Regulatory Impact Estimator

Estimate Your Trading Volume Impact

See how regulatory changes affect trading volume based on your market position and compliance strategy.

Estimated Volume Change:

$0

When crypto prices hit new all-time highs in early 2025, most traders expected volume to surge along with them. Instead, something strange happened: trading volume dropped 27.7% quarter-over-quarter. Bitcoin rose over 30%, yet the biggest exchanges saw billions in daily trades vanish. This wasn’t a market crash. It was a regulatory crackdown.

What Happened to Trading Volume After New Rules?

In Q2 2025, centralized exchanges like Crypto.com saw their spot trading volume collapse from $560 billion to just $216 billion - a 61.4% plunge. That’s not a glitch. That’s policy. The U.S. passed the GENIUS Act in mid-2025, forcing stablecoins to be backed 1:1 with U.S. dollars and requiring exchanges to get federal licenses or shut down U.S. operations. Crypto.com chose compliance. The result? Millions of U.S. users lost access to dozens of altcoins overnight. Trading activity didn’t disappear - it just moved.Exchanges that stayed in the U.S. and followed the rules saw volume drop 18.7% on average. Those that didn’t - like MEXC, HTX, and Bitget - relocated to places like the UAE, Singapore, and Hong Kong. Their volumes went up. The market didn’t shrink. It fragmented.

Why Did Volume Drop Even When Prices Rose?

Normally, when Bitcoin surges, more people trade. More trades mean more volume. But in Q2 2025, that link broke. Bitcoin hit $104,000, yet daily trading volume on major exchanges fell below $130 billion - the lowest since early 2023. Why? Because regulation changed the rules of participation.U.S. regulators didn’t ban crypto. They made it harder to trade anything that wasn’t a regulated asset. Tokens like SOL, ADA, and DOGE were delisted from major U.S.-licensed exchanges. Stablecoins like USDT and USDC stayed because they met the new rules. But altcoins? Gone. That wiped out over 70% of the trading pairs users could access on platforms like Coinbase and Kraken.

People didn’t stop trading. They just stopped trading on the big exchanges. Volume shifted to decentralized platforms, peer-to-peer markets, and offshore exchanges. Chainalysis data shows total crypto transaction volume actually rose to $10.6 trillion in 2024 - up 56% from 2023. The money didn’t vanish. It just left the regulated lanes.

Who Got Hit Hardest? Who Survived?

The pain wasn’t spread evenly. Exchanges in places with clear, stable rules - like Japan, Switzerland, and the EU under MiCA - saw volume drops of only 7-12%. Why? Because users knew what was allowed. If you were in Switzerland and your exchange followed MiCA, you could trade EURC (a regulated euro-backed stablecoin) with confidence. Volume dipped at first, but then bounced back as trust returned.In contrast, markets like India and parts of Europe saw volume drop by over 22%. Why? Because rules kept changing. One week, a token was legal. The next, it was banned. Traders couldn’t plan. So they waited. And when they waited, volume fell.

The biggest loser? Crypto.com. It stayed in the U.S., complied fully, and lost its spot as the second-largest exchange. It went from #2 to #8. Meanwhile, Bitget and MEXC, which moved operations offshore, grew 3-5% in the same period. The lesson? Compliance isn’t always about staying put. Sometimes, it’s about moving before the rules trap you.

What About Illicit Activity? Did Regulation Work?

Yes - and that’s part of why volume dropped. TRM Labs found that illicit crypto transactions fell from 0.9% of total volume in 2023 to just 0.4% in 2025. That’s a 51% drop. More KYC checks, more reporting, more license requirements - it all made it harder for bad actors to move money.But here’s the trade-off: the same tools that blocked criminals also blocked normal users. Many small traders couldn’t pass the new identity checks. Some exchanges required proof of income, bank statements, or even tax IDs just to trade $500 worth of crypto. Reddit threads from U.S. users show frustration: “I lost access to half my portfolio.” “I had to sell my ETH because they delisted it.” “Verification took 3 weeks.”

