Cat.Ex Fee Calculator

Trading Fee Calculator

Estimate your trading costs and potential savings based on your trading volume and CATT holdings.

Estimated Costs

Fee Structure Summary

Trading Fees

- Maker Fee: 0.01% to 0.05%

- Taker Fee: 0.02% to 0.10%

- Discount tiers based on CATT holdings (up to 100% withdrawal fee rebate at Tier 10)

Withdrawal Fees

- Flat Fee: 3.5% of withdrawal amount

- Network Fees: Fixed fees for BTC ($14) and ETH ($12)

- Higher-tier CATT holders receive withdrawal fee rebates

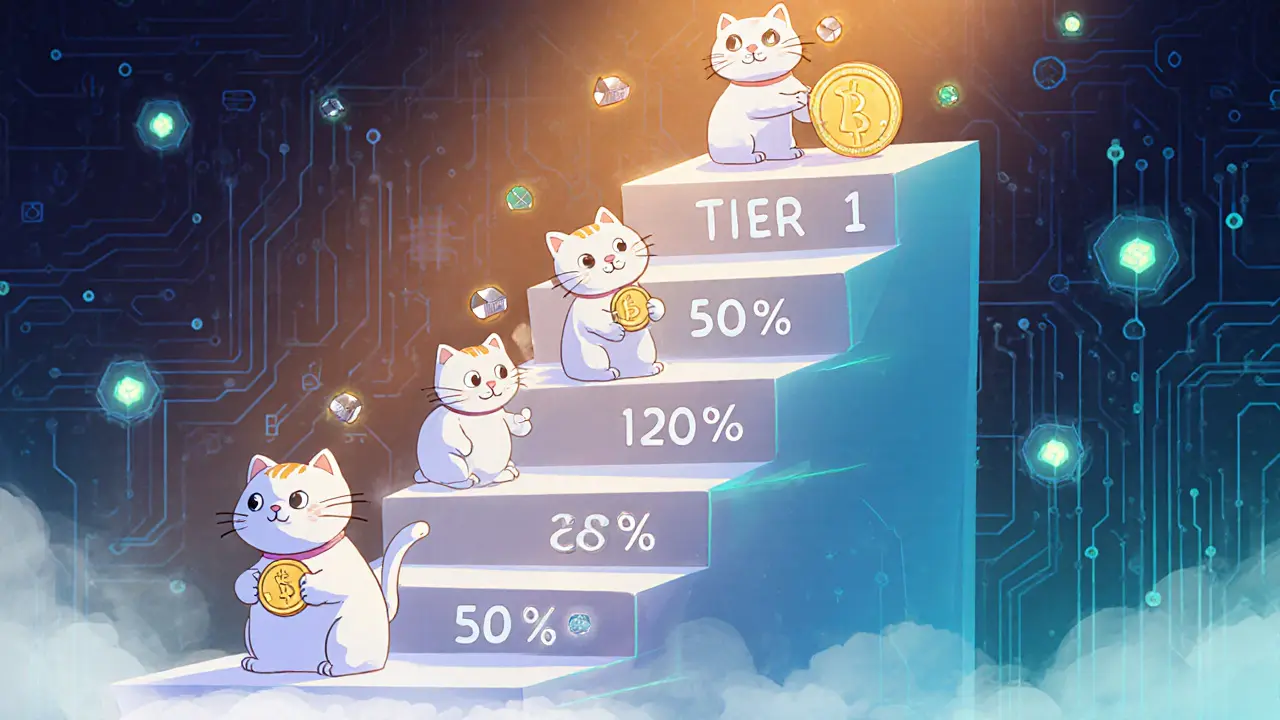

CATT Tier System

- Tier 1 (100K CATT) - 5% discount

- Tier 5 (2M CATT) - 20% discount

- Tier 8 (10M CATT) - 50% discount

- Tier 10 (20M CATT) - 100% withdrawal fee rebate

Quick Takeaways

- Cat.Ex launched in 2018, offers spot trading on ~30 coins with a focus on low trading fees.

- Transaction‑mining lets you earn the native CATT token while you trade.

- Maker fees start at 0.01%, taker fees at 0.02%; withdrawal fees sit at a steep 3.5%.

- No margin, futures or copy‑trading features - just pure 1:1 spot markets.

- Registered in China, no major regulator oversight, and blocks users from 23+ jurisdictions.

What is Cat.Ex?

Cat.Ex is a centralized cryptocurrency exchange that began operating in August 2018. It markets itself as a low‑fee, user‑friendly platform that combines traditional spot trading with a “transaction mining” model, rewarding traders with its native CATT token for each executed order. The exchange is officially registered in China, although it does not hold any licence from recognised financial authorities such as the SEC, FCA, or MAS.

