W3Swap vs Uniswap Fee & Slippage Calculator

Calculate Your Trade Costs

See estimated fees and slippage for trading on W3Swap versus Uniswap based on your trade parameters.

How volatile is the token you're trading?

Estimated Gas Fee

Potential Slippage

0.5%

Estimated Gas Fee

Potential Slippage

0.0%

Recommendation

Based on your trade parameters, W3Swap offers lower fees but potentially higher slippage than Uniswap. Trade under $500 on W3Swap for best results.

W3Swap isn’t another copycat crypto exchange. It’s trying to carve out space in a market dominated by giants like Uniswap - and it’s doing it with a twist. If you’ve ever struggled with high gas fees, slow trades, or front-running on other DEXs, you might have heard whispers about W3Swap. But is it legit? Or just another project riding the DeFi hype train? Let’s cut through the noise.

What Exactly Is W3Swap?

W3Swap is a decentralized exchange (DEX) built to let users trade crypto directly from their wallets - no sign-ups, no KYC, no middlemen. That’s the standard for DEXs, sure. But what sets W3Swap apart? It’s tied to the Shardeum blockchain, a network designed for speed and scalability. While the exact launch date isn’t public, by December 2025, W3Swap had already established a presence on Coinpaprika with real trading data for its native token, W3.Think of it like this: Uniswap runs on Ethereum, and while it’s the biggest DEX out there, it’s often slow and expensive during peak times. W3Swap, by contrast, appears to be optimized for Shardeum’s auto-scaling tech - meaning transactions can process faster and cheaper. That’s not just marketing. If true, it solves one of the biggest headaches for active traders: paying $50 in gas to swap $200 worth of tokens.

The W3 Token: More Than Just a Trading Pair

The W3 token isn’t just a coin you can trade. It’s the engine behind the platform. It’s used for:- Pay trading fees (possibly at a discount)

- Stake for rewards or governance voting

- Access exclusive liquidity pools

As of late 2025, W3 had a measurable market cap and circulating supply listed on Coinpaprika - which means it’s not just a ghost token sitting in a dev’s wallet. Real volume is moving. But here’s the catch: there’s no public breakdown of how much liquidity is actually in W3Swap’s pools. Without that, you can’t tell if your trade will slippage by 15% or 2%. That’s a red flag if you’re trading larger amounts.

How Does It Compare to Uniswap?

Uniswap still rules the DEX space. It supports over 11 blockchains, has deep liquidity for thousands of tokens, and has been audited and certified under SOC 2 and ISO 27001 standards. It’s the safe, proven choice.W3Swap? It’s the underdog. It doesn’t have Uniswap’s liquidity. It doesn’t have the brand recognition. But it might have something better: speed and fairness. Shardeum’s architecture claims to prevent front-running - a nasty tactic where bots snipe your trades before they execute. If W3Swap truly blocks this, it levels the playing field. That’s huge for retail traders who get picked off daily on other platforms.

Here’s a quick snapshot:

| Feature | W3Swap | Uniswap |

|---|---|---|

| Blockchain | Shardeum (likely) | Ethereum |

| Transaction Speed | Fast (inferred) | Slow during congestion |

| Gas Fees | Low (estimated) | High (10-20 gwei post-Dencun) |

| Front-Running Protection | Claimed | No |

| Liquidity Depth | Unclear | Industry-leading |

| Wallet Support | MetaMask, Trust Wallet | MetaMask, WalletConnect, etc. |

| Fiat On-Ramp | No | No |

If you’re trading small amounts of newer tokens or testing the waters, W3Swap could be a breath of fresh air. But if you’re moving $5,000+ in a single trade? Stick with Uniswap or a centralized exchange. Liquidity matters more than speed when your trade could tank.

