Independent Reserve – What You Need to Know

When exploring Independent Reserve, a regulated Australian crypto exchange that lets users buy, sell, and trade digital assets with fiat. Also known as IR, it provides strict KYC checks and a secure custody system, you instantly see how it fits into the larger crypto exchange, a platform connecting buyers and sellers of cryptocurrencies ecosystem. This tag page gathers everything written about Independent Reserve, from fee breakdowns to security audits, so you can decide if it matches your trading style.

Why Independent Reserve Matters in the Australian Market

The Australian cryptocurrency market, a fast‑growing space with strong regulatory oversight shapes how Independent Reserve operates. Independent Reserve must follow local AML rules, which means the KYC process is more thorough than on some offshore platforms. This requirement influences user experience: you’ll spend a few minutes verifying identity, but you gain peace of mind knowing the exchange complies with Australian law. At the same time, the exchange offers a fiat on‑ramp that lets you fund your account with AUD, a feature not all global exchanges provide. That fiat‑to‑crypto bridge reduces friction for new traders and encourages broader adoption.

Security is another core piece. Independent Reserve stores the majority of user funds in cold storage, separating them from hot wallets used for daily trades. This design follows best‑practice guidelines and cuts down the risk of hacks. In addition, the platform runs regular audits and publishes proof‑of‑reserve reports, giving users a transparent view of asset holdings. The combination of strong custody, KYC compliance, and fiat support creates a trust loop that many traders look for when choosing an exchange.

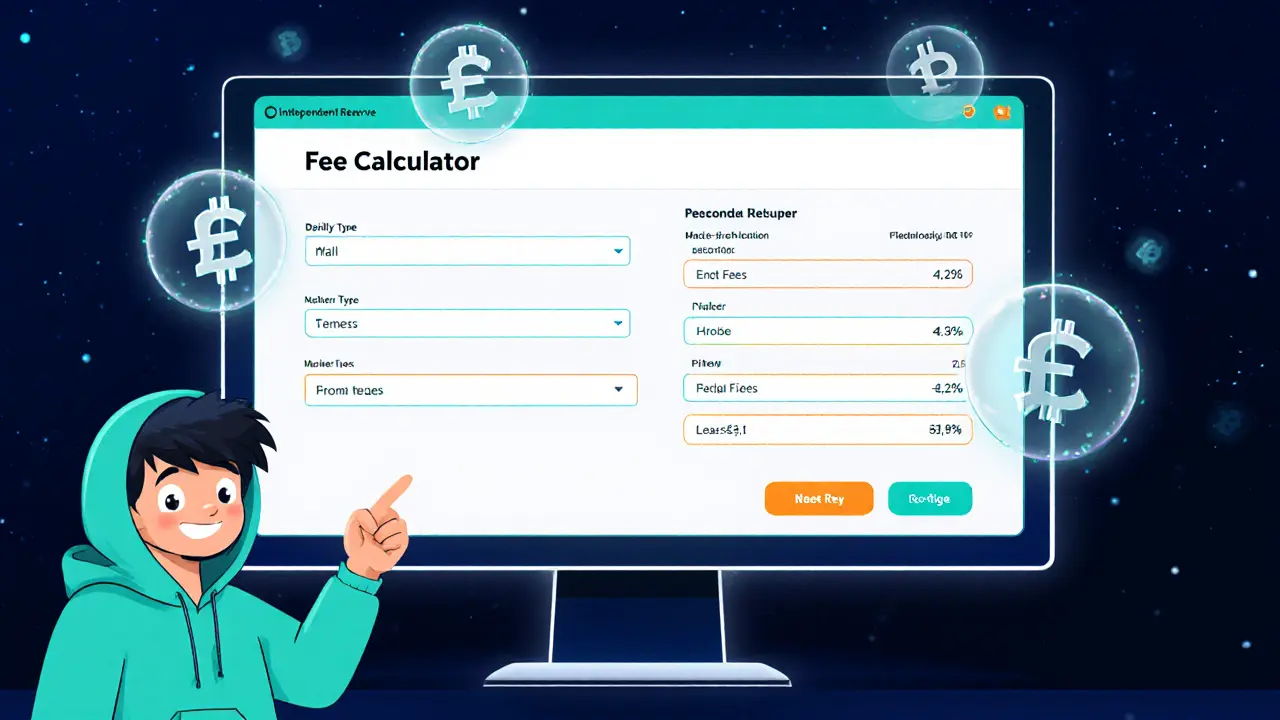

Fees and trading tools also play a big role. Independent Reserve charges a tiered maker‑taker fee structure, which rewards high‑volume traders with lower costs. Spot trading pairs include Bitcoin, Ethereum, and a handful of altcoins, while the platform recently added futures contracts for more advanced users. Order types range from simple market orders to limit and stop‑loss orders, giving both beginners and pros the flexibility they need. Because the exchange is based in Australia, you’ll pay AUD‑based fees, which can be cheaper than converting through an overseas platform and then back to your local currency.

All these pieces—regulation, security, fiat on‑ramp, and fee design—connect to form a cohesive picture of why Independent Reserve stands out. Below you’ll find a curated collection of articles that break down each aspect in detail, from deep‑dive reviews to step‑by‑step guides on using the platform. Whether you’re just starting out or looking to sharpen your trading strategy, the posts on this page give you practical insights you can act on right away.

Independent Reserve Crypto Exchange Review: Fees, Security & OTC Services

A deep review of Independent Reserve, Australia’s oldest crypto exchange. Covers regulation, security, fees, OTC desk, mobile app, user feedback and who should trade on it.

read more