Key Features Overview

- Spot‑only trading with 1:1 leverage.

- Transaction mining that automatically converts a portion of trading fees into CATT tokens.

- 11‑tier fee‑discount system based on CATT holdings - Tier10 holders (20MCATT) enjoy 100% withdrawal‑fee rebates.

- Basic security: mandatory two‑factor authentication (2FA) for login, trading and withdrawals.

- KYC is required for full account activation, though limited anonymous trading is possible for small volumes.

- Staking plans and crypto faucet for additional passive income.

Fee Structure Deep Dive

Cat.Ex advertises some of the lowest maker/taker rates in the industry, but the withdrawal side tells a different story.

| Fee Type | Range | Typical Example |

|---|---|---|

| Maker | 0.05% - 0.01% | 0.01% for high‑volume traders (>$1M monthly) |

| Taker | 0.10% - 0.02% | 0.02% once you hold ≥10MCATT (Tier8) |

| Withdrawal (flat) | 3.5% of withdrawal amount | 5USDT fee on a 100USDT withdrawal |

| Bitcoin Withdrawal | 0.0005BTC (≈$14) | Fixed fee regardless of amount |

| Ethereum Withdrawal | 0.008ETH (≈$12) | Fixed fee regardless of amount |

The 3.5% flat withdrawal fee dwarfs the trading‑fee discounts for most users. Even with the 50% fee rebate on trades, the net cost of moving funds off‑exchange can outweigh any savings, especially for small‑balance traders.

CATT Tokenomics and Mining

The native token, CATT, serves three main purposes:

- Pay for transaction‑mining rewards - a portion of each trade’s fee is converted into CATT and sent to the trader’s wallet.

- Unlock tier‑based fee discounts, including the coveted 100% withdrawal‑fee waiver at Tier10.

- Participate in periodic buy‑back programs that aim to stabilize the token price.

In practice, the tier system is a hurdle for newcomers. To reach Tier5 (which grants a 20% fee rebate), you need roughly 2MCATT, and each tier requires a near‑exponential increase in holdings. The token’s market cap hovers around $180M (as of Sep2025), but liquidity is thin, making large purchases costly.

Security and Compliance

From a security standpoint, Cat.Ex covers the basics:

- Two‑Factor Authentication (2FA) is mandatory for logins, trades, and withdrawals.

- KYC verification involves photo ID, proof of address, and a selfie check. Some users can trade under a “limited” profile without full KYC, but withdrawal limits apply.

- No insurance fund or custodial guarantees - assets sit in the exchange’s hot wallets.

The glaring compliance gap is that Cat.Ex holds no licence from any major regulator. The China‑based registration does not equate to regulatory approval, especially given Beijing’s strict stance on crypto since 2021. This lack of oversight means users have limited legal recourse if the platform were to freeze assets or shut down.

Supported Assets and Trading Options

Depending on the source, Cat.Ex lists anywhere from 23 to 218 cryptocurrencies. Independent monitoring in 2025 shows 29 coins available for both deposit and withdrawal, forming 40 active trading pairs. The most liquid pairs include BTC/USDT, ETH/USDT, and BNB/USDT.

Order types cover market, limit, stop‑limit, and iceberg orders. There is no margin, futures, or options market, and the platform does not offer copy‑trading or social‑trading features.

One operational quirk: certain assets are deposit‑only (e.g., XRP) or withdrawal‑only (e.g., IOST), forcing traders to keep those tokens on‑exchange if they want to move them later.

User Experience: Pros and Cons

Real‑world feedback paints a mixed picture.

Pros

- Simple, clean UI that works on desktop and mobile browsers.

- Low maker/taker fees benefit high‑volume traders.

- Transaction mining provides a passive CATT income stream.

- Staking plans let users lock assets for modest APYs (3‑5%).

Cons

- 3.5% flat withdrawal fee is prohibitive for small withdrawals.

- Complex 11‑tier discount system confuses many newcomers.

- Geographic blocks prevent access from the US, UK, Canada, EU, and several Asian markets.

- No live chat; support is limited to ticketing and a Telegram group.

- Lack of regulatory oversight raises legal risk.

Geographic Restrictions

Cat.Ex enforces a blacklist of over 23 jurisdictions. Users from the following major regions are automatically denied access:

- United States

- United Kingdom

- Canada

- Australia

- European Union members (France, Germany, Italy, Spain, etc.)

