Australian Crypto Exchange Guide: Fees, Security, and Regulations

When working with Australian crypto exchange, a locally based platform that lets you buy, sell and trade digital assets while complying with Australian law. Also known as Aust crypto platform, it serves both retail investors and institutions.

The broader concept of crypto exchange, online service that matches buyers and sellers of cryptocurrencies applies worldwide, but Australian versions have unique twists. Australian Securities and Investments Commission (ASIC), the government agency that oversees financial services and enforces compliance in Australia influences every local platform. In practice, ASIC influences Australian crypto exchange regulation, requiring strict KYC and AML checks. This means you’ll often see identity verification before you can deposit funds.

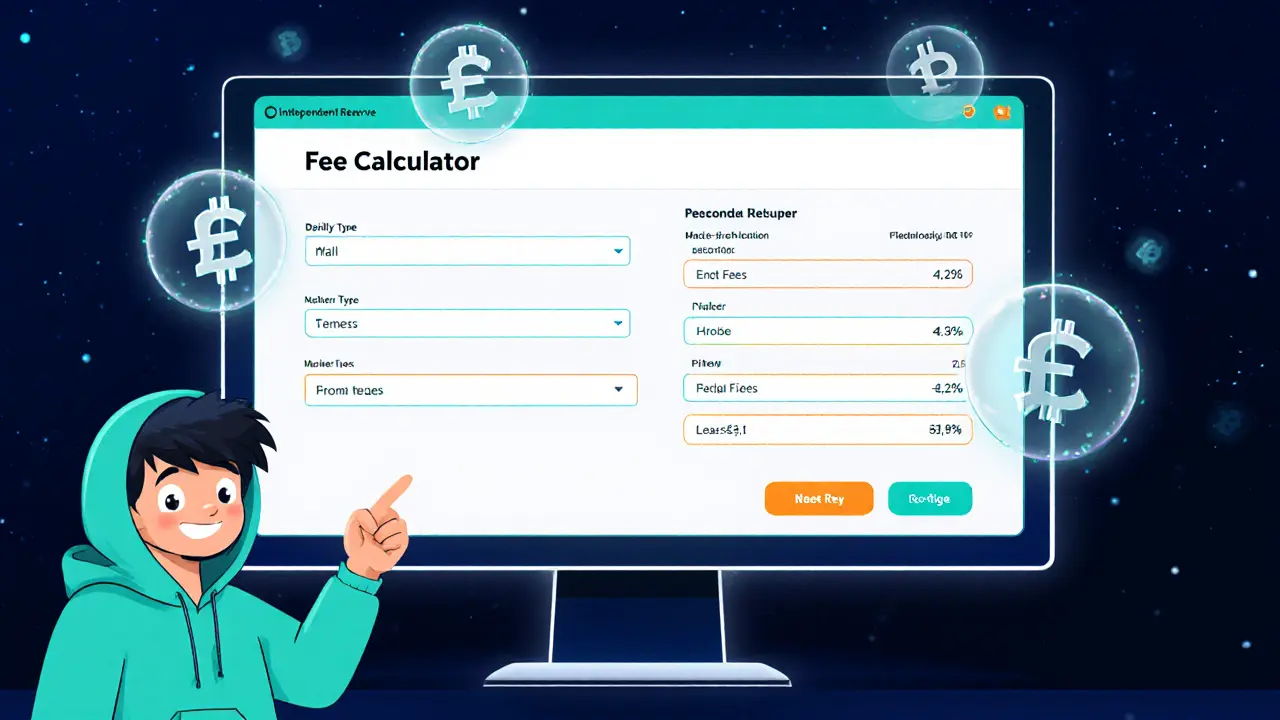

One of the first things traders look at is cost. Australian crypto exchange fee structures vary: some charge a flat 0.1 % maker fee, others use a tiered model based on 30‑day volume. Withdrawal fees can differ dramatically between fiat and crypto, with AUD bank transfers usually costing around $1‑$2, while crypto network fees depend on blockchain congestion. Understanding these nuances helps you avoid surprise charges and choose a platform that matches your trading style.

Security is another non‑negotiable factor. Reputable Australian platforms employ cold‑storage for the majority of user assets, two‑factor authentication, and regular third‑party audits. Some even offer insurance coverage for custodial losses, a feature that ties back to ASIC’s consumer‑protection mandate. Knowing the security measures each exchange offers lets you weigh risk versus convenience when deciding where to keep your coins.

Beyond fees and security, the user experience matters. Local fiat on‑ramps allow you to fund your account directly from an Australian bank via POLi, BPAY or PayID, which speeds up deposits compared to international wire transfers. Many platforms also provide native AUD trading pairs, letting you avoid conversion to USD or EUR before you trade. These conveniences are directly linked to the domestic regulatory environment and make the Australian crypto exchange ecosystem distinct from its global peers.

The articles below dive deeper into each of these areas. You'll find a review of a privacy‑focused exchange, a step‑by‑step guide to avoiding common DCA mistakes, and an analysis of flash‑loan arbitrage opportunities that work on Australian DEXs. Whether you're a beginner looking for a safe entry point or an advanced trader hunting profit‑maximizing strategies, the collection gives you concrete data, real‑world tips, and the context you need to navigate Australian crypto exchanges confidently.

Independent Reserve Crypto Exchange Review: Fees, Security & OTC Services

A deep review of Independent Reserve, Australia’s oldest crypto exchange. Covers regulation, security, fees, OTC desk, mobile app, user feedback and who should trade on it.

read moreAustralian Crypto Exchanges Ban Privacy Coins - What It Means for Users

Australian crypto exchanges have stopped listing privacy coins like Monero, Zcash and Dash. While ownership stays legal, trading on regulated platforms is blocked, pushing users to riskier peer‑to‑peer markets. Learn why regulators acted, the global context, and what to expect next.

read more