Trustpilot ratings for major exchanges dropped from 4.3 to 2.5 stars in Q1 2025. People weren’t angry about prices. They were angry about being locked out.

What’s Really Driving the Decline?

It’s not fear of prices. It’s fear of rules.Amberdata found that Bitcoin’s Stock-to-Flow ratio hit a record 117.5 in early 2025 - a sign of scarcity and long-term value. Yet price dipped from $104,000 to $76,500 because traders didn’t know what they could trade next week. Regulatory uncertainty became the biggest risk factor - bigger than inflation, bigger than interest rates.

Dr. Alex Thorn from Galaxy Digital put it bluntly: “The -27.7% volume drop despite Bitcoin’s rise is the clearest proof yet that regulatory fragmentation is breaking the global crypto market.”

It’s not one law. It’s 50 different ones. The U.S. has one set. The EU has MiCA. Japan has its own. India has tax rules that feel like punishment. Singapore is welcoming. Australia is testing. No one knows what’s coming next. So traders hold back. They wait. And volume falls.

Is This the End of Crypto Trading?

No. It’s the beginning of a new phase.Institutional money is flowing into crypto ETFs - $5.95 billion in one week in 2025. That’s not retail traders. That’s pension funds, hedge funds, and banks. They don’t trade on Binance. They trade through regulated vehicles. Their volume doesn’t show up in exchange data. But it’s real.

Stablecoins are adapting. USDC and EURC are growing fast. EURC’s monthly volume jumped from $47 million to $7.5 billion in just one year under MiCA. Why? Because it’s legal. Because it’s backed. Because institutions can use it.

By Q4 2025, most major exchanges had finished relocating or re-licensing. Volume stopped falling. It flattened. CoinGecko now predicts growth will return in Q1 2026 - not because prices are going up, but because the rules are finally settled.

Regulation didn’t kill crypto. It killed the wild west. The traders who stayed - the ones who followed the rules, moved smartly, or switched to compliant tools - are still trading. The ones who didn’t adapt? They’re gone.

What Comes Next?

