exigencies of operational efficiency, selecting the venue that aligns with one's risk tolerance and philosophical commitment.

Irene Tien MD MSc

Ah, the classic "trust the giant" versus "trust the code" narrative-always a delightful dance of illusion and paranoia. Imagine a world where every transaction is silently curated by an invisible cabal of algorithmic overlords, extracting subtle commissions while you blissfully believe you're supporting independent creators. Then, picture the alternative: an abyss of gas fees so high they could fund a small nation, all while you fumble with private keys that might as well be cursed talismans. Both paths lead to the same destination-your assets are always at the mercy of forces you can't fully comprehend, whether they're corporate compliance teams or obscure smart‑contract bugs. So, pick whichever scapegoat you prefer, and enjoy the endless scroll of hype and regret that follows.

kishan kumar

Indeed, the dichotomy mirrors a broader existential conflict; one may view centralization as a pragmatic convenience, yet it subtly erodes the foundational decentralization ideals that birthed blockchain. :)

Anthony R

From a user‑experience perspective, the immediacy of centralized platforms cannot be overstated; they provide instant feedback, streamlined onboarding, and robust support channels-features that are often lacking in purely decentralized solutions.

Vaishnavi Singh

While speed and ease are valuable, one must also contemplate the enduring implications of ceding custodial control to a singular entity.

Linda Welch

Let's be real-centralized marketplaces brag about "fiat on‑ramps" and "customer service" while quietly siphoning a chunk of every sale, and decentralized venues lament gas fees yet still rely on centralized metadata hosts. It's a lose‑lose scenario for the average creator who just wants to sell art without the bureaucratic circus.

Kevin Fellows

Sounds good to me!

meredith farmer

Honestly, the drama surrounding this debate feels manufactured-one day the "decentralization" hype peaks, the next a major exchange collapses, and the cycle repeats. It's as if the industry thrives on perpetual uncertainty, using it as a marketing tool to keep users perpetually engaged and, frankly, a little scared. While some genuinely believe in the ethos of trustless systems, others simply ride the wave of hype, capitalizing on every new "revolutionary" feature. In the end, we all end up choosing whatever platform offers the most convenient exit strategy for our own wallets.