Thailand Crypto Platform Compliance Checker

- Bybit

- 1000X

- CoinEx

- OKX

- XT.COM

All foreign platforms targeting Thai users must obtain a license from the Securities and Exchange Commission (SEC) to operate legally.

Bybit

BLOCKED1000X

BLOCKEDCoinEx

BLOCKEDOKX

BLOCKEDXT.COM

BLOCKED- Up to 3 years in prison

- Up to 300,000 Thai baht fine ($8,700 USD)

- Both penalties may apply

Foreign platforms must obtain a license from the SEC Thailand to serve Thai users.

TL;DR

- In April2025 Thailand passed emergency decrees that forbid any foreign, unlicensed peer‑to‑peer crypto platforms from serving Thai users.

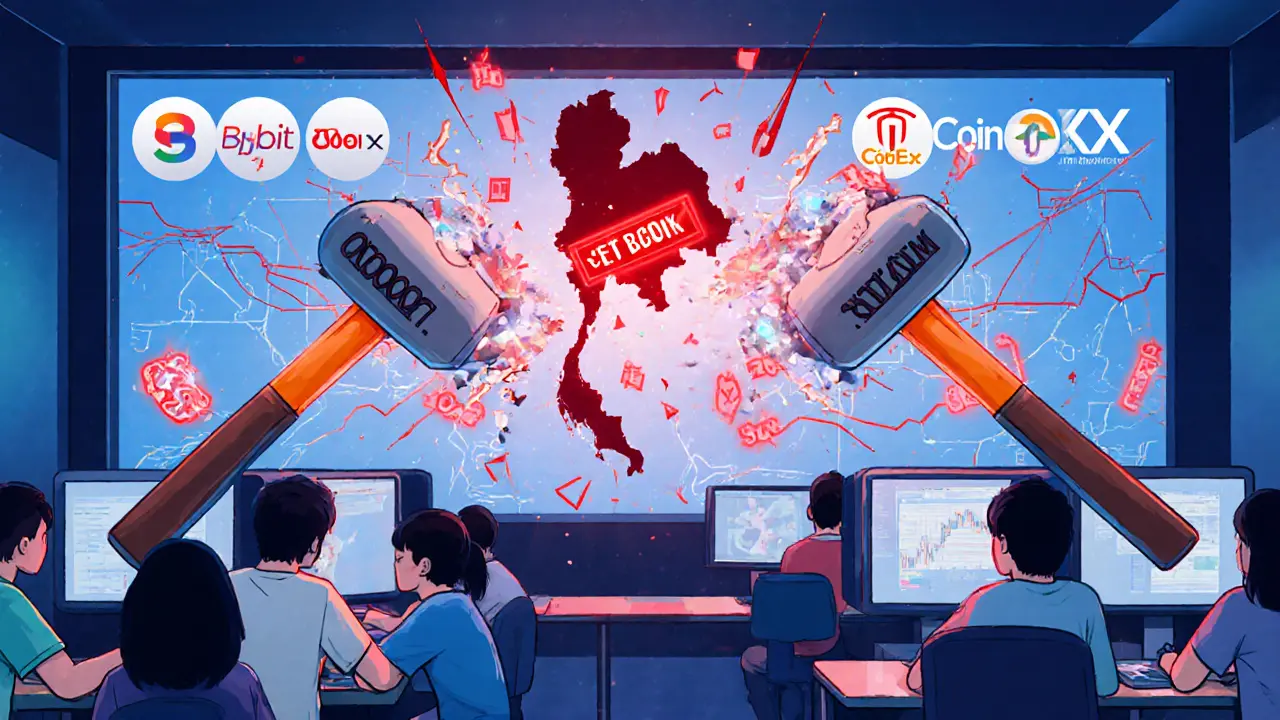

- Five major exchanges - Bybit, 1000X, CoinEx, OKX and XT.COM - were blocked nationwide on 28June2025.

- Violations can bring up to three years in prison, a fine of 300,000baht, or both.

- Thai investors had only one month to withdraw or move assets before the shutdown.

- Domestic innovation continues: the government is still rolling out blockchain projects and a government‑backed stablecoin.