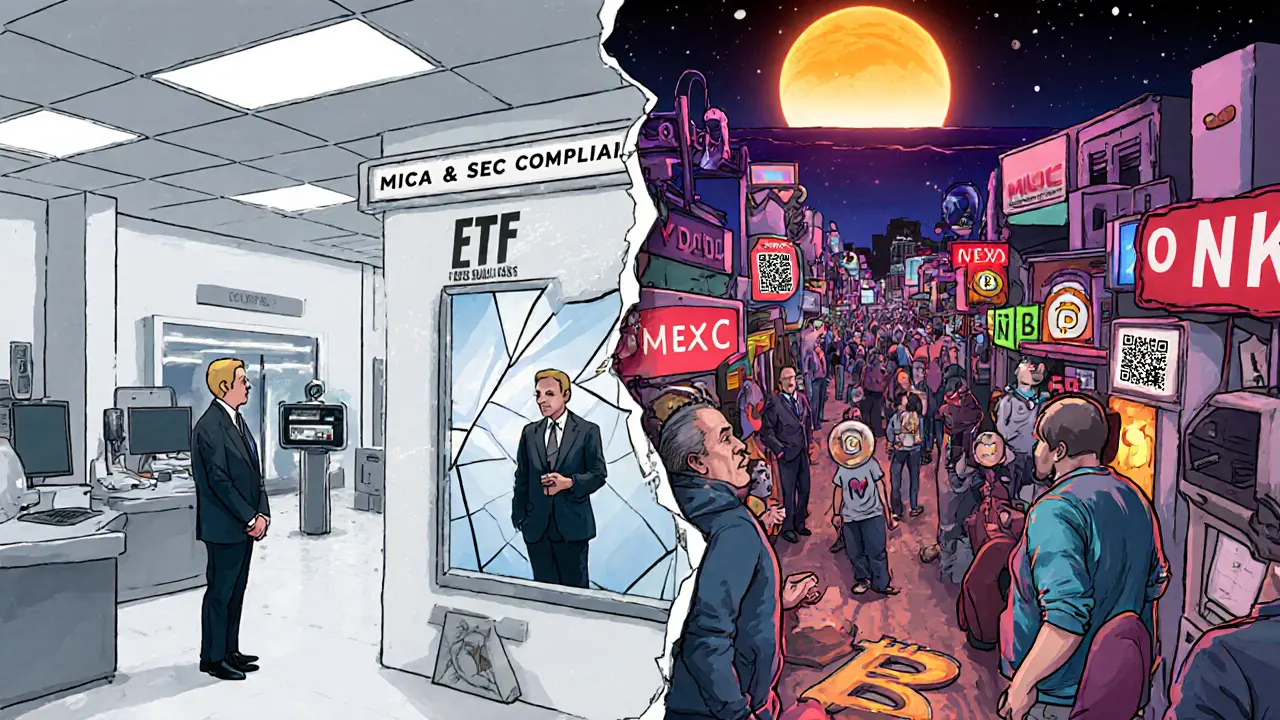

The market is now split into two tracks:- Regulated track: Bitcoin, USDC, EURC, and ETFs. High compliance, lower volume, but steady growth. Used by institutions and cautious retail.

- Unregulated track: Altcoins, P2P trading, offshore exchanges. Higher volume, higher risk, no oversight. Used by speculators and users in restrictive markets.

If you’re a retail trader in the U.S., your options are narrower. But your money is safer. If you’re outside the U.S., you might have more coins to trade - but less protection. The choice isn’t about which market is better. It’s about which rules you’re willing to live under.

One thing’s clear: crypto isn’t going away. It’s just becoming less chaotic. And that means fewer people trading - but the ones who are, are doing it with more confidence.

Why did trading volume drop even though Bitcoin’s price went up?

Because new regulations forced exchanges to delist most altcoins and restrict trading for U.S. users. Even though Bitcoin’s price rose, traders couldn’t access the coins they used to trade. Volume dropped because the number of tradable assets and active users shrank - not because people stopped believing in crypto.

Which exchanges lost the most volume after crypto restrictions?

Crypto.com suffered the biggest drop, falling 61.4% in Q2 2025 after choosing to fully comply with U.S. regulations. Other U.S.-focused exchanges like Coinbase and Kraken saw volume drop 15-20%. Exchanges that moved offshore - MEXC, HTX, and Bitget - actually grew their volumes during the same period.

Did regulation reduce fraud and scams in crypto?

Yes. Illicit crypto transactions dropped from 0.9% of total volume in 2023 to 0.4% in 2025 - a 51% decline. KYC checks, licensing rules, and transaction monitoring made it harder for criminals to move money. But these same rules also made it harder for regular users to trade quickly.

Are stablecoins still growing despite restrictions?

Yes. USDC and USDT remain dominant, with monthly volumes over $1 trillion each. Under the EU’s MiCA rules, EURC - a euro-backed stablecoin - grew from $47 million to $7.5 billion monthly in just one year. Regulated stablecoins are thriving because they meet legal standards, making them safe for banks and institutions to use.

Should I keep trading crypto if regulations are tightening?

It depends. If you want safety and long-term growth, focus on regulated assets like Bitcoin and licensed stablecoins. If you want access to altcoins, you’ll need to use offshore exchanges or P2P platforms - but that comes with higher risk. The market is no longer a free-for-all. Your strategy must match the rules you’re operating under.

Will trading volume recover in 2026?

Yes, but not the way it used to. CoinGecko predicts volume growth will return in Q1 2026 as exchanges finish adapting to new rules. The recovery won’t come from wild altcoin trading. It’ll come from institutional adoption, regulated ETFs, and compliant stablecoins. The market is maturing - not dying.

Comments

MICHELLE SANTOYO

So the market got boring and people stopped gambling. Who knew regulation could be this effective?

Now we just have two kinds of crypto: the safe kind and the wild kind.

Guess which one I miss?

Sunny Kashyap

India ban crypto. US ban crypto. Why people still talk?

