If you're looking for a crypto exchange that lets you trade without giving up control of your coins, ICDex sounds like it should be on your radar. But here's the truth: ICDex isn't a mainstream platform. It doesn't have millions of users, high liquidity, or even a decent number of trading pairs. It's a tiny, technically interesting experiment built for one specific group of people - those who want to trade Internet Computer (ICP) tokens in a fully decentralized way.

What Is ICDex, Really?

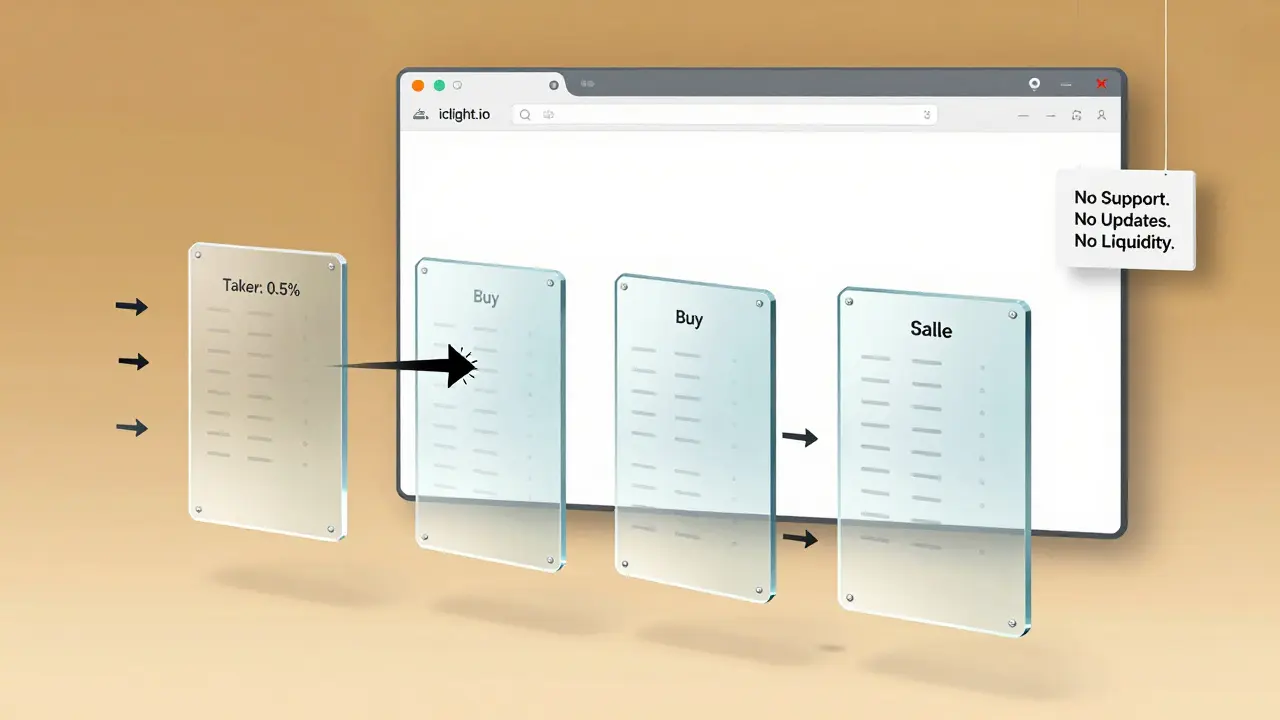

ICDex is a decentralized exchange (DEX) built entirely on the Internet Computer a blockchain designed to run web applications and smart contracts at web speed without relying on traditional cloud infrastructure. Unlike Uniswap or PancakeSwap, which use automated market makers (AMMs), ICDex uses a real on-chain order book. That means buy and sell orders are stored directly on the blockchain, just like a traditional stock exchange. You place a limit order, someone else matches it, and the trade settles on-chain - no middleman, no custodial wallet.

This is a big deal technically. Most DEXs sacrifice order book functionality for simplicity. ICDex doesn’t. It gives you limit orders, stop orders, and fill-or-kill options - tools you’d normally find only on centralized exchanges like Binance or Kraken. But here’s the catch: you need to already own ICP or related tokens. There’s no way to deposit fiat. No credit card option. No bank transfer. If you don’t have crypto on the Internet Computer network, you can’t trade on ICDex.

How Does It Work? The Technical Side

ICDex runs on smart contracts audited by third parties (though no public audit report names are available). All trades happen on-chain, so every transaction costs a small fee paid in ICP. The fee structure is simple: makers (people placing limit orders) pay 0% - that’s right, zero. Takers (those who fill existing orders) pay between 0.2% and 0.5%, depending on which board they trade on. Most users end up on the THIRD Board with a 0.5% taker fee.

The platform supports only 8 tokens and 8 trading pairs. The most active pair is ICL/ICP, which accounted for nearly all of the $93.79 in 24-hour volume reported by CoinGecko in late 2023. That’s not a typo. Ninety-three dollars. For comparison, Uniswap processes over $4 billion daily. ICDex’s volume is so low, it’s barely registering. Some days, the 24-hour volume drops below $10.

Because of this, order books are extremely thin. If you try to buy 100 ICP, you’ll likely see the price jump instantly because there aren’t enough sellers. This makes it nearly impossible to execute larger trades without massive slippage. It’s not a bug - it’s the result of almost no users.

Who Is ICDex For?

Let’s be clear: ICDex is not for beginners. It’s not for people looking to trade Bitcoin, Ethereum, or Solana. It’s not even for most DeFi users.