Thailand has always tried to walk a tightrope between embracing blockchain tech and protecting people from scams. The latest move - a full‑blown ban on foreign peer‑to‑peer (P2P) crypto platforms - pushes the country into the most restrictive corner of Southeast Asia. Below we break down why the ban happened, how it works, and what it means for you if you trade crypto in Thailand.

Why Thailand decided to act

Thailand's foreign P2P crypto platform ban is a regulatory response aimed at cutting money‑laundering risks and curbing online fraud. The Thai Securities and Exchange Commission (SEC Thailand) warned that many overseas platforms slipped through the cracks of the 2019 Digital Asset Business Act, offering Thai users a fast way to move money without proper AML/KYC checks.

SEC Secretary‑General Pornanong Budsaratragoon said the goal wasn’t to stifle innovation but to stop “digital asset scammers exploiting loopholes.” The crackdown came after a spike in crypto‑related fraud reports in early 2025, many of which involved foreign exchanges that weren’t subject to Thai oversight.

The legal backbone - emergency decrees and amendments

Two Royal Decrees, both issued on 13April2025, form the backbone of the ban:

- Royal Decree on the Operation of Digital Asset Businesses (No.2), B.E.2568 - forces any foreign crypto service targeting Thai users to secure a license from the SEC.

- Royal Decree on Measures to Prevent and Suppress Technology Crimes (No.2), B.E.2568 - gives the Ministry of Digital Economy and Society (MDES) power to block unlicensed platforms instantly, without needing a court order.

The decrees amended the original Digital Asset Business Act, tightening licensing, reporting, and enforcement rules. The SEC rolled out a clear compliance checklist in May, giving platforms a 30‑day window to apply for a license or shut down.

Who got blocked and how the shutdown unfolded

On 28June2025 the Ministry ordered internet service providers to block access to five exchanges that had not obtained a license:

- Bybit

- 1000X

- CoinEx

- OKX

- XT.COM

The SEC announced the block on 29May, giving users roughly a month to withdraw or transfer funds. Email alerts, push notifications from the SEC’s website, and posts on official Twitter and Facebook pages were the primary communication channels.

Penalties - what happens if you ignore the rule

Violating the new law carries heavy consequences:

- Up to three years in prison.

- A fine of up to 300,000baht (about$8,700USD).

- Both prison time and fine can be imposed simultaneously.

These penalties apply to platform operators, but the decrees also extend liability to banks, telecom firms, and even social‑media apps that enable illicit transactions without proper safeguards.

Impact on Thai users and businesses

For everyday traders, the ban meant scrambling to move assets before the deadline. Many reported “withdrawal bottlenecks” because the platforms were suddenly overwhelmed by traffic. Those who missed the window faced frozen balances that could only be released after a formal request to the SEC.

Cross‑border businesses felt the pinch even more. International invoices that previously used OKX for rapid settlement now have to route through a locally licensed exchange or a traditional bank, adding layers of AML/KYC paperwork and raising transaction costs by 2‑4% on average.

On the bright side, the crackdown cleared the playing field for domestic exchanges. Licensed Thai platforms reported a 15% surge in new user registrations within two months of the block, suggesting that many traders simply switched to compliant services.

How to stay compliant - a quick checklist for Thai investors

- Verify that the exchange you use is on the SEC’s approved list (available on the SEC website).

- Complete KYC verification if you haven’t already - the SEC now requires a photo ID, proof of address, and a source‑of‑funds declaration.

- Move any holdings from unlicensed foreign platforms before the next enforcement deadline (the SEC routinely announces updates).

- Keep transaction records for at least five years - the MDES can request them during a cyber‑crime investigation.

- Consider using a locally licensed exchange that offers fiat on‑ramps; they often have lower withdrawal fees for Thai baht.

If you’re a business, work with a compliance consultancy familiar with SEC Thailand’s reporting format. The agency now requires daily transaction logs for any volume exceeding 5millionbaht.

What’s next - government projects that keep the crypto vibe alive

Even with the ban, Thailand isn’t turning its back on blockchain. In May2025 the Ministry announced a rollout of “G Tokens,” a government‑backed digital asset worth roughly 5billionbaht, intended for public‑debt financing. The plan is to issue the tokens on a secure, domestically controlled ledger.

