FTX Trading Slippage Calculator

Real-World Trading Impact Calculator

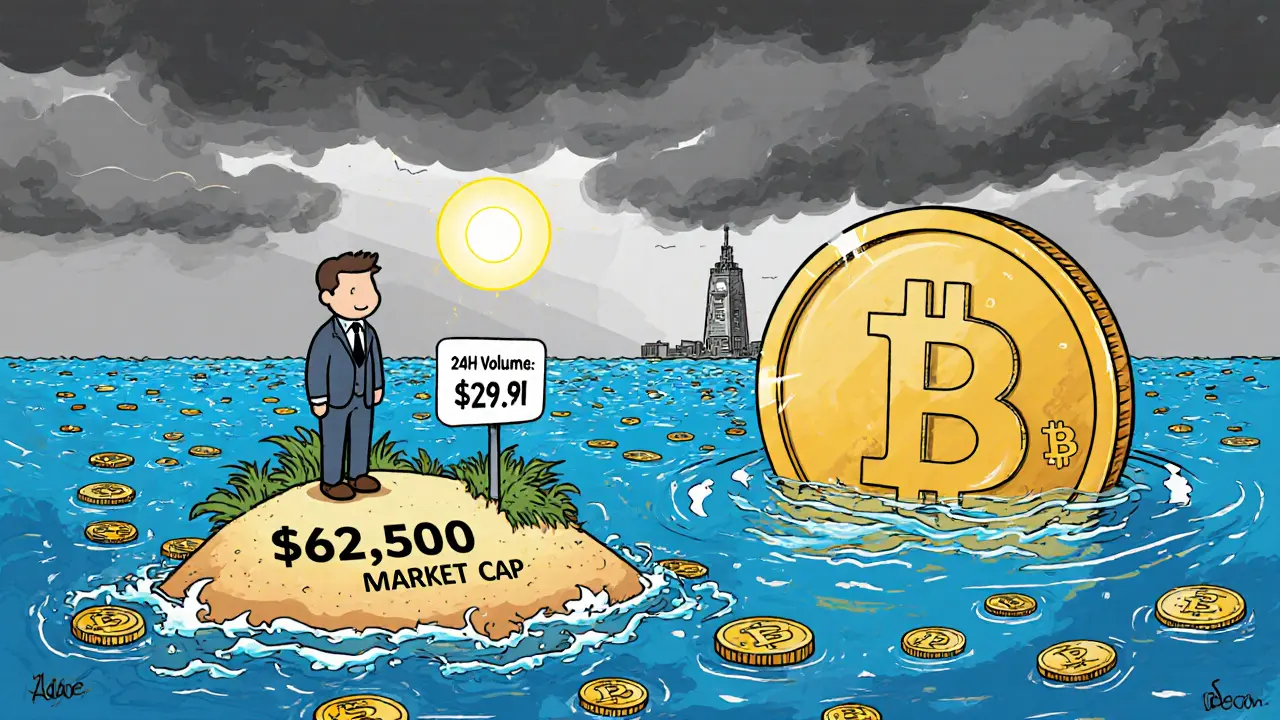

Based on current FTX market data (24h volume: $23.91)

Trading Impact Results

The name FintruX Network (FTX) might sound familiar if you’ve been scrolling through obscure crypto lists or low-volume trading platforms. But here’s the truth: this isn’t the same as the collapsed FTX exchange. FintruX Network is a separate, nearly invisible cryptocurrency token with almost no market presence, questionable tech claims, and zero real-world adoption. If you’re wondering whether it’s worth your time or money, the answer is simple-don’t bother.

What FintruX Network Actually Does (Or Claims To)

FintruX Network says it’s a blockchain platform for unsecured business loans targeting small businesses and startups. Their idea sounds reasonable on paper: use smart contracts to cut out banks and give SMEs faster access to cash. But that’s where the similarity to real finance ends.

