When you borrow money in traditional banking, the bank looks at your credit score, income, and payment history. In DeFi, none of that matters. Instead, it asks: what do you own? That’s where collateral factor and borrowing power come in. If you’ve ever wondered how you can borrow $5,000 worth of ETH just by depositing $10,000 in USDC, this is how it works.

What Is a Collateral Factor?

The collateral factor is a percentage that tells you how much of your deposited asset you can borrow against. It’s set by the lending protocol based on how stable and liquid the asset is. Think of it like a safety margin. The more unpredictable an asset’s price swings, the lower the factor. Stablecoins like USDC and DAI often have high factors - sometimes 75% or even 80%. Volatile assets like Bitcoin or Ethereum might sit at 60% to 75%. Some obscure tokens? Maybe 30% or less.For example, if Compound Finance gives WBTC a 85% collateral factor and you deposit 1 WBTC worth $60,000, you can borrow up to $51,000 in another asset - say, USDC. That $51,000 is your borrowing power. The protocol doesn’t care if you’ve paid your rent on time. It only cares that your collateral is worth more than what you’ve borrowed - and that it won’t crash overnight.

How Borrowing Power Works

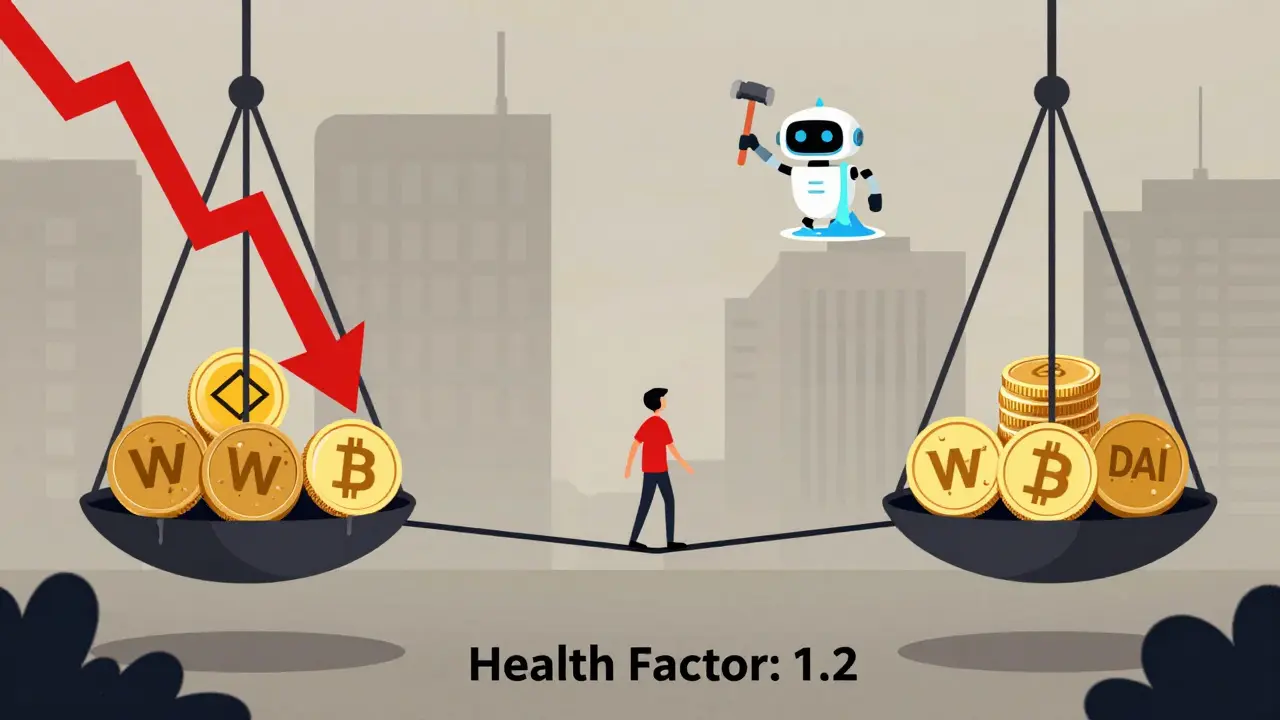

Borrowing power isn’t fixed. It changes as your collateral’s value changes. If you deposit $10,000 in ETH and the collateral factor is 70%, your initial borrowing power is $7,000. But if ETH drops 20% in value, your collateral is now worth $8,000. Your borrowing power drops to $5,600. If you’ve already borrowed $6,000, you’re now over-leveraged. That’s when things get risky.DeFi protocols track your health factor - a number that tells you how close you are to being liquidated. If it falls below 1, you’re in trouble. The protocol automatically sells part of your collateral to cover the loan. No warning. No grace period. Just a smart contract executing a liquidation. That’s why monitoring your positions isn’t optional - it’s survival.

DeFi vs. Traditional Lending