Additionally, the Securities and Exchange Commission is piloting a blockchain‑based trading platform for securities firms, aiming to cut settlement times from three days to under an hour. A stablecoin backed by Thai government bonds is also in the pipeline, expected to launch in early2026.

Regional ripple effects

Thailand’s decisive move is being watched closely by neighbors like Vietnam, Malaysia, and the Philippines. All three have expressed interest in tightening AML regulations for crypto, but none have yet granted their ministries the sweeping blocking powers that MDES now enjoys.

If the ban successfully reduces crypto‑related scams (early data suggests a 12% drop in reported fraud cases Q22025), regulators across Southeast Asia may adopt similar decree‑style frameworks. That would create a more uniform, albeit stricter, environment for cross‑border digital asset flows in the region.

Key takeaways

- The Thailand crypto ban targets only foreign, unlicensed P2P platforms - domestic exchanges remain legal if they hold a SEC license.

- Penalties are severe; compliance is non‑negotiable.

- Investors must act fast to move assets from blocked platforms.

- Innovation isn’t dead - the government continues to fund blockchain projects and a state‑backed stablecoin.

- Regional regulators may follow Thailand’s lead, reshaping the Asian crypto landscape.

Frequently Asked Questions

Can I still use a foreign exchange if I’m in Thailand?

No. Any foreign exchange that targets Thai users must obtain a license from the SEC. Unlicensed platforms are blocked, and accessing them can lead to penalties.

What should I do with funds on Bybit or OKX right now?

Withdraw or transfer them to a SEC‑licensed Thai exchange before the next announced deadline. If the deadline has passed, you’ll need to file a release request with the SEC.

Will the ban affect crypto‑related jobs in Thailand?

The ban actually creates new jobs in compliance, legal, and blockchain development for licensed local firms. Demand for domestic talent is rising.

How can businesses comply with the new reporting rules?

Register with the SEC, implement AML/KYC software that captures the required data fields, and submit daily transaction logs for volumes over 5millionbaht. Working with a local compliance consultant is highly recommended.

Is Thailand planning to legalize a national digital currency?

Yes. The government is developing a stablecoin backed by sovereign bonds, slated for a 2026 launch. It will operate alongside existing digital asset regulations.

Comments

Marie-Pier Horth

In the grand theatre of regulation, Thailand's latest act feels like a cautionary fable whispered by the ancients. They claim to protect the flock, yet they bind the wings of foreign innovators. One wonders if the chorus of compliance truly harmonizes with the spirit of progress. It's a delicate dance between safety and stagnation.

Gregg Woodhouse

meh, another gov move. they block sites, people lose money, same old story. what r they even do?

F Yong

Oh sure, the Thai SEC is suddenly the hero of the day, while the real puppeteers-those offshore platforms-are the villains. It's almost as if they don't want us to suspect that the data streams are being siphoned into hidden ledgers. Imagine the surveillance potential when you force everyone into a single, licensed gateway.

Sara Jane Breault

Just a heads up for anyone still on those blocked sites ‑ move your funds ASAP. The licensed Thai exchanges have stepped up their support teams so you can get help quickly. If you need a walkthrough on how to set up KYC, let me know I can guide you through the steps

Maggie Ruland

Cool, another country decides to play gatekeeper. Guess the crypto wild west just got a new sheriff.

jit salcedo

Imagine the grand conspiracy: a hidden cabal of bankers pulling strings, convincing governments to lock out foreign platforms.

They say it’s about AML, but perhaps it’s about controlling the flow of wealth. The timing, the pressure points, all align-like a staged performance. Yet the audience feels the chill of reality.

Joyce Welu Johnson

Hey folks, I get why the crackdown feels heavy. If you’re worried about losing access, start withdrawing to a trusted local exchange now. Remember, keeping documentation of every transfer will smooth any future audits. We’re all in this together, and staying informed is our best defense.

Ally Woods

Honestly, I’m not impressed. They throw a ban out there, and we scramble. It’s fine, just do the thing-move your crypto before you’re locked out. No need to make a big deal about it.

