Operation Final Exchange: What It Is and Why It Matters

When dealing with Operation Final Exchange, a term used to describe a specific crypto exchange platform that entered its last operational phase in 2025. Also known as Final Exchange, it serves as a hub where traders swap tokens, chase arbitrage chances, and hunt for airdrop rewards. The platform’s closure sparked a wave of analysis because every move—whether a fee change or a security upgrade—directly impacts users’ portfolios. Understanding its mechanics helps you avoid costly mistakes and spot hidden opportunities.

Key Concepts Around Operation Final Exchange

The first concept to grasp is the broader crypto exchange, an online service that matches buyers and sellers of digital assets, typically charging a fee for each trade. Think of it as the marketplace where Operation Final Exchange lived. Next, consider DeFi arbitrage, the practice of exploiting price differences across decentralized finance platforms using tools like flash loans. This strategy often flourished on Operation Final Exchange because its liquidity pools were deep enough to accommodate large, rapid swaps. Finally, an airdrop, a distribution of free tokens to eligible wallets, usually to promote a new project or reward community participation, played a role in driving traffic to the exchange during its final weeks. Each of these entities influences the others: a strong crypto exchange attracts arbitrage bots, which in turn makes airdrops more valuable as users seek platforms with ample liquidity.

Why does this web of relationships matter to you? First, exchange reviews—like the ones we’ve compiled—break down fees, security features, and token utility, giving you a clear picture of what you’re paying for. Second, knowing how DeFi arbitrage works lets you assess whether the exchange’s price feeds are reliable enough for flash‑loan strategies; a mispriced asset can turn a profitable trade into a loss in seconds. Third, airdrop monitoring helps you verify legitimacy before you hand over private keys—many scams masquerade as “final exchange” giveaways. By connecting the dots between fee structures, arbitrage potential, and airdrop legitimacy, you can build a balanced approach that protects capital while still tapping into high‑yield opportunities.

Below you’ll find a curated list of articles that dive deeper into each of these angles: flash‑loan arbitrage guides, common DCA mistakes, privacy‑focused exchange reviews, token‑specific deep dives, and step‑by‑step airdrop verification checklists. Use them to sharpen your strategy, avoid pitfalls, and make the most of the remaining window that Operation Final Exchange offers before it fully shuts down.

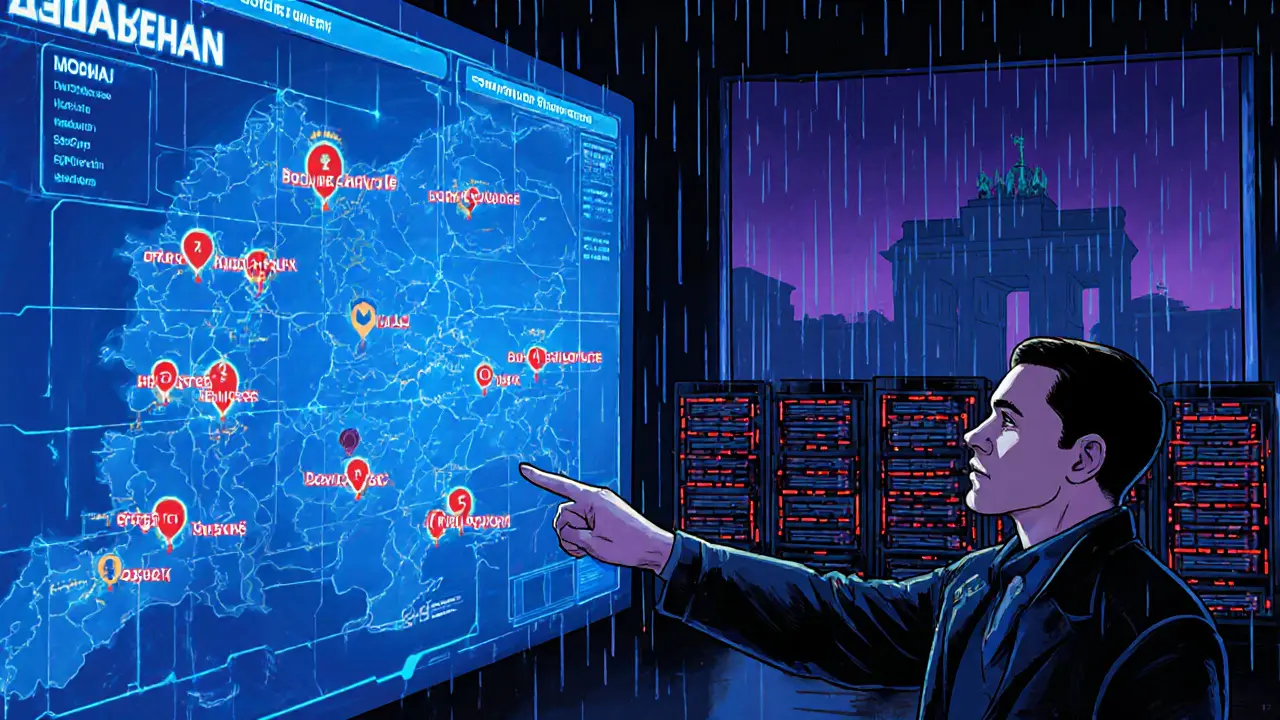

Operation Final Exchange: How Germany’s Biggest Crypto Crackdown Targets No‑KYC Exchanges

Operation Final Exchange was Germany's massive 2024 crackdown on 47 Russian no‑KYC crypto exchanges, seizing servers, data and disrupting sanctions evasion, ransomware, and darknet finance.

read more