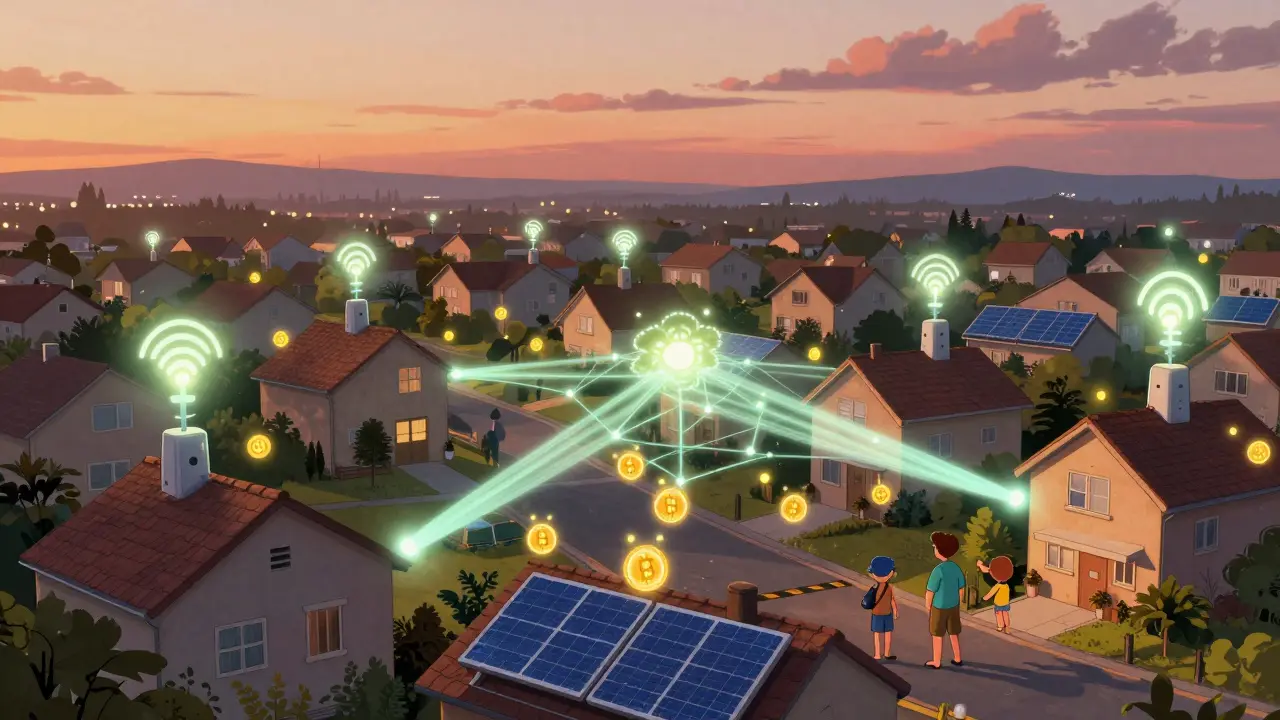

Imagine your neighbor’s WiFi router suddenly becomes part of a global internet network - and they get paid for it. Or your unused home solar panels start selling excess power directly to others in your neighborhood, without a utility company in between. This isn’t science fiction. It’s happening right now through DePIN - Decentralized Physical Infrastructure Networks.

DePIN is where blockchain meets real-world stuff: Wi-Fi, power grids, data storage, even car sharing. Instead of big corporations owning and controlling these systems, everyday people contribute their spare resources - and get rewarded with crypto tokens. It flips the script on how infrastructure is built and maintained. No more waiting for a cable company to expand service to your town. If enough neighbors pitch in, the network grows - fast.

How DePIN Works: The Three Core Pieces

At its heart, every DePIN network runs on three simple but powerful parts: blockchain, smart contracts, and tokens.

The blockchain is the public ledger. Every time someone shares bandwidth, stores data, or supplies energy, it’s recorded permanently. No one can delete or fake it. That builds trust. You don’t need to trust the person next door - you trust the code.

Smart contracts are the automated rules. They’re like digital vending machines. If you install a Helium hotspot and it provides reliable internet coverage for 24 hours? The contract automatically sends you tokens. No paperwork. No customer service call. Just proof of work, paid instantly.

Tokens are the incentive. They’re not just digital money - they’re ownership stakes. The more you contribute, the more tokens you earn. And those tokens can be used to access services on the network, traded for other crypto, or held as an investment. It turns passive assets - like unused hard drive space or an idle EV charger - into income streams.

Real Examples: DePIN in Action

Let’s cut through the buzzwords. Here’s what DePIN actually looks like today.