In traditional finance, your home is collateral for a mortgage. If you default, the bank takes years to foreclose. They hire lawyers, go to court, list the property. It’s slow, expensive, and messy. In DeFi, liquidation happens in seconds. No bureaucracy. No appeals. Just code.Traditional lenders care about your credit history. Did you pay your phone bill? Your student loan? They build a profile over years. DeFi doesn’t care. You don’t need a Social Security number. You don’t need a bank account. You just need a wallet and some crypto. That’s why someone in Nigeria or Argentina can access the same borrowing power as someone in New York - if they have the collateral.

But here’s the catch: traditional loans are usually one-way. You borrow USD to buy a house. DeFi lets you borrow anything. You can deposit ETH and borrow DAI. Deposit USDC and borrow SOL. Deposit LINK and borrow WBTC. That flexibility is powerful - but it also means you’re exposed to multiple price swings at once.

Why Collateral Factors Change

Collateral factors aren’t set in stone. They shift with market conditions. If a token starts seeing massive sell-offs, protocols lower its factor to protect themselves. In late 2022, after the Terra collapse, many protocols slashed collateral factors for stablecoins tied to algorithmic systems. Some dropped from 75% to 50% overnight.Similarly, when Bitcoin hits new all-time highs, its liquidity increases. Protocols might raise its collateral factor because there’s more demand to borrow against it. More buyers = more stable pricing = less risk. That’s why WBTC often has a higher factor than lesser-known Bitcoin sidechains.

Platforms like Aave and Compound update these factors based on real-time data: trading volume, order book depth, historical volatility, and even on-chain sentiment. They don’t guess. They calculate.

How to Maximize Your Borrowing Power

If you want to borrow more, you need to optimize your collateral. Here’s how:- Use stablecoins with high factors - USDC and DAI are usually the safest bets.

- Don’t pile all your collateral into one volatile asset. Spread it across ETH, WBTC, and stablecoins.

- Keep a buffer. Never borrow up to 80% of your limit. Aim for 60% or less to survive market dips.

- Monitor your health factor daily. Set price alerts on your collateral assets.

- If your position is at risk, add more collateral or repay part of your loan - don’t wait for liquidation.

