No‑KYC Exchanges – What They Are and Why They Matter

When exploring no-KYC exchanges, platforms that let you trade crypto without submitting identity documents. Also known as anonymous exchanges, they appeal to users who value privacy over regulatory hassle. Many of these services belong to the broader category of decentralized exchanges, peer‑to‑peer trading platforms that run on smart‑contract infrastructure. At the same time, they deliberately avoid KYC compliance, the process of verifying users' identities to meet anti‑money‑laundering rules. This creates a semantic triangle: no‑KYC exchanges encompass privacy‑first trading, they require permissionless protocols, and they exist because regulators push for stricter KYC compliance. If you’ve ever wondered how you can keep your wallet address hidden while still swapping tokens, this is the place to start.

Key Benefits and Risks of Going KYC‑Free

The biggest draw is privacy‑focused crypto, digital assets that let users stay anonymous or pseudonymous. By skipping identity checks, traders can jump into markets instantly, avoid data breaches, and sidestep jurisdictional bans. However, the lack of KYC also means fewer consumer protections; fraud, rug pulls, and liquidity issues are more common on these platforms. Permissionless trading environments often rely on automated market makers (AMMs) and smart contracts, which means you need to understand gas fees, slippage, and contract audits before committing funds. In practice, marrying privacy with safety requires doing your own due‑diligence, monitoring community signals, and using hardware wallets wherever possible.

Our collection below pulls together real‑world examples, deep‑dive reviews, and step‑by‑step guides that illustrate these points. You’ll find a comprehensive MCDEX analysis that shows how a permissionless perpetual contracts DEX operates without KYC, a look at XCOEX’s fee structure for anonymous traders, and practical tips for spotting red flags in airdrops that target privacy‑first users. Whether you’re a beginner curious about anonymous trading or an experienced hodler looking for new venues, the articles ahead give you the tools to evaluate, compare, and safely navigate the no‑KYC landscape.

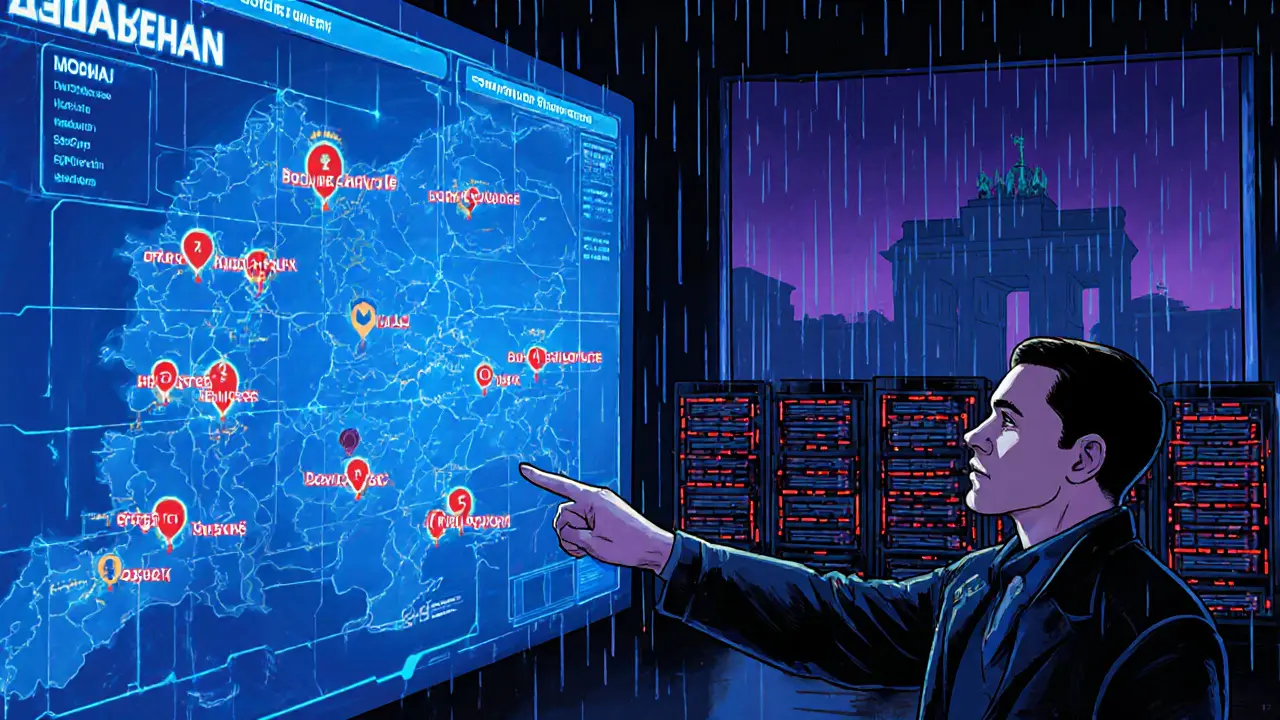

Operation Final Exchange: How Germany’s Biggest Crypto Crackdown Targets No‑KYC Exchanges

Operation Final Exchange was Germany's massive 2024 crackdown on 47 Russian no‑KYC crypto exchanges, seizing servers, data and disrupting sanctions evasion, ransomware, and darknet finance.

read more