Pranav Shimpi

u forgot to mention how many indians moved to dubai to trade altcoins lol. we still use p2p and binance even if its 'offshore'. u think govt can stop people? nah. just make it harder for the weak ones.

jummy santh

In Nigeria, we never trusted exchanges anyway. We trade directly via WhatsApp, Telegram, and even bank transfers. Regulation? We laugh at it. The real crypto is the one you hold in your pocket, not on some app that can freeze your funds tomorrow.

Volume dropped? Maybe on their charts. But here? We never stopped.

Kirsten McCallum

It's not about volume. It's about maturity. You wanted chaos. You got it. Now you're mad it's clean.

Henry Gómez Lascarro

Let me break this down for the 7th time because apparently nobody reads: the drop wasn’t because people stopped believing. It was because the U.S. government decided to turn crypto into a corporate compliance nightmare. You can’t have a free market and then demand 17 forms of ID to buy $200 of ETH. That’s not regulation. That’s economic suffocation wrapped in a compliance suit.

And don’t give me that 'illicit activity dropped' nonsense - yes, the criminals got scared. But so did the retirees trying to hedge inflation, the students buying BTC for tuition, the freelancers getting paid in crypto. You didn’t clean up the market. You just kicked out the people who didn’t have lawyers.

Meanwhile, Bitget and MEXC grew because they didn’t care about your paperwork. They cared about liquidity. And guess what? Liquidity follows freedom, not forms.

And now we have ETFs? Cute. That’s not crypto anymore. That’s Wall Street with a blockchain sticker. Real crypto was about permissionless access. Now it’s permissioned, taxed, and monitored. Congrats. You killed the soul of the thing.

Will Barnwell

So the altcoins died. Big deal. Bitcoin still went up. The real money was always in BTC. Everyone else was just noise.

Jean Manel

You call that a drop? Try living in a country where your exchange gets shut down and you can’t even withdraw your coins for 6 months. This isn’t regulation. It’s theft with paperwork.

William P. Barrett

The market didn’t shrink. It evolved. Like forests after fire. The old growth died. New roots grew in the ash.

What we’re seeing isn’t decline. It’s pruning. The wild, unregulated parts didn’t vanish - they just went deeper. The regulated side became institutional. The unregulated became underground. Both are still alive. One just doesn’t show up on CoinGecko anymore.

Cory Munoz

I get why people are frustrated. I lost access to my ADA and DOT too. It felt like they took half my portfolio and said 'sorry, not safe for you'.

But I also see why regulators did it. I had a cousin who lost $12k on a rug pull last year. That’s not just 'risk'. That’s trauma.

Maybe the trade-off is worth it. Less chaos. Fewer broken people. Fewer Reddit threads like 'HELP I LOST EVERYTHING'.

It’s not perfect. But it’s less painful.

Ron Murphy

The fragmentation is the real story. You’ve got a bifurcated market now: one side is institutional-grade, KYC-heavy, low-volatility. The other is a dark pool of P2P, DeFi bridges, and offshore liquidity. Neither talks to the other. The data’s misleading because you’re comparing apples to shadow oranges.

Prateek Kumar Mondal

Crypto is not dead. It is just growing up. The kids who wanted to get rich fast are gone. The adults who want to build are still here. This is better. Trust me

Nick Cooney

I used to trade 10 coins a day. Now I trade BTC and USDC. It’s boring. But I sleep better.

Also, I didn’t know 'EURC' was a thing until last week. Now I’m holding it. Who knew the EU could be the crypto cool kids?

Wayne Overton

You’re all just mad because you can’t pump your shitcoins anymore.

Alisa Rosner

I just want to know: will USDC still work if the U.S. defaults? 😭😭😭

Lena Novikova

Regulation didn't kill crypto it killed the scammers and the hype machines

and honestly? good riddance

Olav Hans-Ols

I used to think crypto was about freedom. Now I think it’s about choosing your cage. One’s got better lighting. The other’s got more coins.

Still trading. Still learning. Still here.