Helium: The Decentralized Internet

Helium is the poster child of DePIN. Started in 2019, it’s now one of the largest decentralized wireless networks on Earth. Anyone can buy a $200 hotspot, plug it in, and start providing LoRaWAN coverage for IoT devices - things like smart agriculture sensors, bike trackers, or environmental monitors.

For every device that connects through your hotspot, you earn HNT tokens. As of 2025, over 2.3 million hotspots are active globally. In rural parts of Indonesia, Kenya, and Peru, Helium networks are the only affordable internet option for local businesses. No telecoms needed. No permits. Just people sharing what they already have.

Filecoin and Arweave: Decentralized Storage

Think of iCloud - but instead of Apple owning the servers, thousands of people rent out spare hard drive space. Filecoin lets you earn FIL tokens by storing other people’s data. Arweave takes it further: pay once, store forever. Artists, researchers, and activists use Arweave to archive websites, videos, and documents permanently - immune to censorship or corporate shutdowns.

In 2024, Filecoin stored over 10 exabytes of data - more than the entire Library of Congress, 2,000 times over. And it’s all distributed across homes, garages, and small data centers in 80+ countries.

Power Ledger and PowerToken: Peer-to-Peer Energy

What if your solar panels could sell electricity directly to your neighbor instead of the grid? Power Ledger, based in Australia, lets households trade excess solar power using blockchain tokens. In pilot programs in Thailand and the U.S., families cut their energy bills by 30% by buying power from neighbors instead of the utility.

During blackouts in California and New Zealand, these microgrids kept lights on - because they didn’t rely on a single power station. When the grid failed, the neighborhood network kept running.

Render Network: Decentralized GPU Power

Rendering 3D animations or training AI models used to cost thousands in cloud computing fees. Render Network lets anyone with a gaming GPU - even a mid-range NVIDIA card - rent out unused processing power. Creators pay in RNDR tokens. Artists in Manila, coders in Lagos, and indie game devs in Auckland now access enterprise-grade computing at 1/10th the price.

The DePIN Flywheel: How It Grows Itself

What makes DePIN different from old-school startups? It doesn’t need venture capital to scale. It grows on its own.

Here’s how:

- Incentivize participation - You plug in a hotspot or share storage. You get tokens.

- More participants = better service - More hotspots mean wider coverage. More storage nodes mean faster downloads.

- Better service = more users - People who couldn’t get internet before now can. Artists who couldn’t afford rendering now can.

- More users = more investment - Investors see growth. They fund new hardware, better software, more features.

This loop keeps spinning. No CEO needs to order more servers. The community builds it - and gets paid while doing it.

Why DePIN Beats Centralized Systems

Big companies like Amazon, Verizon, and PG&E control most infrastructure today. But they’re slow, expensive, and fragile.

Centralized systems have one big flaw: a single point of failure. One data center goes down? Millions lose access. One power plant shuts off? Whole cities go dark. One telecom cuts service? You’re offline.

DePIN has no single point. Thousands of nodes. If one hotspot dies, ten others pick up the slack. If one storage node disappears, your data is still on 50 others. It’s like having a backup for your backup - for everything.

And it’s cheaper. Helium’s network costs 70% less to operate than a traditional cellular tower. Filecoin storage is 40% cheaper than AWS. Why? No corporate overhead. No shareholders demanding quarterly profits. Just people sharing what they already own.

Who’s Using DePIN Today?

You don’t need to be a tech expert. Here’s who’s already benefiting:

- Rural communities - In parts of Colombia and the Philippines, DePIN Wi-Fi is the first reliable internet they’ve ever had.

- Small businesses - A café in Wellington uses Helium to track inventory via IoT sensors. No monthly fees.

- Artists and creators - Animators in Nairobi use Render Network to render films without paying $500/hour for cloud GPUs.

- Homeowners - A retired couple in Christchurch sells solar power to neighbors via Power Ledger and earns $150/month.

These aren’t pilot projects. They’re live, profitable, and growing.

What’s Next for DePIN?

The next wave is coming fast.

Electric vehicle owners are starting to use their car batteries as mobile power banks for the grid - earning tokens when they feed energy back during peak hours. That’s called V2G (vehicle-to-grid), and it’s already live in Norway and Australia.

DePIN is also moving into mapping. Projects like Hivemapper let drivers earn tokens just by recording road conditions with their dashcams. The data builds free, real-time maps - no Google required.

And then there’s water. Early-stage DePIN networks are testing sensor networks to monitor clean water flow in developing regions - paid for by token rewards from NGOs and governments.