Kristen Rws

Don’t panic! It’s just a bump in the road. Take a breath, check the SEC list, and you’ll be back on track faster than you think.

karsten wall

From a systems‑engineering perspective, centralizing compliance through a licensed gateway could reduce transaction latency associated with cross‑border AML checks. However, the risk of a single point of failure must be mitigated via redundancy protocols and decentralized verification layers.

Jenny Simpson

Ah, the inevitable backlash-how predictable! While the regulators trumpet their righteousness, the real story is the stifling of competition. The market will adapt, and those who think they can block innovation with decrees are merely delaying the inevitable.

Sabrina Qureshi

Indeed, the drama unfolding in Bangkok is nothing short of a theatrical masterpiece, replete with twists, turns, and an unmistakable scent of bureaucratic intrigue, all while the everyday investor watches helplessly, clutching their dwindling portfolios, hoping that the next act grants them a reprieve.

Aman Wasade

Look, we all want transparency, but the sarcasm in these policies is thinly veiled. Let’s keep the dialogue civil and focus on solutions, not just blame.

Ron Hunsberger

If you need help navigating the new licensing requirements, feel free to ask. The SEC’s compliance portal can be confusing, but with the right steps you’ll be up and running in no time.

Mangal Chauhan

Dear community, it is my honor to emphasize that adhering to the SEC’s guidelines not only ensures legal compliance but also fortifies the integrity of our digital ecosystem. Please consider scheduling a consultation with a certified compliance specialist; such proactive measures are invaluable. 😊

Iva Djukić

When dissecting the ramifications of Thailand’s recent prohibitive decree, one must first acknowledge the multifaceted interplay between sovereign regulatory prerogatives and the transnational architecture of decentralized finance. The statutory instrument, framed under the auspices of the Digital Asset Business Act, operates not merely as a prohibitive measure but as a catalyst for a paradigmatic shift toward a licensed‑only operational model. This transition, while ostensibly protecting retail participants from pernicious fraud vectors, concurrently engenders a consolidation of market power within domestically sanctioned entities. From a macro‑economic viewpoint, the emergent concentration may attenuate liquidity provision in the short term, thereby exerting upward pressure on bid‑ask spreads across the Thai crypto ecosystem. Moreover, the enforcement mechanism-leveraging ISP-level domain blocking-introduces a technical vector that could be subverted by VPN circumvention, albeit at increased compliance risk for end‑users. It is also germane to consider the legal reciprocity implications; foreign exchanges disenfranchised by this decree may seek redress via bilateral trade forums, potentially precipitating a tit‑for‑tat regulatory cascade within the ASEAN region. Concurrently, the domestic blockchain initiatives, such as the “G Tokens” project, stand to benefit from a de‑facto captive market, accelerating token adoption metrics previously stunted by cross‑border competition. However, this concentration of economic activity raises pertinent questions regarding systemic risk, especially if a singular platform encounters operational distress. In light of these dynamics, stakeholders ought to pursue a bifurcated strategy: diversify asset holdings across multiple SEC‑licensed exchanges while maintaining a vigilant watch on policy evolution. The prudent investor will also factor in the emerging compliance overhead-daily transaction reporting thresholds, expanded KYC documentation, and periodic audit submissions-into their cost‑benefit calculus. Ultimately, the Thai regulatory schema embodies a double‑edged sword: it offers a veneer of investor protection while simultaneously reshaping the strategic landscape for both local and foreign market participants.

Enya Van der most

Team, let’s turn this challenge into an opportunity! Push your crypto funds to the compliant Thai platforms and watch the community thrive. The more we rally, the stronger the domestic ecosystem becomes.

Keith Cotterill

What a spectacular illustration of nationalist overreach! By imposing draconian controls, they betray the very principles of economic freedom that once defined the region. It’s a self‑servicing narrative designed to cement domestic dominance while vilifying foreign competitors.

C Brown

Ah, the classic tale of the big bad state versus the daring outsider-how original! While the officials parade their new rules like triumphs, the real winners are the local firms that get a free pass to the buffet. Let’s see how long that lasts.

Noel Lees

Curious how the new reporting thresholds will affect daily traders-any insights? 🤔

Raphael Tomasetti

Thai regulators are setting a precedent; watch the ripple effect across Southeast Asia.

Narender Kumar

In sum, compliance is the inevitable path forward.