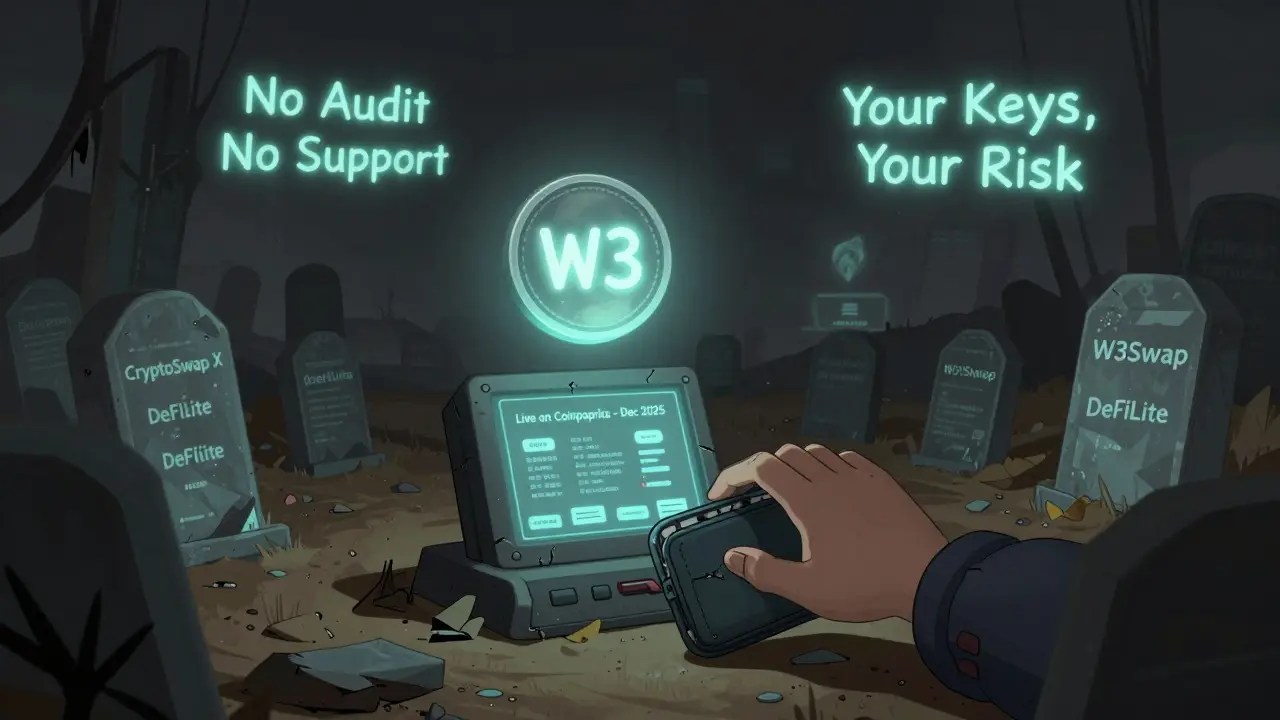

Security: What Don’t We Know?

This is the biggest question mark. W3Swap doesn’t publish audit reports. No CertiK, no Hacken, no PeckShield. Uniswap’s smart contracts have been reviewed by top-tier firms and hold industry certifications. W3Swap? Nothing public.That doesn’t mean it’s unsafe. But in crypto, absence of proof is a risk. If you’re connecting your wallet to a DEX, you’re trusting its code. No audit = no third-party validation. That’s like driving a car with no safety inspection - maybe it works, but you’re rolling the dice.

Also, there’s no public info on whether W3Swap has a bug bounty program or how it handles smart contract upgrades. That’s another red flag for serious traders.

Who Is W3Swap For?

Not everyone. W3Swap isn’t for beginners. You need to know how to connect a wallet, approve token allowances, and understand slippage settings. No customer support. No live chat. No email helpdesk. If you mess up, you’re on your own.But if you’re:

- A DeFi power user tired of Ethereum’s fees

- Trusting Shardeum’s tech and want to support its growth

- Trading small to mid-sized altcoins with low liquidity on other DEXs

- Willing to accept higher risk for potentially better speed and fairness

…then W3Swap might be worth a test run. Start small. Use only what you can afford to lose.

The Bottom Line: Try It, But Don’t Bet the Farm

W3Swap isn’t a scam. It’s real. The W3 token has market data. It’s listed on Coinpaprika. FxVerify even has a dedicated review page. But that’s it. There’s no transparency on audits, no clear roadmap, no user reviews you can trust.It’s a high-risk, high-reward experiment. If Shardeum takes off, W3Swap could become a major player. If not, it might fade into obscurity like dozens of other DEXs that promised the moon but delivered nothing.

Use it if you’re curious. Use it if you want to support a new chain. But don’t park your life savings here. And never, ever trust a DEX without an audit.

How to Get Started (If You Decide To)

If you’re still interested, here’s how to use W3Swap:- Get a non-custodial wallet: MetaMask or Trust Wallet.

- Add the Shardeum network manually (check W3Swap’s official site for RPC details).

- Buy some W3 tokens on a centralized exchange like Kraken or Bybit, then send them to your wallet.

- Connect your wallet to W3Swap’s website.

- Approve the token allowance when prompted.

- Set slippage to 0.5-1% for stable trades, 2-3% for volatile altcoins.

- Swap your tokens. Watch the gas fee - it should be under 0.001 ETH equivalent.

Remember: you’re in control of your keys. If you lose your seed phrase, your funds are gone forever.

Is W3Swap safe to use?

W3Swap hasn’t published any smart contract audits, so its safety can’t be verified. It’s not a scam, but it carries higher risk than audited platforms like Uniswap. Only use funds you’re prepared to lose.

Can I buy crypto with fiat on W3Swap?

No. W3Swap is a decentralized exchange. You can’t deposit USD, EUR, or any fiat currency. You need to already own crypto and transfer it to your wallet first.

What’s the W3 token used for?

The W3 token is used to pay reduced trading fees, stake for rewards, and possibly vote on platform upgrades. It’s the native utility token of the W3Swap ecosystem.

Does W3Swap have customer support?

No. W3Swap is a fully decentralized platform. There’s no live chat, email support, or help center. If something goes wrong, you’re on your own.

Is W3Swap better than Uniswap?

