Tokenized Real Estate: How Property Meets Blockchain

When working with Tokenized Real Estate, the process of issuing blockchain‑based digital tokens that represent fractional ownership of physical property. Also known as real‑estate tokenization, it opens up property markets to anyone with an internet connection and a crypto wallet. A closely related concept is Security Tokens, which are regulated digital securities that must comply with local securities laws. Another key player is Real‑Estate Tokenization Platforms, the software layers that handle token issuance, secondary trading, and investor KYC/AML checks. Finally, Regulatory Compliance ensures that token issuers meet jurisdiction‑specific rules, protecting investors and keeping the ecosystem legitimate.

Why Tokenized Real Estate Matters

Tokenized real estate brings liquidity to an asset class that traditionally locks up capital for years. By slicing a building into thousands of tokens, investors can buy a piece for the price of a coffee, diversify across cities, and sell instantly on secondary markets. Security tokens add a layer of legal protection, because they are issued under recognized securities frameworks, making it easier for institutions to participate. Platforms like RealT, Lofty, and Propy automate everything from title verification to dividend distribution, so owners don’t need a law firm for every transaction. At the same time, regulatory compliance acts like a safety net: it forces issuers to disclose financials, undergo audits, and follow anti‑money‑laundering procedures, which builds trust and reduces fraud risk.

Below you’ll find a curated set of articles that dive into these themes. We cover practical guides on how to evaluate a tokenized property, compare different platforms, and understand the tax implications in regions such as Qatar and Thailand. You’ll also see real‑world case studies, security token fundamentals, and a look at how blockchain is reshaping the broader real‑estate market. Whether you’re a curious newcomer or a seasoned investor, the collection gives you actionable insights to navigate tokenized real estate with confidence.

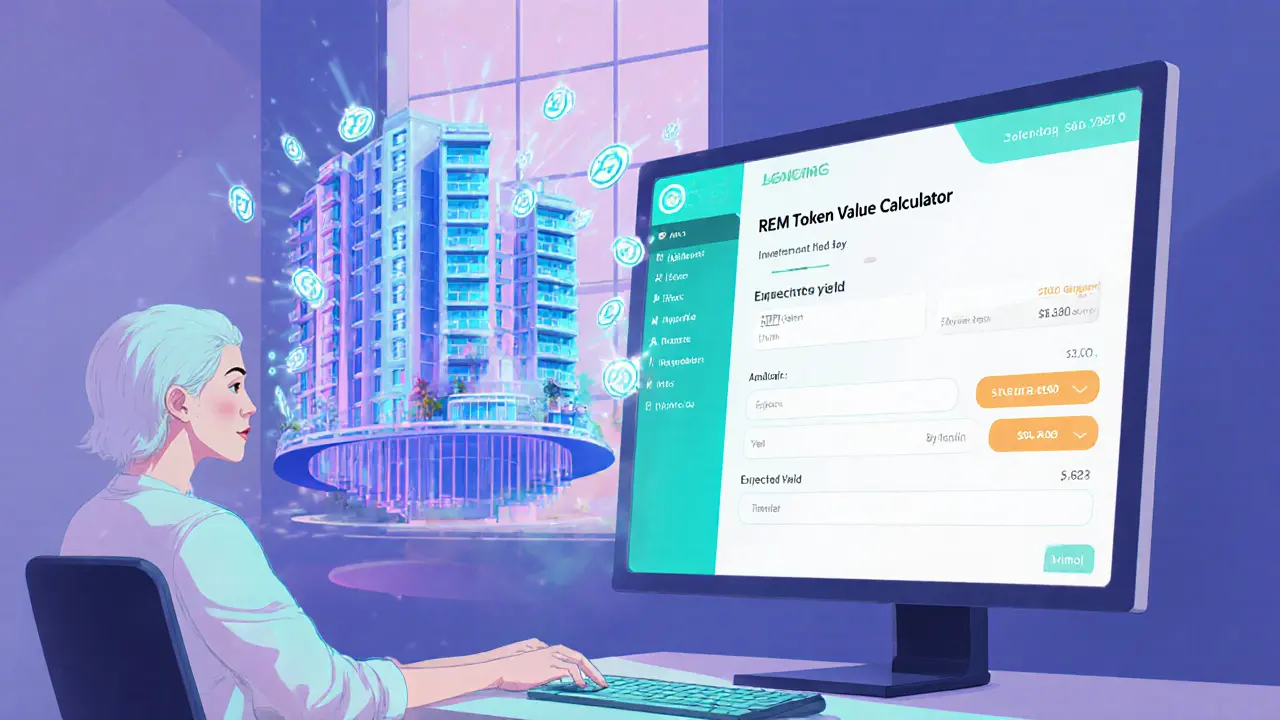

Real Estate Metaverse (REM) Crypto Coin Explained - Definition, How It Works & Investment Basics

Learn what Real Estate Metaverse (REM) crypto coin is, how it tokenizes property, its market data, how to start investing, benefits, risks, and FAQs-all in plain English.

read more