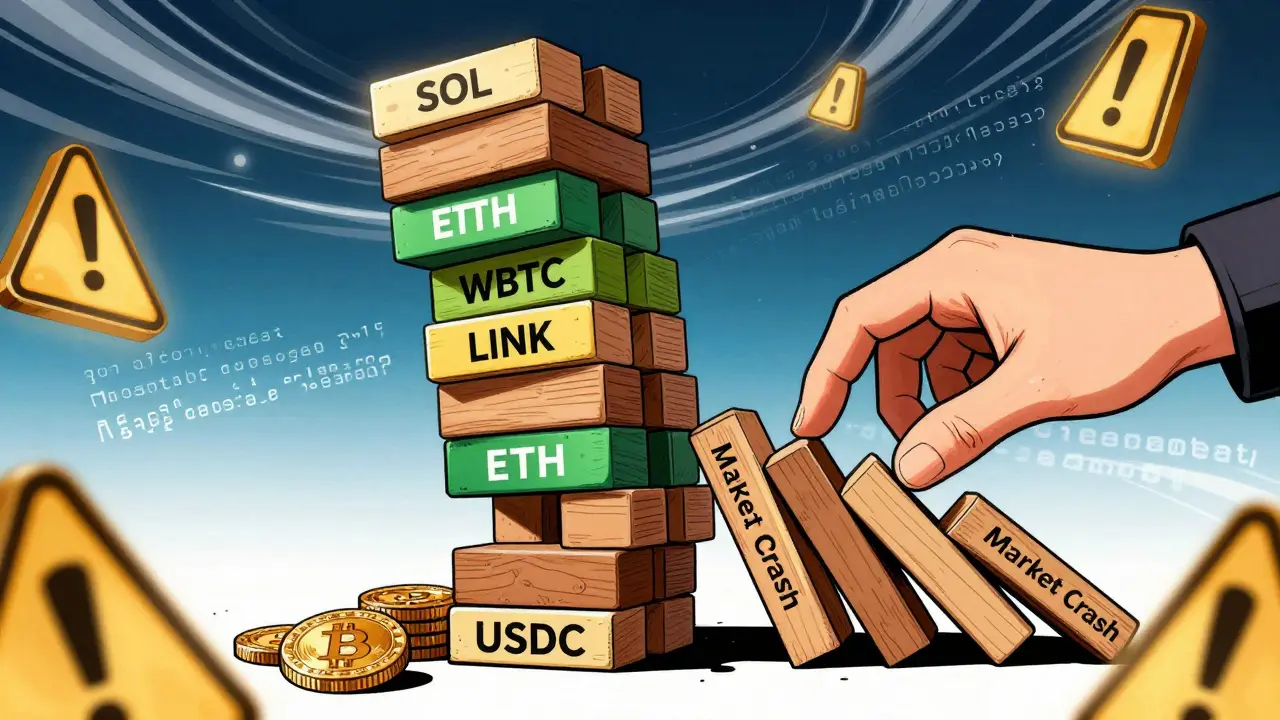

Some advanced users even use “collateral swapping” - depositing a low-factor asset, borrowing a high-factor one, then using that to deposit something else. It’s like financial Jenga. Do it wrong, and the whole tower falls.

Risks You Can’t Ignore

Borrowing power sounds great until you lose it. The biggest danger isn’t losing money - it’s losing your collateral without warning.Let’s say you deposit $10,000 in SOL as collateral with a 60% factor. You borrow $6,000 in USDC. Then SOL drops 40% in a day. Your collateral is now worth $6,000. Your borrowing power is $3,600. You’ve borrowed $6,000. You’re underwater. The protocol liquidates 50% of your SOL to cover the difference. You lose half your asset - and still owe money.

Another risk: competing claims. If you use a token that’s been hacked or frozen (like some L1 tokens after exploits), the protocol might freeze its value or reduce its factor retroactively. You could wake up to find your $10,000 collateral now counted as $2,000. No recourse. No customer service.

And don’t forget gas fees. If you’re trying to add collateral during a market crash, Ethereum or Solana network congestion can delay your transaction. That delay can mean the difference between saving your position and getting liquidated.

What’s Next for Collateral Factors?

The next wave of DeFi lending is smarter collateral. Protocols are starting to use real-time oracle data from multiple sources to adjust factors in milliseconds, not hours. Some are testing cross-chain collateral - letting you use Bitcoin on Ethereum-based protocols via wrapped tokens. Others are building insurance layers that pay out if you’re liquidated unfairly.Traditional banks are watching. JPMorgan and BlackRock have filed patents for blockchain-based lending systems that mimic DeFi’s collateral models - but with compliance layers. The future won’t be DeFi vs. banks. It’ll be banks using DeFi logic to offer faster, more flexible loans.

For now, the rule stays the same: collateral factor determines your power. The more you understand it, the less likely you are to get caught off guard. Borrowing power isn’t free money. It’s a lever. Use it right, and you multiply your position. Use it wrong, and you lose everything.