- China (despite registration, Mainland users face additional restrictions)

- Iran

- South Korea (partial access only)

If you reside in a blocked country, you’ll see a “service unavailable” message during login.

Is Cat.Ex Worth It in 2025?

Answering that question boils down to your priorities.

- If you value ultra‑low trading fees and are willing to hold large amounts of CATT, Cat.Ex can be a cost‑effective spot venue.

- If you need fast, cheap withdrawals, or you live in a blocked jurisdiction, the platform becomes a liability.

- For institutional or regulated‑compliant traders, the absence of licensing and the high withdrawal cost make Cat.Ex a poor fit.

- Casual hobbyists who trade modestly and enjoy earning a token on each trade might find the transaction‑mining gimmick appealing, provided they accept the fee structure.

Overall, Cat.Ex fits a niche segment: traders in allowed regions who prioritize low‑fee spot trading over regulatory protection. If you fall outside that niche, consider alternatives like Binance, Kraken, or a decentralized exchange (DEX) that offers comparable fees without withdrawal penalties.

Frequently Asked Questions

What is the native token of Cat.Ex?

The native token is CATT. It is used for fee discounts, transaction‑mining rewards, and participation in buy‑back programs.

How high are Cat.Ex withdrawal fees?

A flat 3.5% of the withdrawal amount is charged on all assets. Fixed network fees also apply (e.g., 0.0005BTC, 0.008ETH). Holding enough CATT can waive the 3.5% fee, but the tier thresholds are very high.

Can I trade on Cat.Ex without completing KYC?

Yes, Cat.Ex offers a limited “anonymous” profile that allows small‑volume spot trading. However, withdrawals and higher‑volume trading require full KYC verification.

Is Cat.Ex regulated in any jurisdiction?

No. The exchange is registered in China but holds no licence from recognized financial regulators such as the SEC, FCA, or MAS. This lack of oversight presents legal risk for users.

What trading pairs are most liquid on Cat.Ex?

BTC/USDT, ETH/USDT, and BNB/USDT dominate the order book, together accounting for roughly 70% of daily volume (≈$87M as of Sep2025).

Comments

Alie Thompson

It is astonishing how many users overlook the fundamental moral obligations we bear when we entrust our hard‑earned wealth to platforms that lack clear regulatory oversight, and this very negligence is a symptom of a deeper societal malaise that glorifies profit above principle; the fact that Cat.Ex markets itself as a low‑fee exchange while imposing a predatory 3.5% withdrawal charge reveals a calculated exploitation of unsuspecting traders, especially those lured by the seductive promise of token mining rewards; one must ask whether the allure of free CATT tokens justifies the surrender of financial sovereignty, for when the exchange holds the keys to your assets, it simultaneously holds the power to freeze or confiscate them with impunity; the tiered discount system, which demands holdings of tens of millions of CATT for any meaningful fee relief, is nothing short of a pyramid scheme that rewards the already affluent while marginalizing the average participant; furthermore, the absence of any recognized licensing or insurance fund betrays a reckless disregard for consumer protection, a fact that should alarm any conscientious investor; the geographical blocks placed on jurisdictions with stringent regulations are a thinly veiled admission of the exchange’s non‑compliance, and they effectively create a blacklist of legitimate users; in addition, the platform’s reliance on hot wallets for asset custody magnifies the risk of hacking and loss, an exposure that cannot be mitigated by mere two‑factor authentication; the purported “transaction‑mining” model, while superficially innovative, merely redistributes fee revenue in a manner that benefits the exchange’s token price at the expense of traders; the 0.01%‑0.05% maker fees are attractive on paper but become irrelevant when the net cost of withdrawal erodes all gains; the fixed network fees for Bitcoin and Ethereum withdrawals further diminish the appeal, especially for smaller traders; beyond the financial calculus, one should consider the ethical dimension of supporting a platform that operates in a jurisdiction with ambiguous legal standing, thereby potentially facilitating illicit activities; the lack of a transparent governance structure or community oversight compounds these concerns; ultimately, the decision to engage with Cat.Ex must be weighed against the values of accountability, fairness, and security, which this exchange appears to sidestep in pursuit of market share; consequently, I implore prospective users to critically evaluate whether the short‑term fee savings justify the long‑term ethical compromises.

Samuel Wilson

From a coaching perspective, the platform's low maker and taker fees are commendable for high‑volume traders, yet it's essential to balance that advantage against the steep withdrawal rate; prudent risk management dictates that users calculate total cost of ownership before committing capital.

Rae Harris

Yo, the whole CATT tier thing feels like a hype‑driven tokenomics maze, but if you’re already deep in DeFi jargon, you’ll see the marginal fee cuts as a sweetener for staking those mega‑tokens, even though the flat 3.5% exit tax still bites hard on small ops.