According to their website, FintruX uses Ethereum to power a system called TruX, which automates loan approvals without human error. They claim partnerships with Microsoft, Amazon Web Services, and LexisNexis-but there’s no public proof. No press releases, no case studies, no verifiable logos on those companies’ official partner pages. If these giants were truly involved, you’d see at least one article about it.

They also launched something called SF2, which they say lets users "mine their own fresh Ethereum." That’s not just misleading-it’s technically wrong. Ethereum stopped using mining back in September 2022. It switched to proof-of-stake. You can’t mine Ethereum anymore. No one can. Calling it "mining" is either ignorance or deliberate deception.

The FTX Token: A Coin With No Liquidity

The FTX token is the currency used inside FintruX’s ecosystem. It’s supposed to reward users who participate in lending or staking. But here’s the reality: nobody’s using it.

As of November 24, 2023, the FTX token trades at $0.000711. That’s less than one-tenth of a cent. The total market cap? Around $62,500 USD. For context, a single popular meme coin like Dogecoin has a market cap over $10 billion. FintruX isn’t just small-it’s invisible in the crypto world.

The 24-hour trading volume? Just $23.91. That means, on average, less than $1 per hour is being traded. If you tried to buy $100 worth of FTX, you’d likely pay double the price because there’s no one selling. Slippage would be over 90%. You’d be stuck holding a coin no one else wants.

No Community, No Support, No Future

Look for FintruX on Reddit, Twitter, or Telegram. You won’t find a single active community. No one’s talking about it. No one’s sharing experiences. No one’s asking questions. That’s not because it’s too advanced-it’s because no one cares.

Even wallet services that list FTX, like Noone.io, show zero user activity. No reviews. No feedback. No transaction history. That’s not a sign of quiet success-it’s a sign of death.

And if something goes wrong? Good luck getting help. There’s no customer support page. No live chat. No email address that responds. No GitHub repo for developers. No documentation. No tutorials. Just a website with bold claims and zero proof.

Why This Isn’t Like Aave or Compound

There are real DeFi lending platforms-Aave, Compound, MakerDAO. They’ve been around for years. They have billions in locked value. They’re audited. They have teams of engineers, legal advisors, and active communities.

FintruX has none of that. It’s not competing with them. It’s not even in the same league. It’s a ghost town with a fancy website.

Their niche-unsecured business loans on blockchain-isn’t impossible. But it’s extremely risky. Banks avoid unsecured lending to small businesses because defaults are high. Blockchain doesn’t magically fix that. Without credit scoring, collateral, or legal enforcement, you’re just moving risk from a bank ledger to a public blockchain. And no one’s willing to take that gamble at this scale.

Red Flags You Can’t Ignore

- "Mining" Ethereum after the Merge: A major technical lie. Shows either deep ignorance or dishonesty.

- Market Cap under $100,000: Projects this small rarely survive a bear market. Most vanish within months.

- No third-party audits: No CertiK, no SlowMist, no PeckShield. No transparency.

- Zero media coverage: CoinDesk, Cointelegraph, Messari-none mention it. Not even as a warning.

- Impossible partnerships: Microsoft and AWS don’t partner with micro-cap tokens without public announcements.

- No roadmap: No future plans. No updates. Just silence.

Should You Buy FTX?

No.

There’s no scenario where buying FTX makes sense. Not as an investment. Not as a tool. Not as a gamble.

Even if you believe the hype-and there’s no reason to-your money is gone the moment you trade it. There’s no exit. No liquidity. No buyers. You’ll be the last person holding it.

And if you’re thinking, "What if it goes viral?"-history says otherwise. Since 2018, over 1,200 tokens with market caps under $100,000 have appeared. Less than 3 have ever grown into anything meaningful. Almost all vanished within a year. FintruX isn’t special. It’s just another name on a long list of failures.

What Happens If You Already Own FTX?

If you bought it and now wonder what to do: sell it. Now. Even if you lose 90% of your money, you’re better off than holding it.