It’s only for one group: developers, early adopters, or investors who already hold ICP or tokens native to the Internet Computer ecosystem and want to trade them without trusting a centralized exchange. If you’re holding ICP because you believe in the Internet Computer’s vision of web-scale blockchains, ICDex is one of the few places where you can trade it without handing over your keys.

For everyone else, it’s a dead end. There are no educational resources on the site. No tutorials. No customer support. No Telegram group. No Reddit community. The website (iclight.io) looks clean, but it’s empty of useful content. If you get stuck, you’re on your own.

Security and Regulation

Since ICDex is non-custodial, your funds are never held by the platform. That’s a major security win. If the site gets hacked, your wallet isn’t touched - because you never gave them access. The smart contracts have been audited, though details are scarce. That’s better than most DEXs, which often skip audits entirely.

But low activity creates its own risk. With so little liquidity, a single large trade can manipulate prices. There’s no protection against flash loan attacks or whale manipulation. And because ICDex is incorporated in Singapore but operates without any government regulation, you have zero legal recourse if something goes wrong.

There are no KYC requirements, no identity checks, and no compliance team. That’s fine if you value privacy. But if you’re used to regulated platforms like Coinbase or Kraken, this will feel like stepping into the wild west.

Why It’s Not Working

ICDex suffers from the classic DEX dilemma: no liquidity → no traders → no liquidity. The Internet Computer blockchain itself has struggled to gain traction compared to Ethereum or Solana. Fewer developers build on it. Fewer users hold its tokens. Fewer projects launch on it.

As a result, ICDex is stuck in a loop. It offers advanced trading tools - but nobody uses them. It charges low fees - but there’s nothing to trade. It’s technically impressive, but practically useless for anyone outside a tiny circle of ICP enthusiasts.

Compare this to Uniswap, which has over 10,000 trading pairs and billions in daily volume. Or dYdX, which offers derivatives trading with deep liquidity. ICDex doesn’t even make the top 100 DEXs by usage. CoinGecko ranks it in the bottom 21% for volume. Cashbackforex puts it at 490th out of 600 exchanges in organic traffic - meaning only about 264 people visited the site in a month.

What’s Missing?

There’s no mobile app. No wallet integration beyond basic browser wallets. No API for developers. No liquidity mining programs to incentivize traders. No partnerships with other DeFi protocols. No token listings beyond ICP and a handful of obscure tokens.

There’s no roadmap. No announcements. No updates. The project seems frozen. While other DEXs are adding cross-chain bridges, layer-2 scaling, and staking rewards, ICDex hasn’t changed in over a year. The team behind it - tied to the DFINITY Foundation - appears focused elsewhere.

Should You Use ICDex?

Only if all of these are true:

- You already own ICP or Internet Computer ecosystem tokens

- You want to trade them without giving up custody

- You’re okay with trading tiny amounts and accepting high slippage

- You don’t mind zero support, zero tutorials, and zero community

- You’re not trying to trade anything else - no ETH, no BTC, no SOL

If any of those points don’t apply to you, walk away. There are dozens of better options.

For most people, using a centralized exchange like Kraken or Binance (with proper security practices) is safer, faster, and cheaper. For DeFi users, Uniswap, PancakeSwap, or Curve offer thousands of tokens, deep liquidity, and active communities.

ICDex is a proof of concept - not a practical tool. It shows what’s possible with on-chain order books. But it doesn’t show what’s viable.

Alternatives to Consider

If you’re interested in decentralized trading, here are better options:

- Uniswap (Ethereum) - Best for trading ETH and ERC-20 tokens with deep liquidity

- PancakeSwap (BNB Chain) - Top choice for low-fee trading on BNB Chain

- dYdX - Only DEX offering derivatives, futures, and leveraged trading

- Curve - Best for swapping stablecoins with minimal slippage

All of these have millions in daily volume, active teams, and strong communities. None of them are as technically unique as ICDex - but they actually work.

Is ICDex safe to use?

Yes, but only if you understand the risks. Since ICDex is non-custodial, your funds are never held by the platform. The smart contracts have been audited, though details aren’t public. However, with near-zero trading volume, the market is vulnerable to manipulation. A single large trade can swing prices dramatically. Use only small amounts you can afford to lose.

Can I trade Bitcoin or Ethereum on ICDex?

No. ICDex only supports tokens native to the Internet Computer blockchain. That means ICP and a handful of obscure tokens like ICL, ICPUSD, and a few others. You cannot trade Bitcoin, Ethereum, Solana, or any major cryptocurrency on this platform.

Do I need a special wallet to use ICDex?

Yes. You need a wallet that supports the Internet Computer blockchain. The most commonly used is the Dfinity Wallet (browser extension), but others like ICPSwap Wallet or Internet Identity may work. You cannot use MetaMask, Trust Wallet, or Coinbase Wallet - they don’t support ICP.

Is ICDex regulated?

No. ICDex is incorporated in Singapore but operates without any government oversight. There is no KYC, no AML compliance, and no regulatory license. This means you have no legal protection if something goes wrong - no chargebacks, no refunds, no recourse.

Why is ICDex’s trading volume so low?

Because the Internet Computer ecosystem itself has very little adoption. Few people hold ICP tokens. Few projects build on it. Without users, there’s no liquidity. Without liquidity, traders won’t come. It’s a classic chicken-and-egg problem. Even with zero maker fees and low taker fees, there’s simply nothing to trade.

Write a comment