The pattern is clear: any physical resource that’s underused - bandwidth, storage, energy, computing, sensors, even roads - can become part of a DePIN network.

Getting Started With DePIN

Want to join? You don’t need to be a coder.

- If you have spare storage: sign up for Filecoin or Arweave. Plug in an old external drive. Start earning.

- If you have a WiFi router: buy a Helium hotspot ($200-$300). Plug it in. Wait for coverage to activate. Earn HNT.

- If you have solar panels: check if Power Ledger is available in your region. Connect your meter. Start trading.

- If you have a gaming PC: install Render Network. Let it run idle. Earn RNDR while you sleep.

It’s not get-rich-quick. But it’s passive income that scales with your contribution. And you’re helping build something that lasts - not just for you, but for your whole community.

Final Thought: Infrastructure Is a Shared Resource

For a century, infrastructure was built by governments and corporations - and we paid for it through taxes and bills. But what if the people who use it could also build it?

DePIN proves that’s not just possible. It’s already working. Better. Cheaper. Fairer.

The next time you think about the internet, the power grid, or cloud storage - remember: it doesn’t have to be owned by a company. It can be owned by everyone.

What exactly is a DePIN network?

A DePIN network is a decentralized system where people share physical resources - like internet bandwidth, storage space, or solar energy - using blockchain technology. Instead of a company owning the infrastructure, participants earn crypto tokens for contributing their unused assets. These tokens can be used to access services on the network or traded for other currencies.

Is DePIN just another crypto scam?

No. Unlike speculative crypto projects, DePIN networks provide real, measurable services. Helium has over 2 million active hotspots delivering internet to remote areas. Filecoin stores real data for businesses and archives. These aren’t theoretical - they’re operational, with millions of users relying on them daily. The tokens represent actual utility, not just hype.

Do I need to be tech-savvy to use DePIN?

Not at all. Most DePIN apps work like plug-and-play devices. Buy a Helium hotspot, plug it in, connect to Wi-Fi - that’s it. For storage or rendering, you download a simple app. No coding. No blockchain wallet setup required to start earning. The complexity is hidden behind user-friendly interfaces.

Can I make real money with DePIN?

Yes. In New Zealand and Australia, homeowners with solar panels and Power Ledger earn $100-$200/month by selling excess energy. Helium hotspot operators in rural areas make $30-$80/month just by leaving a device plugged in. Render Network users with gaming GPUs earn $50-$150/month passively. It’s not a fortune, but it’s real, consistent income with zero extra work.

What happens if the token price drops?

The value of the token isn’t the only reward. Even if HNT or FIL drops in price, the service you’re providing - like internet coverage or data storage - still has real-world utility. Many users keep contributing because they benefit from the network’s improved performance, not just the token price. The network’s value comes from its function, not speculation.

Is DePIN legal?

Yes, in most countries, including New Zealand, Australia, the U.S., and the EU. DePIN networks operate as peer-to-peer marketplaces, not financial institutions. As long as you’re not running an unlicensed utility or violating local zoning laws (like installing a hotspot on a public pole), you’re fine. Always check local regulations for energy or telecom equipment, but most home-based DePIN setups are fully compliant.

Comments

Sarah Baker

This is the future, and it’s beautiful. I plugged in a Helium hotspot last month and now my block has better coverage than the cable company’s. I make $40 a month just by leaving it on. No hustle. No stress. Just passive income that helps real people. 🌍✨

Bryan Muñoz

They want you to think this is freedom but it’s just another crypto scam wrapped in a wifi router 🤡

Big Tech is letting you play along so they can harvest your data later. You think you’re earning tokens? You’re the product. Wake up.

They’ll shut it down when it’s convenient. Just like Bitcoin. Just like everything else.

They’re laughing at you right now.

Alexandra Heller

What fascinates me is the metaphysical inversion here. We’ve been conditioned to believe infrastructure must be owned, controlled, and monetized by centralized entities - but DePIN reveals a deeper truth: that the physical world is already a commons, and blockchain merely restores the natural order of mutual aid.

It’s not technology. It’s a return to reciprocity.

The state never built roads - communities did. The grid was never a monopoly - it was a shared rhythm. DePIN is just the digital echo of that ancient truth.

And yet, we call it ‘innovation’ as if it’s new. It’s not. We’re remembering.

But will we remember how to live without tokens? Or will we trade one form of alienation for another, even if it’s prettier?

Are we building a network - or just another marketplace with a blockchain sticker?

Pat G

So now we’re rewarding people for sharing their WiFi like it’s some revolutionary act? In America we used to pay taxes so the government could build infrastructure - now we’re handing out crypto to people who don’t even pay their own electric bill?