Comments

Ellen Sales

so like… you deposit usdc and suddenly you can borrow eth? no credit check? no paperwork? my bank would sell a kidney to let me do that. also why does my phone bill matter if i own 10 btc? 🤔

Sheila Ayu

Wait-so you’re telling me… if I deposit a token that’s basically a meme, I can borrow… what? More memes? And if the price dips? Poof! Gone? No warning? No mercy? No second chance? That’s not finance-that’s Russian roulette with a blockchain!

Janet Combs

i dont get it but i like it? like… you put in crypto and you get to borrow more crypto? and if it goes down, you lose stuff? and they dont even call you? just… boom? liquidated? my cat would be confused. but also… kinda cool?

vaibhav pushilkar

Always keep 30% buffer. Never max out. Health factor above 1.5. Monitor daily. Simple.

Lloyd Yang

Man, this whole system is like a high-wire act over a canyon of volatility. One misstep, one sudden dip, one lagging gas fee-and your life’s work in crypto gets auctioned off by a robot that doesn’t even know your name. And yet… it’s beautiful. No gatekeepers. No middlemen. Just math, liquidity, and the cold, quiet hum of smart contracts doing what humans refuse to: being fair. No favoritism. No nepotism. Just collateral. It’s the first financial system I’ve ever trusted.

Zavier McGuire

people think this is freedom but its just debt with fewer rules. you think you're winning until you're not. then you're just another statistic in a blockchain graveyard

Sybille Wernheim

Yesss! This is why I love DeFi! No gatekeeping! No waiting weeks for a loan! Just you, your wallet, and the power to move money like a boss. 💪 If you're careful, it's the most empowering thing in finance. Go get that borrowing power, queen!

Cathy Bounchareune

It’s wild how this turns wealth into a language everyone speaks-no passport, no SSN, just a wallet and a vibe. In Lagos, Jakarta, or Omaha, if you’ve got the collateral, you’re in. It’s the first time finance felt… global. Not just Western. Not just elite. Just… real.

Jordan Renaud

There’s something almost spiritual about it. You don’t borrow money-you borrow potential. And the system doesn’t care who you are. Only what you hold. That’s not cold. That’s pure. It strips away the noise and leaves only value. Maybe that’s the real revolution.

Luke Steven

DeFi is like a forest. You can live off it… if you know the signs. Watch the wind. Know the trees. If you wander blind, you get eaten. The health factor? That’s your gut feeling. The collateral factor? Your map. And gas fees? The noise of the wolves. Stay alert. 🌲⚡

Dan Dellechiaie

Let me break it down for the non-crypto bros: collateral factor = your leverage multiplier. Borrowing power = your risk exposure ceiling. Liquidation = the protocol’s auto-pilot death sentence. And yes, your 10k SOL deposit just became 6k because the market had a panic attack. Welcome to capitalism 3.0. No refunds. No empathy. Just oracle feeds and smart contracts.

Radha Reddy

While the mechanism is innovative, one must consider the systemic risks inherent in decentralized lending protocols. The absence of regulatory oversight and the volatility of underlying assets present considerable challenges to long-term financial stability. Prudent risk management is essential.

Sarah Glaser

The elegance of DeFi lies in its neutrality. No bias. No history. Just math. But that neutrality is also its flaw-because when the market crashes, there’s no human to pause it. No compassion. No mercy. Just execution. We must ask: Is efficiency worth the absence of humanity?

roxanne nott

you said 'usdc' but meant 'usdt' right? everyone knows usdc is the only real stablecoin. also your '75%' factor is outdated-compound updated it to 70% last week. you clearly didn't check the docs. again.

Ashley Lewis

This is not finance. It is gambling dressed in blockchain. A system that liquidates without warning, governed by opaque algorithms, and promoted by influencers who’ve never held a balance sheet. It is not innovation. It is recklessness masquerading as disruption.

Ellen Sales

lol @ashley lewis you sound like my grandpa yelling at the clouds about the internet. if this is 'recklessness' then why is jpmorgan filing patents for it? 🤷♀️