It depends. If you care about speed, low fees, and front-running protection, W3Swap might be better - if its Shardeum integration works as claimed. But if you need deep liquidity, wide token selection, and proven security, Uniswap is still the safer, more reliable choice.

Where can I check the W3 token price?

You can track the W3 token price on Coinpaprika.com, which lists live data, market cap, and trading pairs as of December 2025.

Can I stake W3 tokens?

Staking is likely possible, as it’s common for DEX native tokens. But W3Swap hasn’t published official staking details. Check their website or official social channels for updates before locking up any tokens.

What Comes Next?

W3Swap’s future hinges on one thing: Shardeum’s adoption. If Shardeum gains traction as a fast, cheap, and secure blockchain for DeFi, W3Swap could become its flagship DEX. But if Shardeum fades, so will W3Swap.Right now, it’s a speculative play. Not a bet. Not an investment. A test. If you’re curious, try it with $50. See how the interface feels. See if trades go through smoothly. See if you get front-run. Then decide if it’s worth your time.

But never forget: in crypto, the most dangerous word is “this time is different.” Stay skeptical. Stay informed. And always, always do your own research.

Comments

Abhishek Bansal

W3Swap? More like W3Scam. No audit? Cool. I'll just throw my ETH into a black hole labeled 'Shardeum'.

Scot Sorenson

Bro, you literally said 'front-running protection claimed' like it's a feature and not a red flag. If you're trusting a DEX that won't show you the code, you're not DeFi-ing-you're gambling with your seed phrase.

Ike McMahon

Start small. $50 max. If your trade goes through without slippage and gas is under 0.0005 ETH, you’re already ahead of 90% of DeFi users.

Anselmo Buffet

Interesting take. I’ve been watching Shardeum for months. The tech looks legit but the team is silent. That’s the real risk.

Joey Cacace

Thank you for such a thoughtful and balanced breakdown. I really appreciate how you highlighted both the potential and the pitfalls-this is exactly the kind of clarity the crypto space needs.

Taylor Fallon

It’s funny how we all want innovation but then panic when it’s not audited by a firm we’ve heard of. Maybe the future isn’t in CertiK-it’s in community trust and transparent dev logs. W3Swap might be the quiet pioneer we’re not ready to see yet.

PRECIOUS EGWABOR

Uniswap is the Walmart of DEXes. W3Swap? That’s the indie shop that sells handcrafted crypto candles and charges 0.0001 ETH. Cute. But would you buy a toaster from them?

Caroline Fletcher

Shardeum is just the Fed secretly funding a crypto exit scam. They need low fees so they can drain wallets faster. I saw a guy in a hoodie tweet this last week. He knows things.

Heath OBrien

NO AUDIT = NO TRUST. END OF STORY. WHY ARE WE STILL DOING THIS? WE’RE ALL JUST CLOWNS WITH WALLETS

Toni Marucco

The structural asymmetry between W3Swap’s operational transparency and its risk profile presents a compelling case for epistemic caution. One cannot ethically allocate capital to a system whose verifiable security parameters remain unestablished, regardless of theoretical performance advantages.

Kathryn Flanagan

So let me get this straight-you’re saying if you’re new to crypto, don’t touch this? But also, if you’re experienced, maybe try it with a little money? And also, there’s no customer support? And also, no audits? And also, it’s on a blockchain nobody’s heard of? And also, you’re supposed to just… trust it? I’m confused. Is this a crypto project or a psychological experiment?

Nicholas Ethan

Market cap on Coinpaprika means nothing. That’s a free listing site. The real metric is 24h volume relative to liquidity depth. Neither is disclosed. This is a liquidity vacuum with a token ticker.

Hari Sarasan

The architectural paradigm of Shardeum introduces a novel shard-based consensus mechanism that dynamically scales transaction throughput while maintaining finality-a quantum leap from Ethereum’s monolithic structure. W3Swap leverages this to eliminate MEV exploitation, a systemic flaw in legacy DEXes. The absence of audit reports is a governance failure, not a technical one.

Lynne Kuper

Wait, so you’re saying W3Swap could be better than Uniswap… but you don’t know if it’s safe? That’s like saying a Ferrari might be faster than a Prius, but you haven’t checked if the brakes work. Go ahead-test it. But keep your wallet on a separate device. Just in case.

Lloyd Cooke

Is the real question not whether W3Swap is safe, but whether we, as a community, have stopped demanding accountability? We’ve normalized risk. We’ve romanticized opacity. And now we call it ‘decentralization’ when it’s just negligence dressed in a whitepaper.

Albert Chau

Someone needs to tell the author that ‘claimed front-running protection’ is not a feature-it’s a liability. If you’re not willing to prove it, you’re not a disruptor. You’re a distraction.

Bridget Suhr

honestly i think this is kinda fair? i dont trust it but i kinda wanna try it with like 10 bucks just to see if it works? like… what’s the worst that could happen? i lose 10 bucks and learn something?

Jessica Petry

Oh, so now we’re romanticizing underdogs? Let me guess-the next article will be titled ‘Why You Should Use a Random Telegram Bot as Your Wallet Provider’. Brilliant. Absolutely brilliant.