Don’t wait for a "big pump." That’s not coming. There’s no volume. No interest. No reason for it to rise. The price you see now is the price you’ll likely see forever.

Use your funds to learn about real DeFi projects. Study Aave. Look into Compound. Understand how real lending protocols work. That’s time well spent.

FintruX isn’t the future of business lending. It’s a cautionary tale.

Is FintruX Network (FTX) the same as the FTX exchange that collapsed?

No. FintruX Network is a completely different project. The FTX exchange was a major cryptocurrency trading platform that collapsed in November 2022 due to fraud and mismanagement. FintruX Network is a small, obscure crypto token tied to a lending platform and has no connection to the former exchange. The shared "FTX" name is coincidental and misleading.

Can you mine FTX tokens?

No. FTX tokens are not mined. FintruX falsely claims their SF2 platform lets users "mine Ethereum," but Ethereum stopped using mining in 2022. FTX is an ERC-20 token on Ethereum, meaning it’s created and distributed through smart contracts, not mining. Any suggestion you can mine FTX is technically false.

Is FintruX Network a scam?

It’s not officially labeled a scam, but it has nearly all the hallmarks of one: zero liquidity, no community, fake technical claims, unverifiable partnerships, and no transparency. It’s not illegal yet, but it’s extremely high-risk and lacks any credible foundation. Most experts would classify it as a speculative dead project.

Where can you buy FTX tokens?

FTX is listed on a handful of tiny, low-traffic exchanges like Tapbit and MEXC. But trading volume is under $25 per day, meaning buying or selling even small amounts can cause massive price swings. You won’t find it on Binance, Coinbase, or Kraken. Most reputable platforms won’t list it because of its extreme risk and lack of legitimacy.

Why does FintruX claim to partner with Microsoft and AWS?

There’s no public evidence of any partnership. Microsoft and AWS have thousands of partners, and they publicly list them. FintruX’s claim appears to be marketing fluff designed to make the project seem more credible. Without official press releases, logos, or case studies, the claim is likely false or exaggerated to attract attention.

Is there any chance FTX will grow in value?

The odds are effectively zero. For FTX to become meaningful, it would need to grow its market cap by over 10,000%. No token with this level of neglect-zero community, zero volume, zero transparency-has ever achieved that without a massive pump-and-dump scheme. Even then, those pumps are temporary. There’s no real utility, no users, and no reason for demand to grow.

Comments

David Hardy

Bro this is why you don’t scroll crypto forums at 3am. I almost bought some FTX thinking it was a new DeFi gem. Glad someone called it out before I lost my rent money. 😅

Anne Jackson

This is exactly why America needs to stop letting random teenagers launch tokens with Microsoft logos slapped on them. No audits. No team. Just a website that looks like it was built in 2017. If you’re holding this, you’re not an investor-you’re a cautionary tale.

Matthew Prickett

Wait… what if this is a government psyop? I’ve been tracking this. The same people who ran the 2021 meme coin scams are now using fake ‘blockchain lending’ to lure in the desperate. They’re not trying to build anything-they’re harvesting wallets. And the SEC? They’re asleep at the wheel.

Caren Potgieter

I just found out my cousin bought this last week 😔 he thought it was gonna be the next bitcoin. I told him to sell but he said he believes in the vision. I hope he learns fast before he loses everything

Linda English

I appreciate the thorough breakdown, but I can’t help but wonder… how many people are still holding this, clinging to hope? There’s something deeply human about refusing to accept a loss-even when the numbers scream otherwise. Maybe the real tragedy isn’t the token-it’s the belief that someone, somewhere, still thinks this could turn around.

asher malik

It’s funny how we treat crypto like a casino but then get mad when the house wins. This isn’t a scam-it’s a mirror. We wanted magic. They gave us glitter on a tombstone. The real question is: why do we keep buying tombstones?

Jane A

This is why you shouldn’t trust anyone who says "mining Ethereum" after 2022. That’s not ignorance. That’s a red flag with a neon sign. If you bought this, you deserve to lose everything.