Danny Locher

Looks like a decent spot‑only UI, and for those who just want to trade without fancy derivatives, it does the job; just keep an eye on those withdrawal fees if you plan on moving cash frequently.

Millsaps Delaine

One cannot help but observe the excessive pretentiousness embedded within the promotional literature of Cat.Ex, where the veneer of sophistication thinly masks an underlying architecture designed to reward the elite custodians of CATT while relegating the modest participant to a perpetual state of financial subservience; the ostensibly benevolent tier system, in reality, functions as a stratified gatekeeping mechanism, meticulously calibrated to extract maximum liquidity from those unwilling or unable to amass the requisite quantum of native tokens, thereby perpetuating an inequitable distribution of fee relief and, by extension, of wealth; such a structure not only challenges the egalitarian ethos purported by many crypto platforms but also raises profound questions regarding the ethical responsibilities of exchange operators in fostering an environment that disproportionately advantages a select few; consequently, any discourse that extols the platform's low trading fees without a concurrent critique of its punitive withdrawal regime and opaque regulatory posture remains fundamentally incomplete.

Jack Fans

Hey folks, just wanted to add that the 2FA security feature is solid, but the lack of an insurance fund means you’re still on your own if something goes wrong, so keep your holdings small unless you’re comfortable with that level of risk.

Adetoyese Oluyomi-Deji Olugunna

The platform's interface feels slick, yet the tokenomics are overly complicated for the average user, potentially deterring newcomers.

Krithika Natarajan

Nice UI but beware the fees.

Ayaz Mudarris

In evaluating Cat.Ex, one must adopt a holistic approach that weighs both quantitative fee metrics and qualitative governance factors; the allure of sub‑one‑percent trading fees can be seductive, yet the overarching risk profile is amplified by the exchange's unregulated status and the disproportionately high withdrawal surcharge, which together may erode the net profitability of even the most disciplined trading strategies; therefore, a balanced assessment is imperative.

Irene Tien MD MSc

Isn't it just perfect that we have another exchange promising low fees while secretly pocketing a massive 3.5% withdrawal tax? It's almost as if they're running a stealth tax haven for crypto-everyone signs up for the CATT mining hype, only to discover they're paying the price in hidden fees, a classic case of bait and switch that would make any conspiracy theorist grin with delight.

kishan kumar

One must consider the philosophical implications of token‑based discount structures; they mirror a meritocratic illusion that rewards accumulation over utility, ultimately fostering a self‑reinforcing feedback loop 🙂.

Anthony R

Overall, the platform provides a decent range of assets, but users should remain vigilant about the high withdrawal fees; always read the fine print.

Vaishnavi Singh

Simple and clear, but the fee structure demands careful calculation.

Linda Welch

Honestly, another exchange boasting “low fees” while slapping a 3.5% exit tax is just the same old scam disguised with slick graphics, and the whole CATT tier junk is a clear attempt to milk the community for tokens they don’t even need; it’s absurd yet typical of the space.

Kevin Fellows

Looks decent.

meredith farmer

The whole narrative around Cat.Ex feels like a staged drama, where the protagonist (the exchange) pretends to be the hero delivering low fees, while the villainous withdrawal penalty lurks in the shadows, waiting to ambush unsuspecting traders; it’s a plot twist no one asked for.

Peter Johansson

From a coaching standpoint, if you can navigate the tier system and meet the CATT thresholds, the low maker/taker rates can be a real boost; just remember to keep your security settings tight 😊.

Cindy Hernandez

Cat.Ex offers a straightforward spot trading experience; however, the steep withdrawal fees and lack of regulatory oversight are significant considerations for any trader.

Karl Livingston

The platform’s UI is user‑friendly, but the economics of the CATT token and the high exit fees demand a thorough cost‑benefit analysis before committing substantial capital.

Kyle Hidding

Analyzing the token‑omics reveals a classic case of fee redistribution that benefits the exchange’s native token holders at the expense of average users; the withdrawal fee structure is particularly exploitative, effectively eroding margin gains.

Andrea Tan

Nice platform, but watch out for those fees.

Gaurav Gautam

It’s good to see an exchange that keeps things simple, yet the high withdrawal surcharge remains a hurdle; perhaps future updates will address this imbalance.

Robert Eliason

Honestly, the whole tier system is just a way to keep the token’s price artificial while users pay the hidden costs-nothing new in this space.

Cody Harrington

Overall, useful for spot trades but consider the exit fees before moving large sums.