Crypto Exchange Compliance: Rules, Risks, and Real‑World Insights

When dealing with crypto exchange compliance, the collection of legal, regulatory, and security standards that a digital asset platform must follow. Also known as exchange regulatory compliance, it acts as the safety net that keeps traders, investors, and the broader ecosystem honest. Crypto exchange compliance isn’t just a checklist; it’s a living framework shaped by KYC, Know‑Your‑Customer procedures that verify user identity and AML, Anti‑Money‑Laundering controls that monitor suspicious activity. Together they form the core of any trustworthy platform, and they directly influence whether an exchange can obtain the necessary crypto licensing, official regulatory approvals that legitimize its operations in a given jurisdiction.

Regulatory frameworks act like the rulebook for the whole game. In the EU, the MiCA (Markets in Crypto‑Assets) regulation sets clear thresholds for capital, reporting, and consumer protection, forcing exchanges to redesign risk‑management tools. In the U.S., the FinCEN guidance pushes firms to implement advanced transaction‑monitoring systems, while the SEC’s focus on securities tokens adds another layer of compliance. These regulatory frameworks shape everything from how assets are listed to the fees an exchange can charge. That’s why a platform that ignores licensing requirements may face sudden shutdowns, as seen in Operation Final Exchange, where German authorities seized servers of dozens of no‑KYC exchanges. The lesson is simple: compliance doesn’t just protect users; it shields the exchange from legal fallout.

What You’ll Find Below

Below this overview you’ll discover a curated set of articles that break down compliance from every angle. We’ve got deep dives into KYC verification methods, step‑by‑step guides for meeting AML standards, case studies of exchanges that earned or lost their licenses, and practical tips for traders who want to stay on the right side of the law. Whether you’re a newcomer trying to pick a safe platform or a seasoned operator looking to tighten your compliance program, the posts ahead offer actionable insights you can apply today.

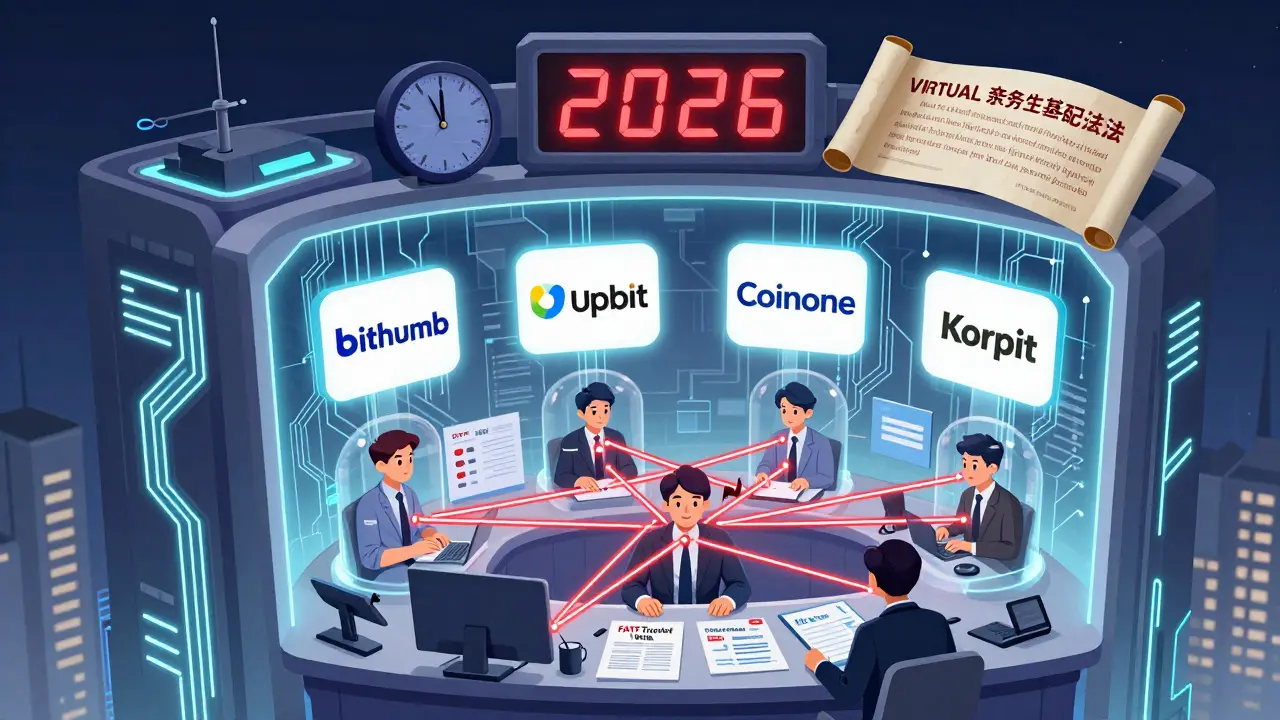

South Korea Crypto Exchange Regulations by FSC: What You Need to Know in 2026

South Korea's FSC enforces one of the world's strictest crypto frameworks, requiring real-name verification, security certs, and FATF compliance. As of 2026, spot crypto ETFs and corporate crypto holdings are now legal under new regulations.

read moreAUSTRAC Registration Requirements for Crypto Exchanges in Australia (2025 Guide)

A practical 2025 guide on AUSTRAC registration for Australian crypto exchanges, covering requirements, step‑by‑step application, upcoming 2026 changes, compliance duties, and FAQs.

read more