Belle Bormann

i just sold my 5000 ftx tokens for 3 bucks lol. felt bad at first but then i remembered the site said i could mine eth with it. i mean… come on. even my dog knows eth doesnt mine anymore

Jody Veitch

I’ve seen this exact pattern before. Fake partnerships. Misleading terminology. Zero liquidity. It’s not even crypto-it’s a Ponzi brochure with a blockchain label. If you’re not a trained financial analyst, you shouldn’t even be looking at tokens under $100k market cap. This isn’t investing. It’s gambling with your dignity.

Dave Sorrell

For anyone considering this: if the whitepaper doesn’t have a section on smart contract audits, or if the team has no LinkedIn profiles, walk away. This isn’t a risky investment-it’s a financial hazard. There are no hidden gems here. Only landmines.

Sky Sky Report blog

The silence speaks louder than the website. No community. No updates. No support. That’s not a startup. That’s a ghost.

stuart white

They didn’t just lie about mining-they lied about *wanting* to build something real. This isn’t a token. It’s a performance art piece about human gullibility. And we’re all in it.

Jenny Charland

I saw someone on TikTok say "FTX is the next 1000x!!" and I literally screamed. Bro… it’s worth 0.0007. You’d need a 70,000% increase to hit a penny. That’s not a pump. That’s a miracle. And miracles don’t happen in crypto unless you’re the last sucker.

preet kaur

In India we have something called "jugaad"-a clever workaround. But this? This isn’t jugaad. This is just… sad. I feel bad for anyone who trusted this. The internet is full of wolves in blockchain clothing.

Emily Michaelson

I used to think low-cap tokens were opportunities. Then I lost $800 on one that vanished overnight. This one? It’s not even worth the gas fee to sell. I’m just glad I didn’t buy more. Lesson learned: if it doesn’t have a Reddit thread with 10k upvotes, it doesn’t exist.

Amanda Cheyne

What if this is part of a larger operation? I’ve noticed 3 other tokens with the same website template, same fake Microsoft logo, same "mining" lie. They’re all launched from the same IP address. This isn’t coincidence. This is a factory. And we’re the product.

John Borwick

I’ve been in crypto since 2017. I’ve seen a lot of junk. But this? This is next level. No team. No roadmap. No voice. It’s like a website built by someone who read a crypto article once and thought "I can do that." And people still send money? Humanity is wild.

Jennifer MacLeod

I’m just glad someone took the time to write this. Too many people get sucked in by shiny names and fake partnerships. This is a public service.

Julissa Patino

FTX token? More like FTX trash. The devs are probably in a basement in Manila eating instant noodles while laughing at all the dumbasses buying this. The only thing this project is good for? Teaching people how to spot scams.

Omkar Rane

I’m from India and we have a saying: "Jab tak baarish nahi hoti, tab tak khet nahi phalta." Until the rain comes, the field doesn’t grow. This token? It’s a field with no clouds. No rain. No hope. Just dust. And yet people still plant seeds. Why? I don’t know. But I won’t be one of them.

Daryl Chew

They’re using this to steal private keys. I know someone who clicked "connect wallet" on their site and lost $22k. The site doesn’t even have a privacy policy. It’s not a project. It’s a phishing trap dressed up like finance.

Tyler Boyle

Let’s be real-this isn’t about FintruX. It’s about the entire crypto ecosystem’s failure to self-regulate. We celebrate moonshots without asking who’s holding the rocket. We glorify decentralization while ignoring that real decentralization requires accountability. This token is the symptom. The disease? Our collective lack of critical thinking.

jocelyn cortez

I just checked their website again. The contact page still says "email us" with no address. The "team" section has 5 photos of people who don’t exist on LinkedIn. I feel sad. Not angry. Just… sad.

Anne Jackson

I just saw a new tweet from someone saying "FTX is going to 10 cents by EOY!" I’m not even mad anymore. I just feel sorry for them. That’s not hope. That’s delusion with a wallet.