What’s next? Paying folks to breathe air? This is what happens when you let anarchists with laptops run the grid.

And don’t even get me started on how this undermines national security.

Any idiot with a hotspot can now be part of a ‘decentralized network’ - great. Now who’s monitoring who’s connecting to it?

Who’s responsible when the bad guys use your neighbor’s hotspot to launch attacks?

Who’s liable?

Not you. Not them. No one. That’s the beauty of chaos, I guess.

Pramod Sharma

Simple. Smart. Powerful.

People sharing. People earning.

No middlemen.

Done.

Liza Tait-Bailey

i just got a render network account and my old rtx 3060 is now earning me $20 a week while i play fortnite??

also my sister in philly is selling solar power to her neighbor and they’re both saving money??

i’m not even joking. this is wild. and kinda beautiful.

why did no one tell us this was possible??

Bill Sloan

Wait - so if I plug in my old NAS and start storing data on Filecoin, I’m basically becoming a mini AWS? And I don’t even need to know how to code?

That’s insane.

And I thought crypto was just gambling.

Now I feel like I’ve been living in the dark.

How many more of these networks are out there? I’m going to check every single one tonight.

Also - can I use my Tesla to power the grid? I’ve got 75k miles on it and it’s basically a battery on wheels.

ASHISH SINGH

They say DePIN is decentralized but who really controls the tokens?

Who made the smart contracts?

Who owns the initial supply?

It’s always the same people.

Same VCs.

Same founders.

Same exit strategy.

They just dressed it up in a new hoodie.

It’s not decentralization.

It’s rebranding.

And you’re the sucker who’s buying the hype.

They’ll rug it when the price dips.

Just wait.

It always happens.

Rod Petrik

Helium hotspots are being used by the Chinese government to map U.S. infrastructure

It’s not a coincidence that 80% of them are in military towns

Why do you think they’re so cheap?

They’re not for you

They’re for them

And you’re the unwitting antenna

They’re collecting your location data, your neighbors’ data, your WiFi traffic

And you’re getting HNT for it

How much is your privacy worth?

20 bucks a month?

Think again

Vinod Dalavai

My cousin in Kerala just got a Helium hotspot. No internet before. Now his kid can do homework. He earns $15/month. He says it’s like magic.

Meanwhile, I’m in Silicon Valley with fiber optic and still paying $120/month.

Who’s really the innovator here?

Not the big guys.

Just regular people with a box and a dream.

Keep it going.

Chidimma Okafor

This is not merely technological advancement - it is a profound reimagining of communal stewardship in the digital age.

When individuals become both contributors and beneficiaries, we transcend the transactional nature of modern capitalism.

DePIN does not merely distribute tokens - it distributes dignity.

It restores agency to the marginalized, the rural, the overlooked.

And in doing so, it challenges the very foundations of extractive infrastructure.

Let us not mistake this for a fad.

This is the emergence of a new social contract - one written not in legalese, but in code, in consent, and in collective will.

May we honor it with humility, not hype.

Callan Burdett

I’ve got a Power Ledger setup in my garage. My solar panels are now my ATM.

My neighbor pays me in tokens to charge his EV.

We don’t even talk about it.

Just a quiet nod when we pass in the driveway.

It’s not about the money.

It’s about knowing we’re part of something that actually works.

And it’s not broken.

And it’s not owned by anyone.

It’s ours.

Tony Loneman

Oh wow another ‘decentralized’ project that needs you to buy $300 hardware to participate

So it’s decentralized until you need to spend real money to join

Then it’s just another pyramid scheme with better branding

And the real winners? The people selling the hotspots

Not the people plugging them in

Wake up

You’re the fuel

Not the owner

Anthony Ventresque

I’m curious - what happens when a DePIN network scales to a city level? Do you still need a central authority to coordinate maintenance? Or does the network self-heal? What’s the failure mode? Is there a backup plan if 10% of nodes go offline? I’m not doubting it - I just want to understand the edges.

Because if it works at scale, this changes everything.

Bharat Kunduri

lol i tried to set up filecoin but my laptop died and now i owe 300 bucks in electricity

also the app kept crashing

and i think my neighbor stole my tokens

not worth it

back to netflix

nathan yeung

My dad in Delhi just got a Helium hotspot. He didn’t even know what blockchain was. He thought it was a new kind of router.

Now he earns $20/month and says he’s ‘helping the internet’.

He doesn’t care about crypto.

He just likes that his grandson can watch YouTube without buffering.

That’s all that matters.

It’s not tech.

It’s care.

And that’s the real revolution.