German Crypto Enforcement Explained

When talking about German crypto enforcement, the set of legal actions, regulations, and supervisory measures that govern cryptocurrency activity in Germany. It’s also called German crypto law enforcement. This framework decides what’s allowed, what triggers penalties, and how authorities protect investors.

One of the main players is BaFin, the Federal Financial Supervisory Authority that oversees financial markets, including crypto assets. BaFin issues licences, monitors exchanges, and can freeze assets if a breach is detected. Its decisions shape the safety of the ecosystem and influence how quickly new services can launch.

Another cornerstone is the crypto tax exemption, Germany’s rule that long‑term holdings (over one year) are tax‑free. This incentive encourages investors to hold assets, but it also creates a grey area for short‑term traders who must report gains. Understanding the exemption’s criteria helps you stay compliant and avoid surprise tax bills.

Enforcement isn’t limited to taxes. cryptocurrency scams, fraudulent schemes that promise high returns or free airdrops but siphon user funds are actively pursued by German authorities. When a scam is identified, BaFin can issue warnings, ban websites, and cooperate with law‑enforcement to seize assets. Knowing the red flags saves you from costly mistakes.

The EU’s AML (Anti‑Money‑Laundering) directives also feed into German enforcement. They require crypto firms to verify user identities, report suspicious activity, and maintain detailed transaction logs. Compliance with these rules reduces the risk of money‑laundering accusations and aligns German practices with broader European standards.

Exchange licensing is another practical dimension. Any platform that offers crypto trading to German residents must obtain a licence from BaFin. The licence process examines capital requirements, security protocols, and consumer‑protection measures. Licensed exchanges gain credibility, while unlicensed ones risk shutdown and fines.

All these pieces – BaFin oversight, tax rules, scam prevention, AML duties, and licensing – form a tightly woven system. For traders, this means clearer guidelines and stronger consumer safeguards. For startups, it means navigating a detailed compliance checklist before launching. German crypto enforcement therefore influences market confidence, liquidity, and innovation speed.

Below you’ll find a curated set of articles that break down each of these topics in depth, from real‑world enforcement cases to step‑by‑step guides on staying compliant. Dive in to see how the rules play out on the ground and what you can do to protect your assets.

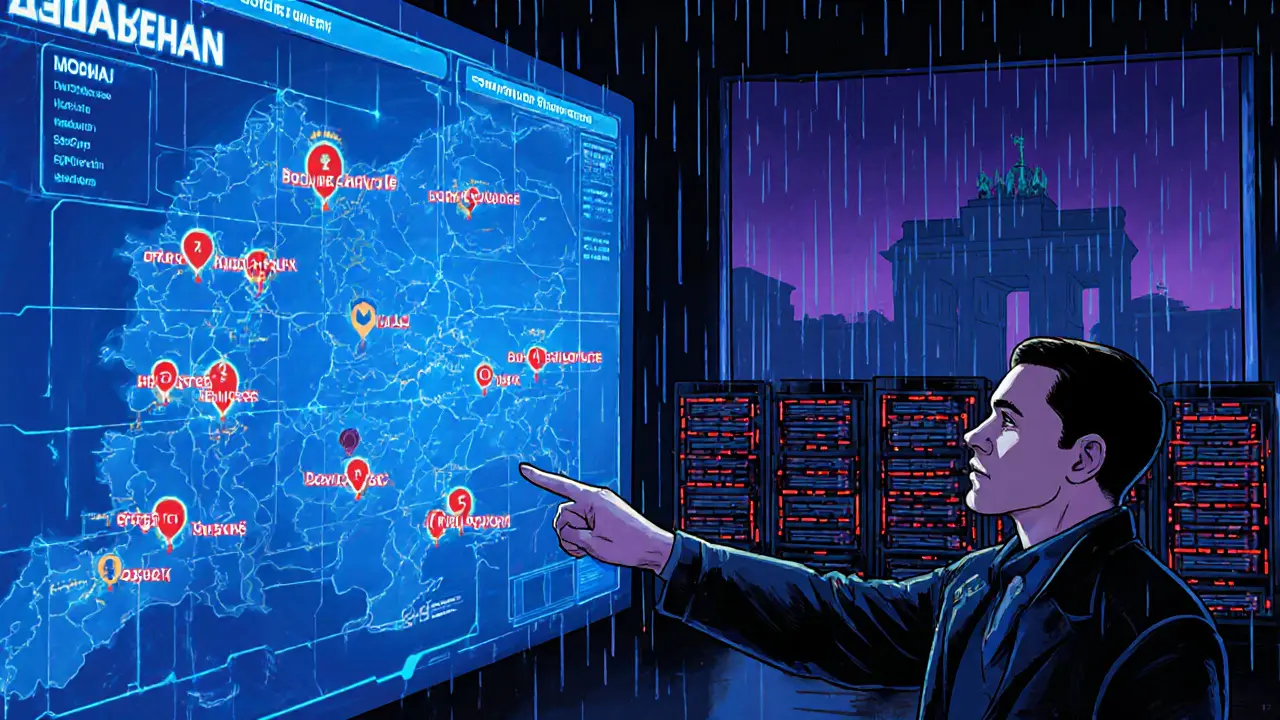

Operation Final Exchange: How Germany’s Biggest Crypto Crackdown Targets No‑KYC Exchanges

Operation Final Exchange was Germany's massive 2024 crackdown on 47 Russian no‑KYC crypto exchanges, seizing servers, data and disrupting sanctions evasion, ransomware, and darknet finance.

read more